Wine in the US: 'Made in China' is rare

Updated: 2015-10-30 11:47

By Jack Freifelder and Bian Jibu(China Daily)

|

||||||||

China has moved into many markets in the United States, but there is one where the 'Made in China' label is rare: wine. The world's second-largest wine grower is focusing on its huge domestic market, report Jack Freifelder and Bian Jibu from New York.

C hina now has more vineyards than France, Italy, Australia and the United States. They occupy more than 3,000 square miles, equal to more than 10 percent of the world's total. And in 2014, the world's second-largest economy became the world's second-largest wine grower by area, overtaking France.

While it has poured billions into the US from real estate to creating and/or acquiring companies and offering a variety of products, China barely pours any wine into the world's largest wine market. The "Made in China" label is hard to find in the United States.

In 2013, the latest year for which data is available, the US drank a total of 339 million cases of wine, according to the UK-based International Wines and Spirits Record (IWSR). That was above France's 296 million cases, Italy's 288 million, Germany's 274 million, China's 144 million and the UK's 133 million.

Despite increasing efforts devoted to wine appreciation and the cultivation of wine culture in China, the country is still relatively unknown as a wine producer globally, according to experts.

Known as the "Big Three of Chinese wine," Changyu Pioneer Wine Co, Great Wall Wine and Dynasty Fine Wines Group account for a majority of the country's wineries, with combined revenues estimated at $8 billion, according to a May 2015 article in the International Business Times (IBT), which noted that about one-half of China's wine sales are by foreign producers, "with Chinese wineries still generally occupying the middle to low end of the market".

Michael Wu, vice-chairman of the Chengdu-based Chinese Wine Associations Alliance (CWAA), said companies like Yantai Changyu and Great Wall Wine control big percentages of the lower price wine market in China.

"[The Big Three] want to go to the US, but they don't really have the capability now. In other words, they want to go to any market that would accept them," Wu wrote in an e-mail to China Daily. "Considering our population of 1.4 billion, I don't think they have an impulse to export to the US now."

Favorable ratings

According to the IBT, international wine critics are now giving favorable ratings to high-end wine made in China, and "given the scale of the Chinese wine industry and its growing ambitions, restaurants from New York to London could add Chinese bottles to their wine lists - eventually."

Wu, who also serves as the general-secretary of the Chengdu Wine Association, said there are 11 wine-producing areas in China.

Some of the most well-known regions for wine production include: Beijing; Ningxia; Taiyuan, Shanxi province; Tonghua, Jilin province; Yantai, Shandong province; and Zhangjiakou, Hebei province.

Ningxia is about 500 miles west of Beijing and has more than 50 wineries. There are about 80,000 acres of vineyards planted in Ningxia. By 2020, they plan to have more than 160,000.

That's more than three times the amount in Napa Valley in California, wine expert and author Karen MacNeil told CBS News in August.

"We thought we knew all of the great wine regions in the world," she said. "You know, we know Tuscany, we know Bordeaux, we know Napa. We thought we knew them. The idea that somewhere in the Chinese desert might be the next great wine region in the world, it's astounding."

"By 2020 we will build the region into the wine capital of the East with more than 100 quality wineries," Li Jianhua, party head of Ningxia said in an interview with China Daily. "This will generate 100 billion yuan ($15.7 billion) in revenue and 100,000 jobs."

Hao Linhai, the official in charge of the Ningxia wine region, told China Daily: "We have never emphasized our wine production. We actually want the market to be impressed by the quality of our wines. We want a big wine industry-composed of smaller-scale wineries.

Debra Meiburg, Hong Kong-based master of wine, said that "Ningxia is the region that's getting a lot of attention at the moment, and the government has thrown in a lot of money to provide a lot of support."

Meiburg told China Daily that the government in Ningxia is sponsoring a reality TV event where nearly 20 international winemakers have been invited to help produce wine in the province.

"That's a really interesting move to draw global attention to their wine region," she said. "To me it's quite exciting that they're bringing these international wine-making influences to the region. That is a shift in thinking."

But Meiburg said that wine growers in Ningxia face problems, especially the extremes of winter temperatures that cause growers to protect vines from the cold.

"The region provides the drier air that is needed to produce high-quality grapes, but the only way to really do that is to literally bury the vines each winter, so that means they have to push the trunk down and pile dirt on top of them," she explained. "Burying the vines in the winter is very hard on the vines. It will never allow the vine trunk to grow firm and stable in its old age. It limits the life of the vine, and older vines almost always produce higher-quality wines. Although Ningxia is one of the best areas at the moment, it has its limitations."

'Down the road'

Pierre Ly, an associate professor of International Political Economy at the University of Puget Sound, in Tacoma, Washington, said: "Producers in China are trying to make better wine year after year. Now they look to be more motivated by the growth of the domestic market, and exports are further down the road.

"If you decide to market wine in a certain way, that's how people are going to think of it," he told China Daily. "If you start promoting it as a different thing, something fun (think of Yellowtail in the US), there are many ways you can sell wine. A lot of these evolutions have to do with how companies seek market niches and new ways to make wine available."

"That's one of the problems when you sell wine abroad is that you have that image problem," he said. "If you're not known for wine, people are not going to believe that you can make good wine."

Not much exporting

As for Chinese wine being sold in the US, Ly said there's simply not much access to speak of.

"There are an only couple places in our area, like The Great Wall Shopping Mall in Kent, Washington," he said. "There they have a bottle of Changyu 2003 for $18. That's all we've seen here."

But right now, winemakers in China don't have very serious export aspirations, according to Meiburg.

And Wu agrees.

"Many of China's major wine-producing regions have little reason to feel confident about the marketability of their wines in the US, or elsewhere," Wu wrote.

"There's not enough locally made wine in the market," Meiburg said. "They are planting like crazy, but they don't feel there's a huge imperative to export. It's far simpler at the moment to sell domestic wine."

Except for a few brands operating on a small scale, she said that there's not much wine coming out of China.

"Grace Vineyards is certainly exporting and Dynasty Wines, but not many labels are coming out yet, so you won't see much Chinese wine on the market," Meiburg said. And she said that it will be a while before Chinese winemakers have a "serious impact" on the global market.

China's history with grape wine dates back more than 4,600 years, but the modern wine industry has its roots in the latter stages of the 19th century when the Changyu Winery in Yantai, Shandong province was established, which is among the country's largest wine producers. In 1910, the Beijing Winery was started and produced wine used in religious rites by China's Christians.

The first Chinese winemaker to establish itself with the help of foreign funding was Great Wall Wine Co in 1979. It used equipment imported from France, Germany and Italy to help set up operations.

A year later, the French firm now known as Remy Cointreau - which makes Remy Martin cognac and Cointreau liqueur - invested in the Chinese city of Tianjin to develop Dynasty Wines.

A number of high-profile vintners from outside of China have grabbed space to grow their grape varieties in the country, including French stalwarts Chateau Lafite Rothschild and LVMH Moet Hennessy.

Rothschild started its own Chinese vineyard at the beginning of the decade with 37 acres of land in Penglai, Shandong province. There it grows grapes for cabernet sauvignon, syrah, cabernet franc and merlot wine varieties.

Karl Storchmann, a professor of economics at New York University and the editor of the Journal of Wine Economics, said China is an attractive market for wine because of its population size and it's small but rapidly growing per capita wine consumption.

"Chinese wines are unknown in this country," Storchmann wrote in an e-mail to China Daily. "However, China has a domestic market that is vast and supports a huge wine industry. I assume that quality will go up rapidly. Consumers need to know that the Chinese can offer very good quality."

Ly and Cynthia Howson, a lecturer at the University of Washington, are married and writing a book together about Chinese wine. They have been to China three times since 2013, each time for a number of weeks while researching the growth of the Chinese wine industry.

Howson said there are a lot of winemakers and people in the wine industry that are talking about markets overseas.

"Exporting has some advantages (bringing legitimacy to Chinese wine overall), but for most companies there's such massive growth in China to begin with," Howson said. "The task of exporting is incredibly challenging legally and practically speaking, and exporting to the US is almost like 50 different countries with a whole new set of challenges."

Howson said for Chinese wine to be more visible in the US there would have to be more development of the industry on the home front.

"More exporting overall little-by-little would include the US," she said, "once the industry is more developed and the strong players have been identified."

Despite the gap between China's imports of foreign wine and its export of domestically produced varieties, Storchmann said he expects import growth to peter out in the coming years.

"We already see some saturation," he wrote. "Domestic production will fill this void. Even further, I expect China to be a net exporter in less than 15 years."

Meiburg said it would be great to see more high-quality Chinese wines in the US market.

"That would be very exciting and add to the diversity of the wine world, but the US market is not the easiest," she said. "A few companies dominate much of the import market, and from state to state the laws differ. So it is somewhat more problematic than it would seem to enter the US.

"My advice would be to pick a state, or even a city, and hope to enter the city, not the full country," she added. "In some ways, that's the same advice I would give someone entering the China market."

Meiburg, who has lived in Hong Kong for 30 years, said she has been tasting wine produced in China for almost 15 years.

"It is absolutely getting better each year, but it's still in general of very ordinary quality to be honest," she said. "There are a few shining stars, and we're starting to see some wines that at least would be mid-market wines elsewhere in the world."

Meiburg reiterated that China's wine growers do not yet have high aspirations for exporting their goods. "But you can be sure that any time China makes up its mind to do something well it does, and they clearly have started making up their minds to produce some high-quality wines," she said.

Wu, with the CWAA, said many of China's major wine-producing regions have little reason to feel confident about the marketability of their wines in the US, or elsewhere. "Nonetheless, they do want exports," he wrote.

"So the question is: What will it take for Chinese wine to be popular in the US? In my opinion, Chinese wines have to do some practical jobs with their wineries and products. The problem is that most of the brands are relatively weak in terms of their knowledge of viticulture, sales."

"Chinese wine still has their own terroir to show, but they need to be patient," Wu wrote. "After that they can go to international or US markets."

Contact the writer at jackfreifelder@chinadailyusa.com

|

A Uygur ethnic woman works in a grape garden in Gaochang district, Turpan city, Xinjiang Uygur autonomous region on Aug 20. Photo Provided To China Daily |

|

|

(China Daily 10/30/2015 page20)

- Thwarted homecoming of soldiers' remains triggers emotional breakdown

- China's first innovative drug approved NDA in the US

- China lists, names five for judicial intervention

- Scientists decode panda language

- Beijing embraces first snow of the season

- New policy expected to bring spike in births, and then fewer

History of Coca-Cola on display in Shanghai

History of Coca-Cola on display in Shanghai

Beijing embraces first snow of the season

Beijing embraces first snow of the season

10 reasons why Chinese tourists like Singapore

10 reasons why Chinese tourists like Singapore

Negotiation is 'right approach'

Negotiation is 'right approach'

Top 10 Asian economies with highest English proficiency

Top 10 Asian economies with highest English proficiency

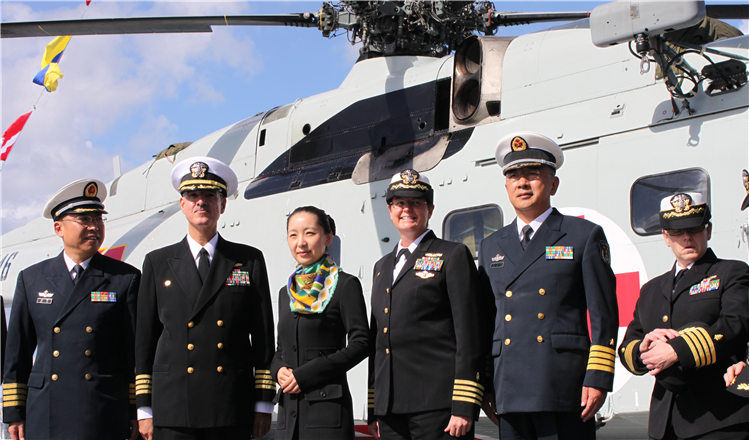

PLA Navy fleet pays visit to Florida

PLA Navy fleet pays visit to Florida

Top Gun: Breathtaking moments of China Air Force

Top Gun: Breathtaking moments of China Air Force

Peace Ark docks at San Diego

Peace Ark docks at San Diego

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US to accept more refugees than planned

Li calls on State-owned firms to tap more global markets

Apple's iOS App Store suffers first major attack

US Weekly

|

|