BYD offers $400m in new shares; proceeds to help expand car output

Updated: 2014-05-26 15:45

By Bloomberg (China Daily USA)

|

||||||||

BYD Co, the Chinese automaker partially owned by Warren Buffett's Berkshire Hathaway Inc, is offering $400 million in new stock, according to a term sheet obtained by Bloomberg News.

The Hong Kong-listed shares are being offered at HK$35 ($4.50) to HK$37 each, according to the document. That's as much as 15 percent below the last trading price for BYD, whose stock was halted from trading in Hong Kong and Shenzhen Friday pending an announcement.

The funds would give Shenzhen-based BYD room to step up investments and bolster production of electric vehicles as governments worldwide step up efforts to fight pollution. Selling shares would also help alleviate the strain on a balance sheet saddled with surging debt.

The company has an option to increase the offering by $100 million, according to the term sheet. Cary Wei, a Shenzhen-based BYD public relations manager, declined to comment on the pending announcement.

Pranab Kumar Sarmah, an analyst at AM Capital Ltd., wrote in a report in March that BYD would probably need to raise money from capital markets because of its deteriorating financial health and rising spending needs.

BYD has gained 8.3 percent in Hong Kong trading this year, while the Hang Seng Index has fallen. Shares of companies typically fall when they disclose large issuances of new stock because they dilute the value of existing shares.

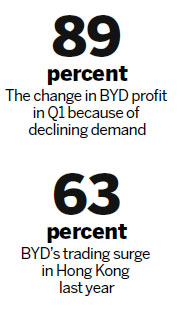

The sale comes after BYD reported profit tumbled 89 percent in the first quarter because of declining demand for its gasoline-fueled vehicles. Last year, profit jumped almost sevenfold after its billionaire founder and chairman, Wang Chuanfu, completed a three-year reorganization during which he cut the number of dealerships and narrowed losses at the solar business thanks to state incentives.

The company has reason to raise funds via shares over bonds or loans. BYD's net debt, or interest-bearing borrowings minus cash and equivalents, climbed 34 percent to a record 20.3 billion yuan ($3.3 billion) at the end of last year. Dividing that by equity, which is how BYD calculates its key gearing ratio for monitoring capital, the proportion of net debt bloated to 94 percent from 71 percent a year earlier.

The offering would also revive a plan shelved about a year ago, according to a person familiar with the matter. The company suspended plans to sell the stock in 2013 after Bloomberg News reported on the share-sale plans, according to the person. At the time, BYD said it wasn't "currently" planning to issue new shares. Bloomberg reported on the revival of the share sale on March 27.

Waiting may have helped the stock. BYD surged 63 percent in Hong Kong trading last year and is this year's fourth-best performer on the Hang Seng China Enterprises Index. On March 17, it climbed to a three-and-half year high of HK$55.35.

While that's short of the record HK$85.50 the stock reached in October 2009, it's still profitable for MidAmerican Energy Holdings Co, the unit of Buffett's Berkshire Hathaway that bought 225 million Hong Kong-listed shares of BYD for HK$8 each about five years ago. The Berkshire unit is BYD's biggest strategic partner by owning 28 percent of the Hong Kong-listed stock.

(China Daily USA 05/26/2014 page14)

US president pays surprise visit to Afghanistan

US president pays surprise visit to Afghanistan

Forum discusses strategies to realize Africa's promise

Forum discusses strategies to realize Africa's promise

South America is prime market for Chinese automakers

South America is prime market for Chinese automakers

Brazil names winners for 'Bridge' finals

Brazil names winners for 'Bridge' finals

37,000 US flags planted in Boston for Memorial Day

37,000 US flags planted in Boston for Memorial Day

The multibillion-dollar house that Jack built

The multibillion-dollar house that Jack built

Highlights of New York Forum Africa

Highlights of New York Forum Africa

Obama picks Director of OMB, new Secretary of HUD

Obama picks Director of OMB, new Secretary of HUD

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama pays surprised visit to Afghanistan

Children from China enroll in US summer academic camps

Senator to renew gun control push

Obama pledges to uphold 'sacred trust' with veterans

22 dead in south China rainstorms

7 dead in drive-by shooting in California

US cyber-scoundrelism to backfire

Van Gogh, Monet works going to US

US Weekly

|

|