Containing land prices

Updated: 2013-09-27 07:01

(China Daily)

|

||||||||

The harsher efforts promised by the Ministry of Land and Resources on Wednesday to prevent spikes in land price in the fourth quarter is a positive response to the latest round of price hikes across the country.

Given that rises in land prices usually trigger a new round of house price rises, such a commitment is desperately needed, especially at a time when China's property prices have witnessed a drastic surge in recent months, prompting concerns that prices will spiral out of control if the tendency remains unchecked.

The news came less than a month after developers paid record prices to purchase land in Beijing, Shanghai and other major cities, which further dampened the prospects of the latest round of government regulations curbing house prices.

In early September the Hong Kong-listed Sunac China Holdings bid 2.1 billion yuan ($343 million) to secure a plot of land in Beijing, a price that could push the average rate of the apartments built on it to 75,000 yuan per square meter. A day later another developer paid a record 21.77 billion yuan for a plot of land in Shanghai. Some other cities, such as Hangzhou, Tianjin, and Wuhan have also witnessed developers paying record prices for land, signaling that home prices will continue to rise in these cities.

China's house prices have already risen far beyond the capacity of most ordinary people. Statistics from the China Index Academy show the average price of new apartments in China's 100 major cities rose for the 15th consecutive month to 10,442 yuan per square meter in August. The average price of an apartment in Beijing rose 14.9 percent year-on-year in August, while the average price in Shanghai was up 15.4 percent.

The accelerated price rises have proved a severe test for the government and have fuelled concerns that a bursting property bubble would have undesirable spillover effects on the economy.

Given that the cost of land has a significant bearing on house prices, containing land prices should be an effective way to cool them. But to facilitate this, land sales need to stop being the dominant channel for local governments to expand their fiscal revenues.

(China Daily 09/27/2013 page8)

Making a wobbly stand on violence against women

Making a wobbly stand on violence against women

Serena Williams back to Beijing for new crown

Serena Williams back to Beijing for new crown

'Battle of the sexes' to start China Open

'Battle of the sexes' to start China Open

US astronaut praises China's space program

US astronaut praises China's space program

Christie's holds inaugural auction

Christie's holds inaugural auction

Aviation gains from exchanges

Aviation gains from exchanges

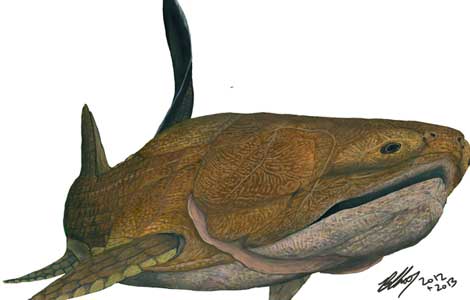

Early fish ancestor found

Early fish ancestor found

Singers' son sentenced to 10 years for rape

Singers' son sentenced to 10 years for rape

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US arms sales to Taiwan still sticking point

US Senate panel drafting bill to limit NSA spying

Popularity of Brazilian president rebounds: poll

UN to draft resolution on Syria's chemical weapons

China urges package deal on Iran's nuke issue

Can the 'Asian pivot' be saved?

Trending news across China

US firms pin hopes on financial liberalization

US Weekly

|

|