The big gamble that paid off

Updated: 2014-07-14 06:59

By Meng Jing and Cai Xiao (China Daily USA)

|

||||||||

|

A big screen near NASDAQ Stock Market shows welcome messages for JD.com Inc, which was listed at the bourse on May 22. JD.com is China's second-largest e-commerce player after Alibaba Group. Wang Lei / Xinhua |

Foreigners led early charge in tech firms like Alibaba, now set for one of biggest listings ever

Some current and former employees of China's Alibaba Group are expected to become millionaires as the e-commerce conglomerate heads into what is expected to be one of the largest initial public offerings in global history.

According to Alibaba's draft prospectus, employees hold 26.7 percent of existing shares, which could translate into roughly $44.8 billion (32.9 billion euros) worth of unlocked shares, according to estimates from a Bloomberg survey of analysts.

As the largest e-commerce company in the world and owner of the Taobao shopping site, Alibaba Group is valued at $200 billion. But employees, who built the company from scratch over some 15 years, are not the biggest winners of the Hangzhou-based company's upcoming IPO in the United States.

Foreign investors have emerged as some of the biggest gainers in China's booming Internet market, and Alibaba is no exception.

Masayoshi Son, chairman of Japan's SoftBank, a top telecommunications and Internet investor, is likely to regain his position among the world's richest people due to the well-timed bet he made on Alibaba Group in 2000. With the $80 million he invested, SoftBank is Alibaba's largest shareholder with a 34 percent stake worth $57.12 billion.

Yahoo! Inc, the US-based multinational Internet giant, which invested $1 billion and holds 23 percent of Alibaba, could also reap billions of dollars from Alibaba's potential $20 billion listing.

"It is difficult to find TMT (technology, media and telecom) companies which have an annual growth of 50 percent in developed markets," says Annabelle Long, managing partner with Bertelsmann Asia Investments, a venture capital firm owned by German-based Bertelsmann.

"Growth rates even as low as 20 percent in Europe or the United States are difficult to find. But companies with such strong growth momentum can be found everywhere in China," she says.

|

Alibaba's headquarters in Hangzhou, Zhejiang province. Ju Huanzong / Xinhua |

"TMT is a high-growth sector in China compared with traditional industries," Long says. She describes TMT's deep and promising potential as "a blue ocean".

While developed Western countries are growing slowly, she notes, China's GDP growth is still more than 7 percent a year - even during a lackluster performance by the world economy.

Bertelsmann Asia Investments has invested in more than 30 startups in China since 2008 and more than half of them are in the TMT sector, Long says.

Four of the companies that Bertelsmann has invested in have gone pubic, including US-listed Bitauto Holdings Limited, a leading provider of Internet content and marketing services for China's fast-growing automotive industry.

Some experts say that despite the dizzying profits, foreign investors should make sure they remove any semblance of rose-tinted glasses before leaping. Unfamiliarity with a foreign market and potential regulatory concerns are factors to weigh, they say.

Still, there have been more than enough winning hands to tempt the hardy.

South African media company Naspers' stake is worth $40 billion from a $34 million investment in what was then a startup - Tencent Holdings Ltd, owner of the QQ messaging service and WeChat mobile messaging app. It is now valued at $120 billion and is one of China's big three Internet colossi, along with Alibaba and search engine giant Baidu Inc.

The venture capital firm Draper Fisher Jurvetson owned nearly one-third of Baidu when the Beijing-based company went public in the US in 2005.

JD.com Inc, China's largest online direct sales company, raised $1.78 billion in its US IPO in May. Backers of JD include foreign investors such as US investment firm Tiger Global, DST of Russia and Prince Alwaleed bin Talal of Saudi Arabia.

Two decades ago, when the world's most populous country gained access to the Internet, Chinese dotcom companies, most of which were private, were desperately seeking investors.

Foreign venture capital firms with deep pockets and mature systems of investment were seen as knights in shining armor by many Chinese Internet startups, which worked to make themselves attractive investment prospects.

"Most of the Chinese TMT companies have business models that originate in the Western developed countries," says William Ng, head of sales of global equity services for Greater China at Deutsche Bank.

BRICS nations don't like West dominance: Experts

BRICS nations don't like West dominance: Experts

Chinese call for Fox host to resign

Chinese call for Fox host to resign

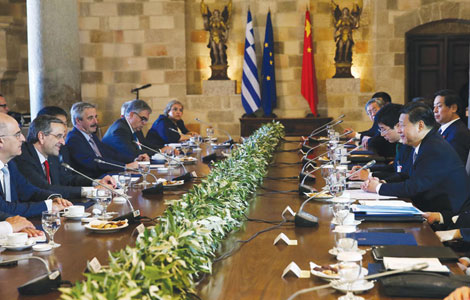

Xi makes 'symbolic' stop on Greek isle

Xi makes 'symbolic' stop on Greek isle

Brazil makes ready to play host to BRICS 'family'

Brazil makes ready to play host to BRICS 'family'

Forum attracts APEC leaders

Forum attracts APEC leaders

Hacker Attacks Memorial Hall's website

Hacker Attacks Memorial Hall's website

Germany wins World Cup on Mario Gotze's brilliance

Germany wins World Cup on Mario Gotze's brilliance

Chinese president pledges to enhance ties with Greece

Chinese president pledges to enhance ties with Greece

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Xi arrives in Brazil for BRICS summit

US network to produce Chinese-inspired drama series

BRICS nations seek new paths to develop global cooperation

BRICS' good story continues

Hacker hits website with threatening message

US network to produce Chinese-inspired drama series

Xi makes 'symbolic' stop on Greek isle

Xi stops in Greece on way to Brazil

US Weekly

|

|