Domestic oil prices to be cut, govt says

Updated: 2013-04-25 05:40

By Du Juan (China Daily)

|

||||||||

China's top economic planning agency said that it will cut domestic oil prices by about 400 yuan ($64) a metric ton starting from Thursday, in the first price adjustment since the country launched a new gasoline pricing mechanism on March 26.

Retail gasoline prices will drop 395 yuan a ton, or 0.29 yuan a liter, and diesel prices will fall 400 yuan a ton, or 0.34 yuan a liter, the National Development and Reform Commission said on Wednesday.

On April 10, the NDRC decided not to change domestic oil prices because average international gasoline prices over the previous 10 working days had remained basically unchanged compared with the last price adjustment on March 27.

The NDRC raised retail gasoline prices 300 yuan a ton and diesel prices 290 yuan a ton on Feb 25. On March 27, it cut gasoline prices by 310 yuan a ton and diesel prices 300 yuan a ton.

According to the new pricing mechanism, domestic oil prices are adjusted every 10 working days instead of the previous 22 working days. The new mechanism abandoned a previous criterion requiring international prices to change more than 4 percent before a domestic adjustment is made.

"China's domestic oil prices have been linked to international oil price changes more closely through the new mechanism and have become more market-oriented," said Lin Boqiang, director of the Xiamen-based China Center for Energy Economic Research.

However, he said it's still too early to say whether the new mechanism is able to reflect the market's demand-supply situation.

"It will be a real test for the mechanism when international oil prices rise," he added.

Recent global economic data were generally lackluster and demand in the United States and Europe has stayed sluggish, which resulted in sufficient global oil supply and declining crude prices, according to JYD Online, a Beijing-based bulk commodity consultancy.

"Gasoline and diesel prices will likely continue to decline," said Yu Jinbo, an industrial analyst at the firm.

In the last month, international oil prices have been declining, albeit with some volatility. London-based Brent, the crude benchmark prices for more than half of the world's oil, dropped to below $100 a barrel for the first time since July 2012.

The continuous decline was caused by the drop of commodity prices, among which the dramatic fall of gold prices was the most obvious one, Lin said.

At the same time, weak demand from the US and China - the two largest oil consumers in the world - is also behind the decline in oil prices, he said.

He predicted that oil prices will stay weak for the first half of the year.

dujuan@chinadaily.com.cn

(China Daily 04/25/2013 page14)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Sluggish growth takes its toll on foreign lenders

Investors find a home in overseas real estate

More Chinese travel overseas, study reveals

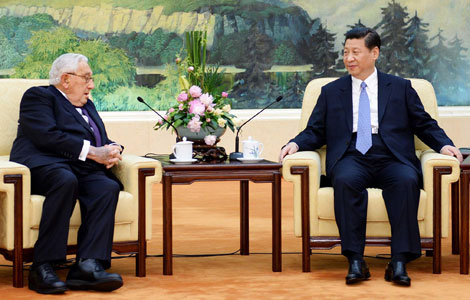

Xi meets former US heavyweights

Li in plea to quake rescuers

Canada to return illegal assets

Beijing vows to ease Korean tensions

Order restored after deadly terrorist ambush

US Weekly

|

|