The big gamble that paid off

Updated: 2014-07-14 06:59

By Meng Jing and Cai Xiao (China Daily USA)

|

||||||||

"It is easy for foreign investors to understand Chinese Internet companies. For example, JD.com can be sold to Wall Street as the Chinese Amazon. Sina Weibo is known as the Chinese Twitter."

Ng, whose bank has been helping many US-listed Chinese dotcom companies with their American Depositary Receipt business, says that TMT is the Chinese sector that meshes best with the US venture capital system.

"The US market provides Chinese TMT companies with a comparatively friendlier growth environment. Regardless of whether you are listing on NYSE or NASDAQ, there are more flexible entry regulations." Ng says, adding that stock markets on the Chinese mainland require companies to be profitable, a tough rule for Internet startups.

In the case of JD.com, for example, despite being China's largest online sales company by market share and listed in the US in late May, it broke even for the first time only in 2013, 10 years after the company was founded in Beijing.

Western venture capital systems, US dollar-based funding and more flexible Western IPO regulations all create an ecosystem suitable for the growth of Chinese TMTs. By injecting cash into Chinese TMTs and listing their shares in the US, the entire capital market in the West benefits from the Chinese Internet boom, insiders say.

Apart from handling American Depositary Receipt business, Western banks also rake in lots of fees by underwriting Chinese companies' IPOs in the US. The six banks leading Alibaba's IPO reportedly will share $400 million in fees, assuming Alibaba raises $20 billion.

Apart from handling American Depositary Receipt business, Western banks also rake in lots of fees by underwriting Chinese companies' IPOs in the US. The six banks leading Alibaba's IPO reportedly will share $400 million in fees, assuming Alibaba raises $20 billion.

This year is expected to see a record-breaking number of Chinese companies make their debut in US stock markets. In 2010, as many as 43 Chinese companies listed their shares in the US, raising nearly $4 billion. That was followed by two slower years for IPOs. So far this year, 10 Chinese companies have gone public in the US, raising nearly $3.1 billion, and a string of Chinese TMT companies are expected to list their shares in the near future.

While the booming IPO market brings foreign banks and investors lucrative fees and returns, where Western investors benefit most from investing in Chinese TMT companies is in access to the Chinese market.

"In just a few years, China's online retail market has become the second largest in the world, after the US. Yet China has an online population that is twice the whole US population, and over 300 million active online shoppers. These Chinese companies offer Western investors the biggest and broadest entry into this booming industry," says Neil Flynn, head equity analyst at Shanghai-based Chineseinvestors.com, a leading financial analysis firm of US-listed Chinese firms.

"Obviously, this is a booming industry, and firms are posting impressive profits. For example, if you look at VIPshop, which has a niche role within the online retail industry, they are seeing incredible revenue and profit, and their stock price has risen 2,600 percent in two years," he says.

Plenty of opportunities remain for investors as the potential of the Internet market in China is huge, he says. "In terms of Internet penetration, we only have about 50 percent in China, whilst the developed nations such as the US and Japan have 80 percent Internet penetration, so there is certainly a lot of potential for the market to grow," Flynn says.

During the past 19 years, many people have asked whether TMT companies as a sector would continue to be a good bet, says Chuan Thor, a managing director at Highland Capital Partners, a global venture capital firm with offices in Silicon Valley, Boston and Shanghai. He says he believes it is always the best sector for early-stage venture investments as the technologies are evolving every year.

Highland invested $17.5 million in Chinese Internet security company Qihoo 360 at the end of 2006, and its 15.94 percent stake had a total value of more than $630 million when it went public on the New York Stock Exchange in 2011.

"The deal with Qihoo 360 shows that doing early-stage investment in China can generate great returns," says Thor, who also invested in leading Chinese TMT companies such as Tuniu 6.CN, GameWave, NetentSec, Viva and UUSee.

He says many Chinese equity investment firms used to seek pre-IPO deals when the companies were very mature and profitable, but such opportunities have become rarer.

Thor says that while TMT giants are quite strong, small companies can provide good opportunities and may become new giants.

Thor cites Lycos, which used to be a popular search engine in the late 1990s. Yahoo overshadowed Lycos, and then Google rose up and became the giant, though Facebook, Twitter or something else might dethrone it someday.

"If a startup team works hard and is willing to innovate and reverse the traditional business pattern, it may create a great company," says Thor, adding that his company invests in companies that are one or two years old, because that's when they need money the most.

Many experts, however, caution that the large number of cash-thirsty startups in China's rosy Internet market don't add up to guaranteed profits for foreign investors.

Some cite concerns that the Chinese government might try to tighten regulations to limit foreign investment in the TMT sector, which has increasingly grown into the most dynamic part of China's economy, or launch policies to give local venture capital an edge in the sector.

Flynn says that Chinese restrictions mean that Western investors will be at a disadvantage compared with Chinese investors when investing in China. There is a growing number of local venture capital firms that could fund the next tech giants, he says.

A total of 189 new yuan-based funds emerged in China's venture capital market in 2013, raising a total of $6.38 billion in that year, while only 10 new foreign currency funds emerged in China in 2013, raising $541 million, according to a recent report from Zero2IPO Research, a leading research institution in China's private equity industry.

China's increasing wealth has provided a new flow of venture capital funds for investment in Chinese businesses, analysts say.

Foreign-based venture capital firms can also find it difficult to understand the market, says Flynn.

"It's very easy for Western investors to see the likes of VIPshop and JD, and read the hype about Alibaba, and get a rosy view about China's e-commerce market. However, investors have to understand the nature of consumers in China, the contrast between the tier-one cities and the tier-four cities, and understand that you can't just view Alibaba as the 'Chinese Amazon'.

"Once Western investors understand these points, they can understand China's e-commerce market, and find where the investment opportunities lie."

However, Long sees things differently. She says many foreign venture capital firms have set up offices in China and hired Chinese people to run their companies and look for deals.

"The main difference between Chinese and Western venture capital firms is the money they raise, RMB or US dollars," she says. At the same time, she says there is "no direct competition" between Chinese and Western venture capital firms because different companies focus on different sectors of the market.

However, what she does see as the major threat for Western firms like hers is the increasing power of China's big three Internet companies - Baidu, Alibaba and Tencent - to gobble up promising companies.

Citi Research has forecast that the three giants will drive Internet-related deals in China to a record this year.

"As a Western VC, how to compete with leading Chinese Internet firms in making deals with startups is our biggest problem," Long says, adding that her firms invest $100 million every year.

She says writing a $5 billion check would be a big decision for any of the Global 100 Index companies, but it is not a difficult choice for rising Internet giants such as Alibaba, which just spent cash and shares worth more than $3 billion to buy UCWeb, a Chinese mobile browser company.

Heading to its highly anticipated IPO in the US, Alibaba has stepped up its buying spree by investing in various companies from media and shopping malls to online video platforms and football clubs. Alibaba alone has spent more than $5 billion this year in buying controlling stakes of smaller firms or making strategic investments in promising startups.

Contact the writers at mengjing@chinadaily.com.cn and caixiao@chinadaily.com.cn.

(China Daily USA 07/14/2014 page13)

BRICS nations don't like West dominance: Experts

BRICS nations don't like West dominance: Experts

Chinese call for Fox host to resign

Chinese call for Fox host to resign

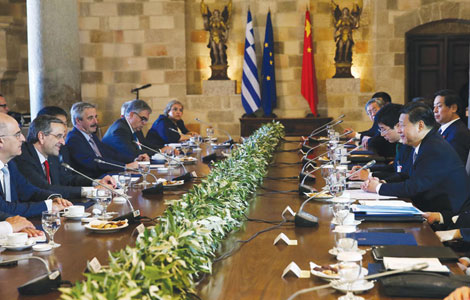

Xi makes 'symbolic' stop on Greek isle

Xi makes 'symbolic' stop on Greek isle

Brazil makes ready to play host to BRICS 'family'

Brazil makes ready to play host to BRICS 'family'

Forum attracts APEC leaders

Forum attracts APEC leaders

Hacker Attacks Memorial Hall's website

Hacker Attacks Memorial Hall's website

Germany wins World Cup on Mario Gotze's brilliance

Germany wins World Cup on Mario Gotze's brilliance

Chinese president pledges to enhance ties with Greece

Chinese president pledges to enhance ties with Greece

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Xi arrives in Brazil for BRICS summit

US network to produce Chinese-inspired drama series

BRICS nations seek new paths to develop global cooperation

BRICS' good story continues

Hacker hits website with threatening message

US network to produce Chinese-inspired drama series

Xi makes 'symbolic' stop on Greek isle

Xi stops in Greece on way to Brazil

US Weekly

|

|