China, EU talking investment

Updated: 2014-01-22 07:17

By Li Jiabao (China Daily USA)

|

||||||||

Negotiations for bilateral treaty will not be easy, says president of economic body

China and the European Union on Tuesday started the first round of negotiations to forge an investment pact as both sides expect to open a new decade of ties between the two economies, officials said.

"The first round of China-EU bilateral investment treaty negotiations took place on Tuesday in Beijing and will last for three days. The two sides will exchange views on the arrangement of the following negotiations and the issues that could be covered by the negotiations," said Shen Danyang, spokesman for the Ministry of Commerce.

A China-EU investment pact will boost two-way investment and enhance the China-EU Comprehensive Strategic Partnership. It is also an important move for China to build an open economy, Shen added.

"Both sides agreed, through the establishment of the investment pact, to provide a steady, transparent, predictable and open legal framework for investors from the two sides. As the EU's economy picks up and the investment pact negotiations get on track, we have reasons to believe that China-EU economic cooperation will develop faster and better in 2014, thereby opening a new decade of the partnership," Shen said.

China and the EU agreed to launch negotiations for an investment agreement in February 2012. In October last year, the EU's member states gave the European Commission a negotiating mandate and, on Nov 21, the launch of negotiations was announced at the 16th EU-China Summit.

The EU sees an investment agreement with China as an important element in closer trade and investment ties between the economies, a news release from the European Commission stated.

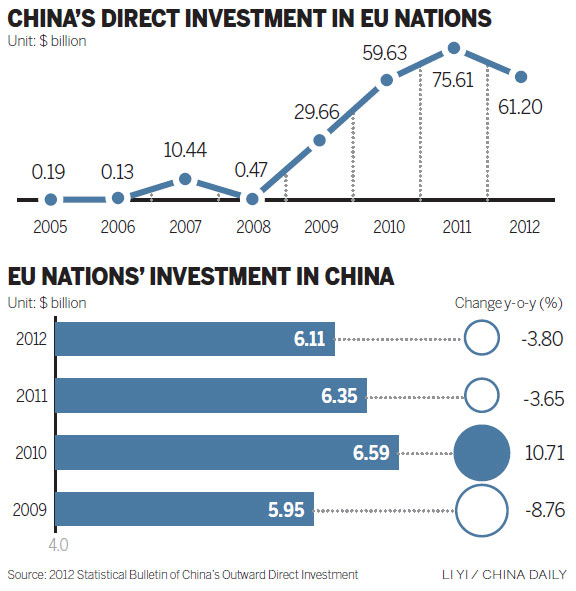

"The current level of bilateral investment between the EU and China is way below what could be expected from two of the most important economic blocs on the planet. Whereas goods and services traded between the EU and China are worth well over billion euros every day, just 2.1 percent of overall EU foreign direct investment is in China," said John Clancy, EU Trade spokesman.

"The main purpose for these negotiations is the progressive abolition of restrictions on trade and foreign direct investment and to improve access to the Chinese market for EU investors."

China-EU investment flows show great untapped potential, especially considering the size of the two respective economies. China accounts for just 2 to 3 percent of overall European investments abroad, whereas Chinese investments in Europe are rising, but from an even lower base.

In 2013, the EU's investment in China, not including financial sectors, rose 18.07 percent year-on-year to $7.21 billion, while China's investment in the bloc declined 13.6 percent year-on-year.

Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank of the Ministry of Commerce, said the China-EU investment pact talks will proceed with "much difficulty".

"The negotiation is based on a new starting point with the adoption of a 'negative list', which specifies bans and restrictions on types of foreign investments," Huo said.

China and the United States restarted the negotiations for a bilateral investment treaty in July 2013, when China agreed that every sector would come up for discussion unless restricted by a "negative list", and foreign enterprises would be given "pre-establishment national treatment", or treated the same as domestic companies. Both sides set down the modalities, the procedures, for the negotiations during the latest round of talks held in Shanghai from Jan 14 to 15.

"China is confronted with challenges in both investment negotiations, and the key problem is how to determine and actualize the 'negative list', which is related to the degree of the opening-up of the domestic market, the services sectors and the relaxing of market access," Huo said.

He called for the approach of the "negative list" to be introduced in broader regions rather than piloted only in the China (Shanghai) Free Trade Pilot Zone.

Shen, the commerce ministry spokesman, said as the Chinese government steps up the revision of outward direct investment regulations, all the outward investments will be managed through registration. Approvals will be reserved only for investments in sensitive regions or sectors.

China pledged to expand outward direct investment by enterprises and individuals and reform the management mechanism in November. The ministry is an important force in advancing the reforms.

Shen also noted that China and the EU share much bigger complementary industrial elements than competitiveness and both sides have the capability and acumen to control trade frictions.

The EU is China's largest trade partner. Bilateral trade hit $559.06 billion in 2013, up 2.1 percent year-on-year, said the ministry. China is the EU's biggest source of imports and has also become one of the EU's fastest-growing export markets. But bilateral trade in services amounted to just 10 percent of total trade in goods. Of the EU's exports to China, only 20 percent are in services, said the European Commission.

lijiabao@chinadaily.com.cn

|

A store in Paris offers Shang Xia products, a luxury label created by Hermes in China. There are also Shang Xia stores in Beijing and Shanghai. Trade between the European Union and China hit $559.06 billion in 2013, up 2.1 percent year-on-year. Chen Xiaowei / Xinhua |

(China Daily USA 01/22/2014 page13)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama, Putin discuss Olympics security in call

Smog descends on the 'two sessions' agendas

Man, 36, executed for rape, murder of sex slaves

IMF taking more upbeat view of growth in China

Xi won't meet Abe at Sochi Olympics

Suspected cyberattack on China

China tightens H7N9 coordination

Li hails work of foreign experts

US Weekly

|

|