Pre-holiday losses

Updated: 2013-09-27 07:07

By Wu Yiyao (China Daily)

|

||||||||

The A-share market dropped to a three-week low on Thursday as investors took profits ahead of the National Day holiday that runs from Oct 1 to 7.

The Hong Kong market will be shut on Oct 1.

The CSI300 Index of leading shares listed in Shanghai and Shenzhen finished at 2,384.4 points, down 1.8 percent, while the Shanghai Composite Index dropped 1.9 percent - both the lowest since Sept 9.

Shanghai free trade zone concept stocks were the worst performers on Thursday. Shanghai International Port Group Co and Shanghai Material Trading Co slumped by the 10-percent daily limit after more than doubling this quarter.

The approaching launch of the FTZ on Sunday "has pushed up the share prices of many companies that have proposed, or are likely to propose, to set up business in the free trade zone. However, it takes more than just applications and approvals to support further share price gains", said Wang Lei, a Shanghai-based analyst at Huaan Securities Co.

"The initiation of the Shanghai free trade zone should not be seen as a policy designed to revive short-term economic growth. If deemed successful, the ultimate goal is to replicate the model nationwide for longer-term economic viability," said DBS Bank economist Chris Leung in a Thursday note.

(China Daily USA 09/27/2013 page18)

Making a wobbly stand on violence against women

Making a wobbly stand on violence against women

Serena Williams back to Beijing for new crown

Serena Williams back to Beijing for new crown

'Battle of the sexes' to start China Open

'Battle of the sexes' to start China Open

US astronaut praises China's space program

US astronaut praises China's space program

Christie's holds inaugural auction

Christie's holds inaugural auction

Aviation gains from exchanges

Aviation gains from exchanges

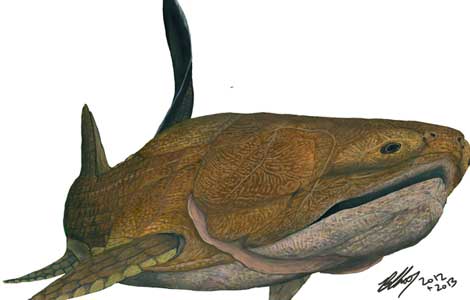

Early fish ancestor found

Early fish ancestor found

Singers' son sentenced to 10 years for rape

Singers' son sentenced to 10 years for rape

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US arms sales to Taiwan still sticking point

US Senate panel drafting bill to limit NSA spying

Popularity of Brazilian president rebounds: poll

UN to draft resolution on Syria's chemical weapons

China urges package deal on Iran's nuke issue

Can the 'Asian pivot' be saved?

Trending news across China

US firms pin hopes on financial liberalization

US Weekly

|

|