Urbanization may lead to policy shift

|

A view of Yonglian village, in Zhangjiagang, Jiangsu province, in March. The village was considered one of the province's poorest and most underdeveloped before economic reforms and opening-up, but has now become a model example of the country's urbanization program. Yang Lei / Xinhua |

Urbanization | Zheng Yangpeng

World Bank economist says imbalance in delivery of public services must be addressed

China's urbanization drive not only increases demand, but also offers a chance to correct previous policy imbalances, said a World Bank economist who participated in the drafting of a special report on China's urbanization efforts.

The urbanization drive crystallizes some major issues that badly need to be addressed, including imbalances in the country's factor market, the central-local fiscal relationship, and the delivery system for public services, Karlis Smits, a senior economist at the World Bank, told China Daily.

A real solution to the problems related to China's urbanization drive should be one that addresses the institutional root of these problems, he said.

For example in the factor market, which is essentially made up of capital, land and labor, China's system still prevents the free flow and competitiveness of these factors, which explains the layout of Chinese cities.

"If you are a local Chinese official, you will likely have your spare land developed into real estate projects such as shopping malls or industrial parks, rather than converting it to a park," Smits said.

"This is because real estate projects give you more revenue. By contrast, in the United States, local officials like to build parks because most of the local governments' revenue comes from property taxes, and a park lifts the value of the property," he added.

Local governments can make money simply from expropriating land from rural residents with artificially low prices and selling it to developers at much higher prices. This explains the sprawling development of many Chinese cities, Smits said.

The built-up area of China's cities has expanded by 83.4 percent from 2000 to 2010, while the country's urban population only increased by 45 percent in the same period, Hu Cunzhi, vice-minister of land and resources, said previously.

The oversupply of cheap land to the industrial sector has been a major driver of China's industrial development, which has reinforced the local governments' reliance on investment- and industry-led growth, Smits said.

"China is extremely competitive in the final-product market, because the market has been subjected to competition. But in the factor market, which leads to the final product, labor, capital, and land are traded internally and there's no competition," Smits said.

Simply blaming the local governments for this situation, however, is meaningless, because they live in an environment that responds to incentives. Without adjusting the incentives mechanism, local governments will continue to tilt toward this type of development model despite repeated guidance from the central government, he added.

A recent Chinese report said that in 2012, the taxes collected from property transactions totaled 1.01 trillion yuan ($160.3 billion), 20 times the level seen in the 2000s, while land transfer fees last year totaled 2.69 trillion yuan. The two sources made up 47.6 percent of the local governments' fiscal revenues.

On the one hand, local governments' revenues are largely driven by profits related to land transactions, while on the other hand there is a big discrepancy between local government fiscal revenue and spending responsibility, Smits said.

China's most serious fiscal disparities are at the sub-provincial level, which accounted for 60 percent of total public spending - including basic health and education, pensions, unemployment insurance, disability, housing, infrastructure maintenance, and minimum income support, but only received 34 percent of the tax revenue, according to a report released last year by the World Bank and the Development Research Center of the State Council, China's cabinet.

The reliance on land revenue is also becoming an obstacle for China to move away from exports and investment, and focus on services.

The dangers of the investment-intensive growth paradigm also lie in the dwindling return on investments.

A recent report by the International Monetary Fund said that China's largely State-led investment has seen a steady fall of return over the last five years.

In the first quarter, China's GDP grew 7.7 percent year-on-year, well below the forecasts of many financial institutions. Smits said this could be partly attributed to the effect of slower credit injections, but that it can also signal something more troubling.

"The worry is that money is flowing to a certain group of sectors that are not very productive, for example the real estate sector," Smits said.

Another example of misallocation of resources is the labor market.

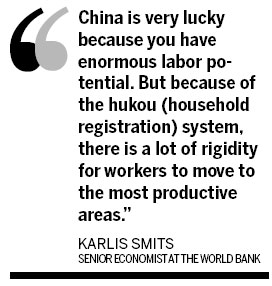

"China is very lucky because you have enormous labor potential. But because of the hukou (household registration) system, there is a lot of rigidity for workers to move to the most productive areas," Smits said.

Responding to concerns that giving migrants equal access to public services such as housing, healthcare and education might encourage more migrants into crowded big cities, Smits said that China should adjust its policies to let migrants move to cities not for the sake of better public services, but for the sake of making contributions to those cities.

This objective should be achieved by giving basic packages of services to all the Chinese citizens, no matter where they live, according to Smits.

"China's urban residents have privileges in accessing better hospitals and schools, and they fear that their cake would be shared by migrants," he said.

"But if the central government can offer all citizens a common package, for example for pensions and healthcare, there is less incentive for migrants to move to cities just for the public services there."

He also noted that the current problem of providing equal access to citizens is that "everybody knows how much it costs, but no one knows who is going to pay for that".

"The central government should work hand in hand with local governments. You can't make reforms by giving everybody equal access without answering how the project is financed," Smits said.

But the need to rebalance the economy is increasingly urgent, meaning that correcting these structural distortions is increasingly becoming a must, rather than an option, he said.

For example, one of China's perennial problems is its underdeveloped consumption demand, which could be partly explained by the fact that China's 260 million rural migrants are not yet full urban residents.

"Under the current system, many rural migrants could not bring their family members to cities. They do not consume and enjoy the urban lifestyle as their counterparts in the cities do. They do not dream of buying a house in the city. Mentally he is still with his family back home," Smits said.

To save enough money to build a house in their rural homes, they save every penny they earn in the city, and so do many young college graduates. This in turn contributes to China's high savings ratio. And with huge deposits, it's easier for Chinese banks to lend money to State-owned companies with low interest rates, which is a distortion of the capital market.

Building public housing is important to address the migrants' housing problems, but alone it will not address the distortion in the land market, he warned.

"In general, by examining urbanization you could touch a mix of deeper, structural problems in China," Smits said.

"China has tremendous opportunities from the process of urbanization by unlocking these distortions."

Contact the writer at zhengyangpeng@chinadaily.com.cn

(China Daily 05/02/2013 page17)