Fosun may bid on Brooklyn Nets

Updated: 2015-03-04 11:14

By Jack Freifelder in New York(China Daily USA)

|

||||||||

China's Fosun Group has expressed interest in buying the National Basketball Association's Brooklyn Nets, and the price tag could be near $2 billion, according to a published report.

Others interested in owning the team include the Qatari government's investment fund, American music mogul David Geffen, and former Time Warner executive Dick Parsons, the New York Post reported on Monday.

Russian billionaire Mikhail Prokhorov acquired the team nearly five years ago and moved it from New Jersey to its current home at the Barclays Center, a multipurpose arena in Brooklyn.

Prokhorov, who was the first foreign owner of an NBA franchise, put up $220 million in 2010 to control an 80 percent share of the Nets and a 45 percent share of the Barclays Center.

Ellen Pinchuk, a spokeswoman for Prokhorov, said Tuesday in a statement to China Daily that the team's ownership is "open to listening to offers" but "nothing is imminent" in terms of the sale of any stake in the team.

Fosun is no stranger to owning property in New York. The Shanghai-based industrial conglomerate paid $725 million for One Chase Manhattan Plaza, a 60-story office tower in Lower Manhattan. It was one of the largest purchases of U.S. property by a Chinese investor.

After the acquisition, Guo Guangchang, who co-founded Fosun two decades ago, told The Wall Street Journal that "in the U.S., the priority is New York," and he added that the company was looking for other investments.

Basketball is among China's most popular sports, with more than 300 million playing the game, according to data from the Chinese Basketball Association.

China also is the NBA's biggest overseas market, according to NBA China CEO David Shoemaker, who said the North America-based NBA has played 18 games there since 1978. The league is now in the midst of its fourth annual Chinese New Year celebration, which ends onWednesday, and includes live broadcasts of 56 games in China.

In January, Bloomberg News reported that the Nets owner hired investment banking advisory firm Evercore Partners to explore sale options for the team.

Bruce Ratner, executive chairman of Forest City Ratner Companies, a national real estate firm, owns the remaining 20 percent of the team as well as the majority share of the Barclays Center, 55 percent, which opened in September 2012.

Ratner also hired Evercore to explore a sale of his stake in the team and the arena, the Post said. Evercore declined to comment.

Peter Schwartz, a managing director of venture capital at Boston-based Christie & Associates, told Bloomberg News in January that he believed a price tag for the Nets could be as much as $1.3 billion. But the arena is worth even more, he said.

Given the backdrop of New York being the No 1 US media market and the infrequency of high-profile opportunities to buy sports franchises, the Nets could exceed the $2 billion that was paid for the Los Angeles Clippers, Schwartz said.

Forbes said in its annual Business of Basketball NBA Team Values list that the Nets are worth $1.5 billion, sixth in the 30-team league.

One issue creating some uncertainty in Prokhorov's hunt for a buyer is the lack of clarity from the NBA on whether he can sell his 80 percent stake separately from his 45 percent stake in the Barclays Center, a banker close to the sale process told the Post.

Prokhorov does not want to sell his stakes as a package because fewer buyers can afford both, according to the Post. The Barclays Center would be valued at $1.2 billion on top of the $2 billion that a sale of the team could bring, the newspaper said.

jackfreifelder@chinadailyusa.com

(China Daily USA 03/04/2015 page1)

Volcano Villarrica erupts in southern Chile

Volcano Villarrica erupts in southern Chile

All dressed up

All dressed up

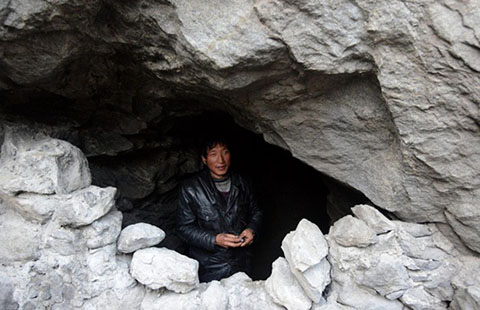

Caveman saves money for family

Caveman saves money for family

Buddhist monks break bricks in kung fu

Buddhist monks break bricks in kung fu

China's interest rate adjustments beteen 2008 and 2015

China's interest rate adjustments beteen 2008 and 2015

Beijing steps up security for two sessions

Beijing steps up security for two sessions

Han-style Chinese beauties at Cambridge

Han-style Chinese beauties at Cambridge

Prince William visits Forbidden City

Prince William visits Forbidden City

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China expects 10% rise in defense budget

Cybersecurity law 'makes sense'

US agents raids 'maternity hotels'

Netanyahu assails Iran-nuclear talks

US firms to lower China stakes in '15

Homeless man shot dead by police

China passes US at movie box office

Air pollution tops public concerns for two sessions

US Weekly

|

|