YTO on fast route to riches

Updated: 2015-11-30 07:56

By Wang Ying In Shanghai(China Daily USA)

|

||||||||

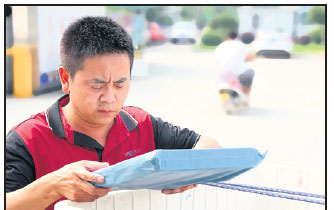

From a small courier in 2000, the Shanghai group now has 20,000 delivery centers across China and employs up to 220,000 workers WANG YING

Yu Weijiao has turned Shanghai YTO Express (Logistics) Co Ltd into a powerhouse group generating billions of yuan in revenue.

From a small courier company in 2000, it is now the largest express delivery business by market share in China after cashing in on the booming e-commerce industry.

In Beijing alone, YTO has 84 centers and 20,000 country-wide as the group takes advantage of the government's decision to realign the economy from cheap, mass-produced exports toward more sustainable consumer-fuelled domestic growth.

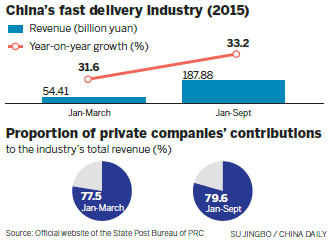

Last year, companies such as YTO delivered 14 billion packages as China raced ahead of the United States in the sector for the first time, Ma Junsheng, chief of the State Post Bureau, revealed.

Revenue topped 204 billion yuan ($37.79 billion), up 42 percent compared to the same period in 2013, an "amazing achievement" during a time of slowing economic activity.

"We have become the No 1 express delivery service in the country and provide more opportunities for other businesses involved in the sector," Yu, chairman at YTO, said.

"In 2014, up to 19 billion yuan was indirectly generated by express delivery services, and that figure is expected to reach 60 billion yuan by 2020."

Yu, 49, who was born in Tonglu county, Zhejiang province, has been the driving force in turning a small firm into an express delivery empire in just 15 years.

The data charting YTO's growth illustrates the group's rapid rise.

During Singles Day this year, the country's biggest online sales festival on Nov 11, the company received a record-breaking 53.28 million orders across China.

Up to 30.59 million packages were handled, or roughly 21 percent of the industry's total.

Expansion has been the key to YTO's success. Last month, the company rolled out new headquarters in Shanghai, costing 600 million yuan.

But then the glitzy headquarters is a far cry from YTO's humble beginnings in 2000 when it was launched with an investment of just 50,000 yuan and employed only 17 staff.

Fifteen years later, the group now employs 220,000 staff and operates a network that covers about 93 percent of the counties across the country.

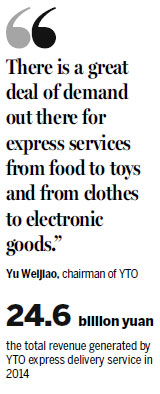

In 2014, YTO delivered 2.1 billion packages, generating revenue of 24.6 billion yuan. The maximum number of parcels handled in a single day last year hit 25 million.

"We still see huge growth potential for the fast delivery industry," Yu said. "There is a great deal of demand out there for express services from food to toys and from clothes to electronic goods.

"There are so many urban areas that are waiting to be developed. Then, of course, there is the much broader rural market."

Still, the sector is highly competitive and only the strongest and the fittest groups will survive. Many of the smaller players are likely to go under or link up with one of the industry's leading companies.

A new age is dawning for the business, Yu pointed out, as it matures and expands.

"Competition can be cruel and only the best will survive," he said. "The rising cost in human resources requires us to set up a solid management system and an experienced team.

"We are also looking for opportunities in setting up cross-border (country-to-country) e-commerce industrial parks by cooperating with local governments."

Already the State Council has approved a proposal to promote the development of the express delivery sector, which is projected to be worth 800 billion yuan by 2020. Key to that is to increase international competitiveness and expand air delivery capacity.

"The big question is how companies can benefit from the government's support policies and grasp the opportunities in urban areas," Yu said.

"There are also opportunities to develop business in free trade zones as well as (other overseas) initiatives."

YTO plans to expand its air cargo operations. Back in September, the company's first aircraft completed its maiden flight, making it the third Chinese delivery firm behind EMS and SF Express (Group) Co to own a jet.

By 2020, YTO hopes to have a cargo fleet of 50 aircraft, rising to 100 in 2025.

"It's only the beginning for YTO's cargo fleet," Li Shiqing, an industrial analyst from Minsheng Securities, said.

"The next step is to raise the level of its information and management ability, because software is equally as important for a company as hardware."

Yu realizes that the group must continue to evolve. There are plans to take YTO public, but a timetable has yet to be announced, while the company is aiming to build a highly competitive international network in the future.

An overseas business department was set up last year, and the company has registered its trademark in more than 100 countries.

"About 20 overseas branches will be established next year, in countries including South Korea, Australia, the United States, Thailand, India, Russia and France," Yu said.

"But there is still a long way to go for domestic delivery companies to catch up with international competitors."

Building an international brand takes time, but SF Express, STO Express Co Ltd and, of course, YTO, are refining their global strategies.

SF Express has extended its network to Singapore, Malaysia, Japan, South Korea, Thailand, Indonesia and Australia.

"We plan to expand further into Asia next year as well as move into the European market," Li Jialin, CEO of SF Express' international business division, told Reuters.

Li at Minsheng Securities has his own views on what is the best route for domestic firms to take when casting envious eyes at the global marketplace.

"Cooperation with international delivery companies is the way ahead for Chinese companies that are interested in expanding their networks beyond the country," Li Shiqing said.

As for YTO, Yu is looking at diversifying part of the business to increase the bottom line and stay competitive.

Naturally, the express delivery service will stay at the core of the company's operations, but IT, finance and cultural projects are being considered.

"While our development is centered on fast delivery, we are also planning to diversify, such as raising the portion of our side businesses from 1 percent to 5 percent within the next five years," Yu said.

"We will do this through cooperation and diversification. By combining the strength of both parties, we can make '1+1=3'."

Time means money for small businesses

Xiao Mu and his wife usually start work selling men's clothing online at 9 am, and finish at around 1 am the following morning.

The hours can be grueling but Xiao loves running his own business, which he set up in 2012 on Taobao.com, the Internet shopping platform owned by Alibaba Group Holding Ltd.

Naturally, there were early teething problems, including slow delivery services.

"At the beginning it could take days to process just one order," Xiao, 28, who used to work at Shanghai Volkswagen Automotive Co, said.

"And when we received orders, it was very hard to get the products delivered to our customers on time. We tried several different courier companies, but most refused to collect packages on a daily basis."

Xiao also received complaints from customers because delivery firms failed to provide a door-to-door service. Many were forced to pick up packages at distant centers.

"This went on until we started working with STO Express (Co Ltd)," Xiao said. "Now, they arrive every day even if we don't have any orders to send out."

STO Express is one of the biggest courier groups in China along with Shanghai YTO Express (Logistics) Co Ltd, SF Express (Group) Co and EMS. The company's policy is that no business is too small.

"We assign specific couriers to serve small e-commerce clients," Sara Gu, head of the marketing department at STO Express, said. "It does not matter how small the order is. In this way, the assigned courier can provide a consistent service to clients. We really cherish small enterprises."

This approach has helped Xiao turn his business around as he joins the growing ranks of online entrepreneurs. Daily orders are hovering around the 200-mark with revenue of about 40,000 yuan ($6,299), he said, without disclosing detailed financial information.

"My original goal of launching a small business on Taobao.com (a consumer-to-consumer site) to make money has been achieved," Xiao said.

"The next goal is to upgrade the business on Tmall (a business-to-consumer platform also owned by Alibaba). This will produce greater opportunities."

The success of small online enterprises such as Xiao's Muge Apparel is crucial for delivery groups such as STO Express.

As these startups expand and grow, they offer new revenue streams in a fiercely competitive sector. "We grow together with our customers," Gu explained.

To retain an edge in a crowded market place, China's leading express couriers are finding out that "loyalty" is a crucial part of their business strategy.

"It's vital for companies to cement the loyalty of customers with better service," Li Shiqing, an industrial analyst from Minsheng Securities, said.

wang_ying@chinadaily.com.cn

|

A Shanghai YTO Express (Logistics) Co Ltd aircraft gets ready to take off at Xiaoshan airport in Hangzhou, Zhejiang province. YTO plans to expand its air cargo operations in the future. It is already the largest express delivery business by market share in China. Provided To China Daily |

|

|

(China Daily USA 11/30/2015 page13)

- Britain's Cameron says time to bomb militants in Syria

- Russia accept full suspension from athletics

- Turkish and Russian FMs to meet in Belgrade

- S.Korea, DPRK agree to hold vice ministers' meeting for improved ties

- Avoiding escalation over Russian warplane downing

- Rights panel presses US over scientists' cases

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US Weekly

|

|