Bankers to step up shared financing

Banks from emerging economies are boosting their presence in infrastructure activities under the Belt and Road Initiative, with bankers vowing on Monday to seek closer partnerships for project financing.

Halil Aydogan, general manager of Turkey's Vakifbank, said there is demand for more than $40 billion of investment in transportation infrastructure in Turkey, and the bank is seeking to expand partnerships with Chinese lenders to fund major projects.

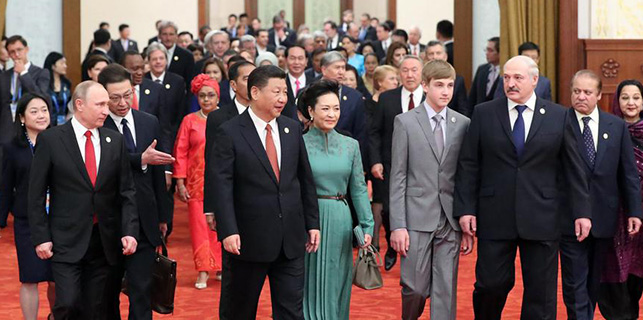

"For many years, European banks were very active in Turkey. Now we see banks from China joining in as they see big value and potential for banking in Turkey," Aydogan said on the sidelines of a roundtable meeting of bankers at the Belt and Road Forum for International Cooperation in Beijing

The Turkish bank has obtained $250 million in loans from Industrial and Commercial Bank of China, the world's biggest bank by assets, Aydogan said, adding that a memorandum of understanding has been signed with ICBC to further develop cooperation in other banking areas, ranging from treasury transactions to renminbi payments.

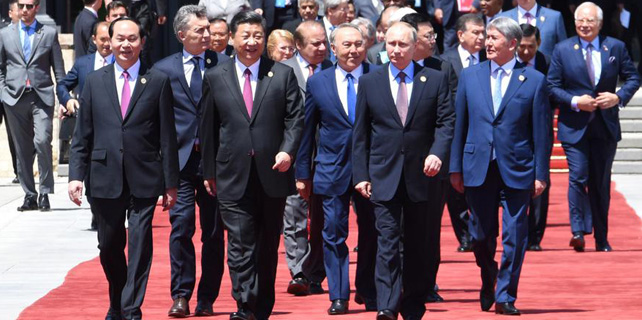

The Turkish banker acknowledged the positive role of the Belt and Road Initiative, originally proposed by President Xi Jinping, in improving global trade and promoting shared benefits.

"The initiative has a mission that aims to increase the level of global trade. It supports a win-win outcome for countries and regions, as opposed to the zero-sum game of protectionist policies," he said.

Similarly, Pakistan's largest bank, Habib Bank, has been working with multiple Chinese lenders - including China Development Bank, ICBC and Bank of China - on four electrical power-related projects in Pakistan with a total investment value of $5 billion, said Nauman K. Dar, the bank's president.

"We should make an effort to utilize local currency and develop the local capital market because there are huge untapped resources in Pakistan," Dar said.

The bank opened a branch in March in the Xinjiang Uygur autonomous region's capital, Urumqi, to provide financial services for China-Pakistan Economic Corridor projects, which are part of the Belt and Road Initiative.

Monday's roundtable of bankers was hosted by ICBC, which is taking the lead in forming a long-term interbank cooperation mechanism to ensure sustainable financing and proper risk management for projects under the initiative.

lixiang@chinadaily.com.cn

(China Daily USA 05/16/2017 page2)