New foundations for Sino-US cooperation

Updated: 2012-02-14 07:58

By Qian Yingyi, Wang Jisi, Wang Min, Bai Chongen, Jia Qingguo (China Daily)

|

||||||||

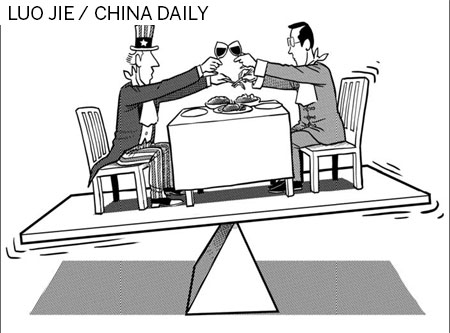

Forty years after the restoration of official communications between China and the United States, economic and trade cooperation between the two countries have grown like a giant tree thriving despite the storms.

I. Mutually beneficial cooperation is the main theme of China-US economic and trade relations

Economic and trade cooperation is at the core of China-US relations and serves as the foundation and stabilizer of strategic cooperation between the two countries.

The development of China-US relations is mainly built on common economic interests.

Common economic interests have always been a strong impetus for the development of China-US relations. As the largest developing country and the largest developed country in the world, China and the US are highly complementary in resources, markets, capital, technology and other areas, with increasing common and overlapping interests. Both sides recognize that the healthy and sustainable growth of one economy is vital to the prosperity of the other. Although China-US economic and trade relations are often affected by political factors, the economic and trade cooperation between two sides continues to strengthen.

China-US trade is the most complementary in the world.

The two countries are the most important trading partners for each other. Their bilateral trade volume reached $446.7 billion in 2011, 188 times the $2.37 billion of 1979. China has been the fastest growing export market for the US for the last 11 years. Last year, China imported $122.1 billion worth of goods from the US, topping $100 billion for the first time. US exports to China have enjoyed a cumulative growth of 468 percent from 2000 to 2010, while its exports to other countries grew by only 55 percent in the same period. China is the US' second largest trading partner, its third largest export market and its largest source of imports. The bilateral trade volume between the two countries is expected to exceed $700 billion in 2015 and Chinese imports from the US are expected to double by then. The rich variety of Chinese export goods meet the demands of American consumers, while the expanding Chinese imports of electronic, aerospace, biological, medical, agricultural and services trade items from the US help meet China's development needs.

The Chinese and US economies have formed a pattern of "each having something of the other".

By the end of 2011, with a total investment of $67.6 billion in more than 60,000 companies in China, the US is one of China's largest sources of foreign investment. According to statistics from the US Bureau of Economic Analysis, direct-invested subsidiaries of American multinational corporations in China have become the most profitable American overseas enterprises. A large portion of goods exported to the US from China is manufactured by US enterprises in China. A survey by the American Chamber of Commerce in China found that 85 percent of the US invested enterprises in China saw increased profits in 2010. At the same time, China is the largest foreign holder of US Treasury Bonds. As of November 2011, the foreign holdings of US Treasury Bonds amounted to a total of $4.74 trillion, of which China held $1.13 trillion, 23.8 percent of the total.

China-US economic and trade relations have an important global impact.

Economic globalization has made China-US economic and trade relations unprecedentedly close. The trade and investment between the two countries have great significance for the world economy. At present, the combined economic volume and the trade volume of China and the US account for one-third and one-fifth of global total respectively, suggesting that the importance of China-US economic and trade relations goes far beyond just the two countries. In the last two years, the enhanced cooperation between China and the United States in coping with the international financial crisis and the European sovereign debt crisis was instrumental in restoring market confidence and boosting the global economic recovery.

II. The causes of economic and trade frictions between China and the United States are complex

China-US economic and trade relations have been moving forward in the midst of friction as well as cooperation. The economic and trade frictions between the two countries stem from multiple complex factors.

Focus of the China-US economic and trade frictions

From China's perspective, there are mainly four major points of friction: The first is China's status as a market economy. China has been a member of the World Trade Organization for 10 years now and should be regarded as a market economy according to objective standards. However, the US refuses to recognize China's status as a market economy. The second is that the US has constantly imposed antidumping and countervailing sanctions against Chinese exports to the US. Textiles, color TVs, steel pipes, furniture, tires and solar photovoltaic panels, along with other products, have all been the target of sanctions one after another. Although these products together account for less than 5 percent of the China-US trade volume, the sanctions have made trade friction commonplace. The third is that the US imposes rigorous restrictions on exports of high-tech products to China. The US Export Administration Regulations assign China to the extremely restricted group D. Although the US has reformed its export controls over the last two years, it has not loosened its control measures against China. For example, although the US revised its trade facilitation policy on Dec 9, 2010, extending preferential trade policies to 164 countries in three categories, China was still excluded. The fourth is that Chinese enterprises are discriminated against when making investments in the US, leading to the failure of the merger and acquisition plans of many Chinese enterprises in the last few years. From the point of view of the US, there are also four major focuses. The first is that many US congressmen and major think tanks are of the view that the renminbi to US dollar exchange rate is undervalued, and have proposed many times to list China as a "currency manipulator". The second is that China-US trade is severely imbalanced and the US trade deficit is too large. The third is that China does not strictly enforce intellectual property law and thus copyright infringements result in damages to the interests of US companies. The fourth is that China's policy of encouraging independent innovation results in discrimination against US companies. In recent years, China and the US have engaged in many rounds of maneuvering with respect to the aforementioned eight focuses.

Structural factors behind China-US economic and trade frictions

The trade imbalance is the main reason for China-US trade frictions. It stems from the two countries' economic and trade structures. From the perspective of economic structure, in the early 1980s, many US labor-intensive industries moved overseas. This coincided with the time when China started its economic reform and opening-up, and its efforts to attract large-scale foreign investment. As a result, China became a natural destination for the relocation of US manufacturing industries. At the same time, the US implemented an expansionary fiscal policy and introduced very low interest rates, which stimulated excessive consumption and a large demand for imported goods. Consequently, the US national savings rate declined and current account imbalance grew with a large trade deficit. Meanwhile, China's processing trade industry expanded rapidly and its exports increased considerably. In this regard, the "opposite" economic structures of China and the US led to trade imbalances between the two countries. From the perspective of the trade structure, according to the US Bureau of Economic Analysis, of the value of imports from China, only a small portion consists of the costs of local labor, material and administration. The majority comes from components and raw materials produced in other countries, including the US. Because of this, China has large trade deficits vis-a-vis Japan, South Korea, ASEAN member states and other countries and regions while having a large trade surplus vis-a-vis the US. For example, as some US researchers point out, in 2007, each Apple iPod costs $150 to produce, but only about $4 of that cost was Chinese value-added and most of the value came from components made in other countries, including the US. Yet when those iPods were imported from China, where they were assembled, the full $150 was counted as an import from China, exaggerating the extent of trade imbalance between China and the US.

Special interests behind China-US economic and trade frictions

Special interest groups are the key players behind China-US economic and trade frictions and disputes. Take the example of the special tariffs on Chinese tires imposed by the US starting from September 2009. According to the price data published by the US Bureau of Labor Statistics, in the two years prior to the imposition of the special tariff, the increase in the price of tires was 5.7 percentage points, which was lower than the increase in the price of vehicle accessories other than tires; but in the two years thereafter, the increase in the price of tires was 3.4 percentage points higher than the increase in the price of vehicle accessories other than tires. This suggests that the special tariffs caused US consumers to pay 9.1 percent more for tires. For the tire market worth billions of dollars in annual sales, the cost of the higher price to the consumers dominates the benefits accruing to the few producers.

Political factors behind China-US economic and trade frictions

In the modern history of international trade and economic relations, no other bilateral economic and trade relations are so influenced by politics as China-US relations. Much of what is behind China-US trade frictions is political maneuvering, which is always initiated by the US. China has always advocated not politicizing economic and trade issues, but because the US insists on approaching economic and trade problems from the standpoint of politics, China is forced to react. Take the renminbi exchange rate as an example. Since China started the reform of renminbi exchange rate formation mechanism in July 2005, the dispute over the exchange rate between the Chinese and US currencies has become almost regularized, "institutionalized", and sometimes "white-hot". Although the renminbi has since appreciated against the US dollar by more than 30 percent in nominal terms, and by about 40 percent in real terms when inflation is taken into account, the US continues to criticize the appreciation of the renminbi as being too little and too slow, and to blame the under-valuation of the renminbi as the main cause of the growing trade deficit and rising unemployment rate in the US.

The US has even accused China of manipulating the exchange rate. On Oct 12, 2011, the US Senate adopted the Currency Exchange Rate Oversight Reform Act of 2011, requiring the government to impose punitive duties on trading partners with undervalued exchange rates. It is generally believed that the act was designed to punish China for "its behavior of forcing the exchange rate down in favor of its exports", so as to force the accelerated appreciation of the renminbi. As Chinese scholars, we believe that the renminbi exchange rate is not the primary reason for the increase in the US trade deficit and unemployment, and that appreciation of the renminbi cannot solve the imbalance of trade between the two countries. If the renminbi exchange rate was to appreciate as much as demanded by some in the US, American consumers would have to pay higher prices for manufactured goods imported from China, or these manufacturers would leave China for countries with lower labor costs. In any case, these manufacturing jobs would not flow back to the US, because it is impossible for the US to lower labor costs to a level lower than China's. Furthermore, as the costs of these manufactured products increase, US firms along the value chains of these products will also suffer. In fact, the exchange rate formation mechanism is very complicated. So far there is neither an exchange rate theory nor empirical model that can accurately estimate the equilibrium exchange rate for the renminbi against the US dollar.

Even though China has maintained surpluses in trade and in its balance of international payments for several consecutive years, and holds large foreign exchange reserve, the share of trade surplus in GDP has declined from 8.8 percent in 2007 to about 3 percent in 2011. Meanwhile, its agriculture has a weak foundation; its industry is big but not strong; and there are still 150 million people living below the UN poverty line. These basic national conditions dictate that at the current stage, the equilibrium exchange rate of the renminbi cannot be excessively high and the currency cannot appreciate too much. More importantly, the renminbi exchange rate is a matter of China's economic sovereignty and it will not succumb to any external pressure. It should be said that both Chinese leaders and political elite have soberly recognized the prominence of the problems of imbalance, lack of coordination and weak sustainability in China's economic development. That being said, it is not caused by the exchange rate of the renminbi. Even if the exchange rate is not completely right, it is the "result" of the economic structural imbalances of China and not the "cause". The politicization of China-US economic and trade frictions manifests not only in the issue of the renminbi exchange rate, but also in the issue of Chinese enterprises' investment in the US. Compared to the investments of nearly $70 billion made by US enterprises in China, the investments made by Chinese enterprises in the US are only $4.8 billion, suggesting a huge investment imbalance between the two countries. With the Chinese economy growing, Chinese enterprises are demonstrating great enthusiasm for investments in the US. The Chinese government sincerely hopes that Chinese enterprises make investment in the US and thus produce some of the currently exported products locally in the US, which would not only help reduce the US trade deficit but also create jobs for US workers, leading to a win-win situation. Regretfully, the US is far more concerned about the potential security problems of Chinese investment than its trade deficit and unemployment. A typical case is the Shenzhen-based Huawei Company whose investment in the US was blocked. Huawei is an ordinary Chinese private company. The Committee on Foreign Investment in the United States jumped to the conclusion that this company has military background simply because the person in charge of the company once served in the Chinese army, leading to the failure of the attempt by Huawei to acquire an US company in 2010.

III. Forging four foundations for China-US economic and trade cooperation

Promoting the healthy and stable development of China-US economic and trade relations is in accordance with the current and long-term interests of the peoples of the two countries. Facing the new circumstances, both China and the US should foster and forge firm foundations for bilateral economic and trade cooperation with strategic vision.

A) The foundation for free trade

In the framework of the World Trade Organization, the principle of free trade refers to substantially reducing tariffs and other trade barriers through multilateral trade negotiations as well as expanding the trade of goods and services among WTO members. Both China and the US should adhere to the principles of free trade and abandon all forms of protectionism. The US should relax restrictions on high-tech exports to China so as to forge more balanced trade relations. The two sides should adopt a constructive attitude toward resolving bilateral trade and investment disputes and should not politicize economic and trade frictions. They should also start the negotiation for a free trade agreement and a free trade zone as soon as possible.

The Chinese side should continue to push reform of the renminbi exchange rate formation mechanism as well as the process of market-based exchange rate formation, while the US side should stop exerting pressure in any form on the renminbi exchange rate.

B) The foundation for mutual benefits

China-US economic and trade cooperation should benefit both sides. The two sides should expand their "common interests" in all areas and at all levels to build an "interest community". They should expand two-way investments and ensure the security of Chinese investment in the US. Both parties should forge new growth points for bilateral economic and trade cooperation; strengthen cooperation in such fields as new energy, clean energy, energy efficiency and emission reduction, biomedicine, aerospace and infrastructure; actively promote effective cooperation between local governments in trade, investment, tourism and other fields; and strengthen the cooperation among enterprises of the two countries, especially small and medium-sized enterprises. China and the US should also work together to foster the formation of an open, equitable, and transparent investment environment.

C) The foundation for balanced structure

China and the US should push forward in-depth structural reform. China should make efforts to encourage domestic demand, especially consumer demand, increase household incomes, lower the savings rate, and increase the contribution of consumption to GDP. The US should increase the share of national savings in its GDP, lower the federal fiscal deficit to a sustainable level, and reduce the dependence of excessive consumption on imports. Both parties should seek a more balanced, new economic partnership, with China not deliberately pursuing trade surplus and the US making serious effort to reduce external imbalance.

D) The foundation for equality and fairness

China-US economic and trade cooperation must be based on equality and fairness, free of political interference. Both parties should provide impartial market access to enterprises from the other side; the US government should abandon its unreasonable discrimination policy against Chinese investment and reduce its tendency of politicizing the review of investment in the real economy. The US should recognize China's status as a full market economy, and substantially relax its control over the exports of high-tech products to China. And China should recognize the non-discrimination principle in government procurement and innovation policies.

We believe that as long as both parties make concerted efforts to nurture it, the tree of China-US economic and trade cooperation will continue to grow and thrive.

Qian Yingyi and Bai Chongen are professors at the School of Economics and Management, Tsinghua University; Wang Jisi and Jia Qingguo are professors at the School of International Studies, Peking University; and Wang Min is special research fellow at Peking University.

(China Daily 02/14/2012 page9)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|