The politics of economic stupidity

Updated: 2014-12-30 08:30

By Josephe.stiglitz(China Daily USA)

|

||||||||

In 2014, the world economy remained stuck in the same rut that it has been in since emerging from the 2008 global financial crisis. Despite seemingly strong government action in Europe and the United States, both economies suffered deep and prolonged downturns. The gap between where they are and where they most likely would have been had the crisis not erupted is huge. In Europe, it increased over the course of the year.

Developing countries fared better, but even there the news was grim. The most successful of these economies, having based their growth on exports, continued to expand in the wake of the financial crisis, even as their export markets struggled. But their performance, too, began to diminish significantly in 2014.

The near-global stagnation witnessed in 2014 is man-made. It is the result of politics and policies in several major economies - politics and policies that choked off demand. In the absence of demand, investment and jobs will fail to materialize. It is that simple.

Nowhere is this clearer than in the eurozone, which has officially adopted a policy of austerity - cuts in government spending that augment weaknesses in private spending. The eurozone's structure is partly to blame for impeding adjustment to the shock generated by the crisis; in the absence of a banking union, it was no surprise that money fled the hardest-hit countries, weakening their financial systems and constraining lending and investment.

In Japan, one of the three "arrows" of Prime Minister Shinzo Abe's program for economic revival was launched in the wrong direction. The fall in GDP that followed the increase in the consumption tax in April provided further evidence in support of Keynesian economics - as if there was not enough already.

The US introduced the smallest dose of austerity, and it has enjoyed the best economic performance. But even in the US, there are roughly 650,000 fewer public-sector employees than there were before the crisis; normally, we would have expected some 2 million more. As a result, the US, too, is suffering, with growth so anemic that wages remain basically stagnant.

Much of the growth deceleration in emerging and developing countries reflects China's slowdown. China is now the world's largest economy (in terms of purchasing power parity), and it has long been the main contributor to global growth. But China's remarkable success has bred its own problems, which should be addressed sooner rather than later.

The Chinese economy's shift from quantity to quality is welcome - almost necessary. And, though President Xi Jinping's fight against corruption may cause economic growth to slow further as paralysis grips public contracting, there is no reason for Xi to let up. On the contrary, other factors - widespread environmental problems, high and rising levels of inequality, and private-sector fraud - need to be addressed with equal vigor.

In short, the world should not expect China to shore up global aggregate demand in 2015. If anything, there will be an even bigger hole to fill.

Meanwhile, in Russia, we can expect Western sanctions to slow growth, with adverse effects on an already weakened Europe.

For the past six years, the West has believed that monetary policy can save the day. The crisis led to huge budget deficits and rising debt, and the need for deleveraging, the thinking goes, means that fiscal policy must be shunted aside.

The problem is that low interest rates will not motivate firms to invest if there is no demand for their products. Nor will low rates inspire individuals to borrow to consume if they are anxious about their future (which they should be). What monetary policy can do is create asset-price bubbles. It might even prop up the price of government bonds in Europe, thereby forestalling a sovereign-debt crisis. But it is important to be clear: the likelihood that loose monetary policies will restore global prosperity is nil.

This brings us back to politics and policies. Demand is what the world needs most. The private sector - even with the generous support of monetary authorities - will not supply it. But fiscal policy can. We have an ample choice of public investments that would yield high returns - far higher than the real cost of capital - and that would strengthen the balance sheets of the countries undertaking them.

The big problem facing the world in 2015 is not economic. We know how to escape our current malaise. The problem is our stupid politics.

The author is a Nobel laureate in economics and also a professor at Columbia University. Project Syndicate

(China Daily USA 12/30/2014 page4)

Top 10 happiest cities in China 2014

Top 10 happiest cities in China 2014

Children step out of Daliang Mountain

Children step out of Daliang Mountain

New Consul General of China in New York arrives at JFK

New Consul General of China in New York arrives at JFK

Missing AirAsia plane maybe at sea bottom

Missing AirAsia plane maybe at sea bottom

Chinese artists get Times Square spotlight

Chinese artists get Times Square spotlight

Yearender: Best selling Chinese films in 2014

Yearender: Best selling Chinese films in 2014

Top 10 policy changes of China in 2014

Top 10 policy changes of China in 2014

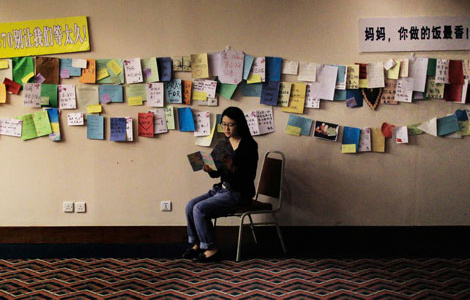

Families of MH370's passengers still hold out hope

Families of MH370's passengers still hold out hope

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

'New normal' focus for new consul general in NY

China says no role in Sony hacking

'Human error' at fault in disappearance of AirAsia flight

Lost plane's request to change course was denied

The Interview gets mixed views

Harvard students seek meaty profits from alpaca

Funeral set for Officer Wenjian Liu

China offers to help in search for missing AirAsia flight

US Weekly

|

|