Chinese home-buying in California is off: Realtors

Updated: 2015-10-19 11:27

By Lia Zhu in San Francisco(China Daily USA)

|

||||||||

California, a popular place for Chinese real estate purchases, has seen fewer homes sold to Chinese shoppers this year and the country’s stock market turmoil and economic slowdown is blamed, according to realtors.

“We saw a decline (in Chinese people buying houses) in June, and the trend is even more remarkable since August,” said Keith Lo, a veteran realtor based in Los Angeles.

He said the drop was felt by other agents, too, in different ways.

“First, the inventory is rising and the sale price is falling,” said Lo, who has more than 30 years of experience in real estate. “Meanwhile, we heard more failed cases and escrow companies experiencing slow business.”

He said three quarters of his clients were from China and most of them were businesspeople who either had business in the US or children in US schools.

“They either purchase or rent here, but I’ve never seen anyone sell their houses,” Lo said.

According to Lo, investors from the Chinese mainland started to become a majority of the foreign homebuyers in California starting around 2005 and by 2010 they were all-cash buyers, partly due to limited access to loans.

The current slump might be fueled by the turmoil in China’s stock market, which left Chinese investors with less spare money and more conservative, he said.

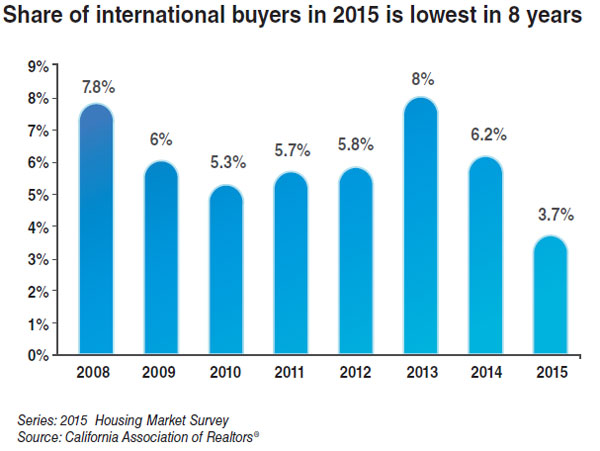

A report published by the California Association of Realtors earlier this month found that 43 percent of international homebuyers in California are from China. The share of international buyers is projected to drop to 4 percent this year, compared with a peak of 8 percent in 2013, according to the report.

“Stock market volatility” and “China’s slower growth” are among the “wild cards” that will influence California’s housing market in 2016, the report said.

Another immediate reason for the home sales drop is that Chinese buyers face more difficulty in moving their money out of China, said Kathy Bian, a San Francisco Bay Area-based realtor.

Chinese law allows individuals to transfer up to $50,000 out of the country per year. “Take a $500,000 home, for example, you need to find 10 people, usually your family, relatives or friends, and ask each of them to transfer $50,000 to the US,” Bian said.

China’s State Administration of Foreign Exchange, the country’s foreign exchange regulator, has recently tightened controls on individuals’ overseas transfer limit to combat money laundering amid concerns over capital flight.

Banks have been told to bolster checks on foreign exchange transactions and identify "abnormal" cross-border fund transfers, including five or more individuals transferring money to the same individual or institution overseas on the same day or within several consecutive days.

A cap of 50,000 yuan ($7,878) has been imposed on cash withdrawals made through UnionPay cards outside the country from Oct 1 to Dec 3, and an annual cap of 100,000 yuan will be introduced in 2016.

“The tightened steps will not stop Chinese from buying houses here, only postpone their plans,” said Coco Tan, president of Chinese American Real Estate Association in San Jose.

“I think the stock market slump, on the other hand, may stimulate them to invest in the housing market in the Bay Area because of its low risk,” said Tan, also a broker associate with Coldwell Banker. “The increasing number of students and tourists, thanks to the 10-year-valid visa policy, will attract more people to buy homes in the US.”

According to statistics provided by Tan’s office based on data from title companies and Santa Clara county recorder's office, 9,871 purchases were made by people with Chinese last names as of Oct 13 this year, taking up 10.9 percent of the sales total.

Last year, the number was 11,172, accounting for 11.3 percent of the total.

Since buyers are not required to disclose their citizenship or residency status, it's difficult to know exactly how many homes were purchased by Chinese nationals, she added.

“Despite the fluctuations over the past 30 years, I think investors will make money in the long run,” Lo said.

- Wide support seen for nationwide smoking ban

- Treat or cheat: Chinese media exposes queer therapies on gay people

- Farmland hot spots increase air pollution

- Mentally impaired earn their bread at Nanjing bakery

- China 'will never recklessly resort to the use of force'

- Chinese look yonder for luxury goods

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US to accept more refugees than planned

Li calls on State-owned firms to tap more global markets

Apple's iOS App Store suffers first major attack

Japan enacts new security laws to overturn postwar pacifism

US Weekly

|

|