Intense focus on debt

Updated: 2013-07-05 07:21

By Chen Jia (China Daily)

|

||||||||

China's leadership is expected to focus on averting any potential debt crisis and following a prudent policy in the coming quarter, to build a sound foundation for steady reforms, said Zhang Zhiwei, chief economist in China at Nomura Securities.

The nation is going through a deleveraging process, which is a priority for deepening the transformation of the economic growth pattern. The earlier the debt ratio can be lowered, the higher the probability China has to avoid a financial crisis, Zhang said.

"Keeping credit growth moderate, in line with GDP growth, and pushing structural reforms to boost growth may be the current task of the new leadership."

In his view, de-leveraging may continue for two or three years, and macroeconomic policy is unlikely to be aggressively eased during that period, unlike what the former government leaders did in 2008 amid the global downturn. China should count on detailed reform measures in the third quarter to provide more room to support stable growth as well as curb systemic financial risks.

Otherwise, the prudent stance may drag down GDP growth expectations to 7 percent after three months, the economist said.

"But it is hard to discover the next, new driving force of the world's largest emerging economy. Excessive production capacity is a nationwide concern in the manufacturing sector, so only a huge technology revolution can spark the industrial growth engine."

The next growth point is likely to emerge from the service sector, Zhang said.

It's necessary to break the monopoly of State-owned enterprises, including the financial and telecommunication service businesses, as a basis for boosting economic development to improve productivity.

"Any reform will shake some group's interests, otherwise there can be no improvement. Maybe the government should take bigger steps."

But to support a specific industry through excessive investment will be "dangerous", Zhang said, citing the the photovoltaic industry, which is stagnant now.

The cash crunch exposed in the past two weeks was a sign that the central bank is determined to slow liquidity growth in the interbank market.

According to Zhang, commercial banks' profits may be affected by the tight controls, especially those intended to limit creation of new wealth management products, a main component of the shadow banking system.

On June 26, a State Council meeting hosted by Premier Li Keqiang issued a statement on urban renewal.

"That is definitely helpful to support growth: however, the downside trend is difficult to reverse."

At the meeting, Li also commented on overall economic conditions and characterized the policy outlook as "stable".

Global financial institutions downgraded second-quarter GDP growth estimates from about 8 percent to an average of 7.5 percent, which would be the slowest since the third quarter in 2012.

"We are heading into hard times," Zhang said. "The local governments, which have been the pillars for infrastructure investment, will face more difficulties in the second half.

"Eventually, local governments will have to liquidate some of their assets, such as highways, and find more revenue sources. Property tax should be extended to more cities quickly, and the central government should take more responsibility in investment."

He said that local government defaults may occur after the second quarter, especially in the central and westsern regions.

"The deleveraging process will be painful," Zhang said. "The government can bear the short-term pain in exchange for sustainable development in the long run."

(China Daily USA 07/05/2013 page18)

Chinese fleet arrives in Vladivostok for drills

Chinese fleet arrives in Vladivostok for drills

Joey Chestnut wins 7th contest with 69 dogs

Joey Chestnut wins 7th contest with 69 dogs

Lisicki, Bartoli to vie for new Wimbledon crown

Lisicki, Bartoli to vie for new Wimbledon crown

Muscle Beach Independence Day

Muscle Beach Independence Day

Tough workout for Li Na in war of words

Tough workout for Li Na in war of words

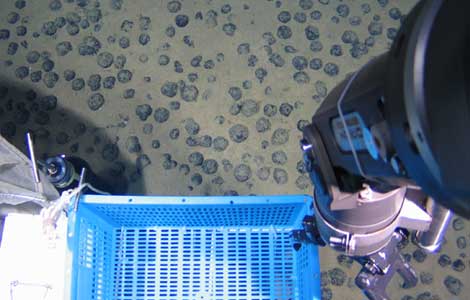

Submersible taps mineral deposits in S China Sea

Submersible taps mineral deposits in S China Sea

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

US martial artists arrive at Shaolin Temple

US martial artists arrive at Shaolin Temple

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Mandela on life support, faces 'impending death'

Missouri govt's veto won't stop Smithfield deal

ROK to discuss Kaesong normalization with DPRK

Gunman shoots two, commits suicide in Texas

Baby formula probe to shake or reshape industry?

Passenger detained over bomb hoax in NE China

High rent to bite foreign firms in China

Egypt's prosecution imposes travel ban on Morsi

US Weekly

|

|