Blast may crimp PX supply, push up price

Updated: 2015-04-08 08:09

By Du Juan(China Daily USA)

|

||||||||

Compound is widely used in textiles and pharmaceutical items

The explosion that ripped through a chemical plant in Fujian province and sparked a major fire may cause paraxylene supply shortages and price hikes, an industry expert said on Tuesday.

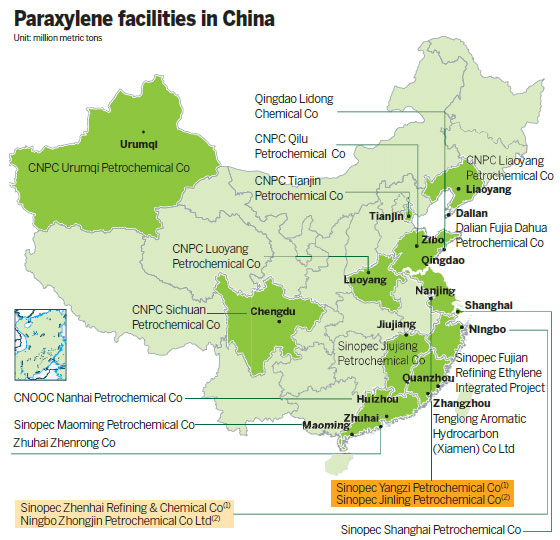

The plant was owned by Tenglong Aromatic (Zhangzhou) Co Ltd, one of China's major paraxylene producers. Up to 19 people including firefighters are believed to be injured from the accident, which was reportedly caused by an oil leakage.

Li Li, research director at ICIS Energy, a Shanghai-based energy information consultancy, said the explosion might cause production suspension, which will result in supply shortages and price hikes in an already tight market.

Paraxylene, which is commonly referred to as PX, a flammable and carcinogenic liquid used in the production of polyester films and fabrics, is widely used for making cloth, drug capsules and water bottles.

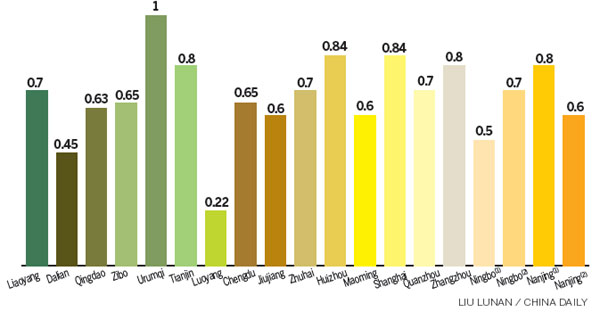

China's demand for PX has been growing steadily in the past few years, and it became the largest consumer of the chemical in 2012 with annual demand of about 13.85 million metric tons. However, the country's annual production capacity of PX is only 8.8 million tons.

Last year, China consumed 17.66 million tons of PX, of which 9.08 million tons came from imports, accounting for 51.4 percent of the demand.

Li said Asia, led by China, will need new PX capacity of 9 million tons in 2015, while the planned new capacity is less than 4 million tons.

"PX facilities are normally shut down for maintenance during the second quarter of the year and this period may see more price hikes due to the blast," she said.

The PX plant on the Gulei Peninsula in Zhangzhou, Fujian, has an annual capacity of 1.6 million tons.

It was originally planned to be built in the coastal city of Xiamen in the same province, but was relocated to Zhangzhou after thousands took part in a protest in 2007.

Media reported that the project had started construction before it got environmental impact assessment approval and was fined by the authorities in 2013.

China's PX projects are mainly dominated by the two oil giants - China National Petroleum Corp, the country's largest oil and gas producer, and Sinopec Group, Asia's biggest refiner. The two companies account for around 80 percent of the nation's total PX output.

Facing the growing demand and supply shortage of PX in the country, some private companies are stepping into the area.

In February, Baota Petrochemical Group, a private oil refining and petrochemical company based in the Ningxia Hui autonomous region, signed an agreement with the United States-based company UOP LLC and introduced the technology for aromatic hydrocarbon production lines from the latter.

Sun Hangchao, board chairman of Baota Petrochemical, said it is the best choice for the company to employ the production line to further develop downstream chemical businesses.

If the cooperation goes well, Baota Petrochemical will become the second private Chinese company that produces paraxylene, following Fujia Group, headquartered in Dalian, Liaoning province.

PX plants are highly controversial in China, and proposed plants met strong public opposition in recent years.

dujuan@chinadaily.com.cn

(China Daily USA 04/08/2015 page13)

- China's last Bombardier CRJ200 civil aviation aircraft retires

- Record travel on Tomb Sweeping Day holiday

- Report highlights growing role of new media

- Southeast China's chemical plant fire put out

- Three injured in chemical plant blast in E China

- Visits to Nanjing massacre memorial more than double in Q1

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Americans prefer China to Japan on economic ties

World Bank welcomes AIIB

Business, energy vital

in trade trip

US tourism spots target

Chinese visitors

Suit filed over US weed killer

China has world's most

congested cities

Cause of China chemical plant blast identified

Chinese group backs reversal on injunction

US Weekly

|

|