Keeping it in the family

Updated: 2013-03-04 10:24

By Han Bingbin (China Daily)

|

||||||||

Separate accounts or joint account? We ask several couples how they balance the family books. Han Bingbin gets the answers.

Zhang Qian, 25, Yiwu, Zhejiang province, China & Husband Adam, 27, from Chicago, USA. Currently based in Yiwu. NEWLY Married.

Adam and Zhang will both have their personal bank accounts where they plan to put part of their individual salaries. They will also have a joint account where they will deposit most of their combined incomes, mainly for savings and investment. It will pay for big items such as house, car and the children's education. Adam and Zhang will make decisions together on how to use the money in the joint account, while maintaining the right to decide how to use their own money in the personal accounts.

Zhang says: "According to what I've heard and seen, the traditional Chinese family financing structure seems to have worked fine in the past. That said, the factors underlying this financing model are changing in current society. As a result, it may not work as well now.

"Three factors that comes to mind are income structure, power structure within the family, and the money management structure.

|

|

|

|

|

|

Adam agrees. "I come from a society where, if there was one partner who controlled the finances, it would likely be the man. In more and more families, the money is shared and both partners have an equal say on how to spend and save.

"I feel this is a much more egalitarian and democratic approach, making both partners active participants in the family's financial destiny. I don't criticize the Chinese way, but I also don't think it's ideal for modern life."

Tang Yang, 26, bank clerk & Zhou Qingqing, 28, civil servant. Nanjing, Jiangsu province. Married.

They were married last year, and have deposited money gifts from the wedding in an independent bank account. They planned to invest it, but agreed to buy a car first. Individual earnings are completely subject to personal arrangements but they agree that the wife pays for the family's food, daily necessities, and small home furnishings. The husband pays for the utility bills such as water and electricity, gas, broadband services, parking and property management fees. He also pays every time they eat out and see a movie. They split expenses for annual vacations.

"I will pay for my own cosmetics and clothes." Zhou says. "But sometimes when they are too expensive, Tang will subsidize the expenses. We don't have much savings now, so it doesn't really need careful 'management'. As for the future, most of our money will go into housing loans. We'll use the rest of the money to buy more risk-free financial products. And if there is a suitable opportunity, I may start a small business."

Tang believes Chinese women are traditionally more frugal, while Chinese men are more extravagant.

"It seems right to let the women take charge of family finances. However, it seems women are wasting a lot more money than men do these days," he adds.

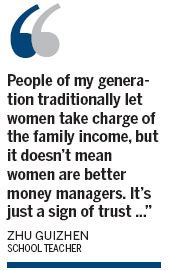

Zhu Guizhen, 55, school teacher & Yang Guangfu, 56, civil servant. Kunming, Yunnan province. Married.

Zhu remembers that they used to earn only about 100 yuan ($16) a month, so they didn't really have savings.

"Even if we decided to save it in the bank, it didn't matter whose name it was under because the savings were always less than what was needed.

"When we started to earn more, our salaries went into individual accounts. If we had spare cash we didn't need at the moment, we would save them in fixed deposits. And that were usually under my husband's name because he's the one who ran to the bank.

"It's perfectly alright for me then. I didn't think of anything like 'getting myself financially prepared for other possibilities'. My husband had a heart attack in 2009 and he has had bad health since, so he transferred all his money and the house to my name.

"People of my generation still traditionally let women take charge of the family income, but it doesn't mean women are better money managers. It's just a sign of trust, I think."

Her husband, Yang, is more philosophical.

"You shouldn't care too much about whose money it is. That's what family is all about. It's probably a modern trend for couples to manage incomes individually. That's acceptable as long as it doesn't damage their relationship."

Contact the writer at hanbingbin@chinadaily.com.cn.

'Taken 2' grabs movie box office crown

'Taken 2' grabs movie box office crown

Rihanna's 'Diamonds' tops UK pop chart

Rihanna's 'Diamonds' tops UK pop chart

Fans get look at vintage Rolling Stones

Fans get look at vintage Rolling Stones

Celebrities attend Power of Women event

Celebrities attend Power of Women event

Ang Lee breaks 'every rule' to make unlikely new Life of Pi film

Ang Lee breaks 'every rule' to make unlikely new Life of Pi film

Rihanna almost thrown out of nightclub

Rihanna almost thrown out of nightclub

'Dark Knight' wins weekend box office

'Dark Knight' wins weekend box office

'Total Recall' stars gather in Beverly Hills

'Total Recall' stars gather in Beverly Hills

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|