What's news

Updated: 2013-09-27 07:07

(China Daily)

|

||||||||

Bosideng warms to Europe expansion

Bosideng International Holdings Ltd, the Chinese maker of coats that runs a store in London's West End, said it is close to buying a UK chain and has met European luxury companies as it seeks deals on the continent. Bosideng is close to acquiring an 80-store apparel chain in England to sell its down jackets. It is also in early talks with European high-end coat brands about making a possible acquisition, Julie Sun, the company's vice-president for corporate strategy and investor relations, said in a Sept 24 interview.

Founder Securities eyes Minzu

Founder Securities announced on Thursday that it plans to acquire China Minzu Securities. The acquisition, if successful, will become the first merger and acquisition within the brokerage industry in China. Founder Securities is China's 14th biggest brokerage by net assets. If the acquisition goes ahead, it may become one of the top 10 brokerages. It has previously completed the merger and acquisition of a futures company and the acquisition of a trust company.

IoT technology does well in China

China has made tremendous progress in applying the Internet of Things technology in sectors such as smart transportation, mobile medicine and distance monitoring, a report reveals. The still-fledgling IoT technology has developed rapidly in food tracking and city management, according to the 2012-2013 China Internet of Things Development Annual report, which is compiled by the State-owned Xinhua News Agency. Greater emphasis will be placed on other livelihood-related areas.

Sharp rise in Chinese M&As

Mergers and acquisitions involving Chinese companies, up to September are at a record-high of $172.7 billion, up 12.5 percent compared with the same period last year, data from Thomson Reuters showed on Wednesday. Energy and electric power were the leading industry sectors for China's M&As, with $37.8 billion, an increase of 8 percent year-on-year, accounting for 21.9 percent of the total M&A volume. In the January-September period, cross-border transactions rose 10.5 percent to a record high of $67.5 billion, the most since 2008 when the total value of M&As stood at $84.1 billion. The US market accounts for a quarter of the total cross-border transaction value with the $7 billion takeover of the US pork processing company Smithfield Foods by China's largest pork producer Shuanghui being a major contributor.

Haitong to acquire 100% of UT Capital

Haitong Securities Co said on Thursday one of its units will acquire a US financial leasing business for $715 million in cash. Haitong International Holdings will buy 100 percent of UT Capital Group from UT Capital Holdings, a company of TPG Capital and its affiliated entities, according to Haitong, which is China's second-largest brokerage by assets. TPG manages $55.3 billion in assets globally.

Gerber Technology to sew up market

Gerber Technology, a leading provider of sewing automation technology, will launch a cutting system project in Shanghai to expand its business in the Chinese market. The system, Paragon, will help customers reduce costs when they produce high-quality cut parts, said Mike Elia, president and chief executive officer of Gerber, at the China International Sewing Machinery & Accessories Show which opened at the Shanghai New International Expo Center on Wednesday.

Steel industry earnings up 7.8%

China's iron and steel industry earned 84.85 billion yuan ($13.87 billion) in the first seven months, an increase of 7.8 percent year-on-year, the National Development and Reform Commission said on its website on Wednesday. The ferrous metal mining and dressing sector contributed 45.68 billion yuan of profit in the January-July period, down 7.2 percent year-on-year, the NDRC said in a monthly report. China's crude steel output increased 7.8 percent to 521.84 million metric tons during the first eight months, according to the NDRC.

China Daily - Agencies

(China Daily USA 09/27/2013 page19)

Making a wobbly stand on violence against women

Making a wobbly stand on violence against women

Serena Williams back to Beijing for new crown

Serena Williams back to Beijing for new crown

'Battle of the sexes' to start China Open

'Battle of the sexes' to start China Open

US astronaut praises China's space program

US astronaut praises China's space program

Christie's holds inaugural auction

Christie's holds inaugural auction

Aviation gains from exchanges

Aviation gains from exchanges

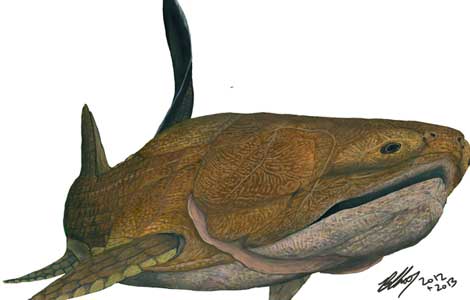

Early fish ancestor found

Early fish ancestor found

Singers' son sentenced to 10 years for rape

Singers' son sentenced to 10 years for rape

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US arms sales to Taiwan still sticking point

US Senate panel drafting bill to limit NSA spying

Popularity of Brazilian president rebounds: poll

UN to draft resolution on Syria's chemical weapons

China urges package deal on Iran's nuke issue

Can the 'Asian pivot' be saved?

Trending news across China

US firms pin hopes on financial liberalization

US Weekly

|

|