Confronting some of the major criticisms of contemporary Sino-African ties

Updated: 2012-05-15 16:12

By Simon Freemantle & Jeremy Stevens (chinadaily.com.cn)

|

||||||||

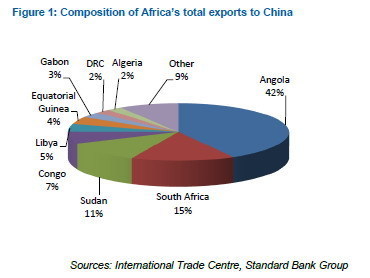

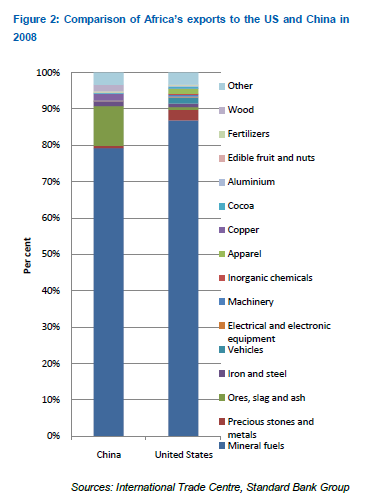

African exports to China have experienced a particularly swift advance, from less than USD1 bn in 1992 to over USD54 bn in 2008. (Africa's exports to China declined to USD43 bn in 2009.) The Chinese economy is energy intensive and in the fairly nascent stages of its own industrialisation. Nearly 80% of China's imports from Africa comprise mineral fuels and oils. Therefore, it is logical that 60% of Africa's exports to China come from the continent's oil flush states.

While undeniably large, the share of commodities in Africa‟s exports to China is not specific to Sino-African ties. Consider that the share of mineral fuel exports in Africa‟s total exports to the US was 87% in 2008 and 85% in 2009. In the case of Germany, the share of mineral fuels was 61% in 2008 and 56% in 2009, but adding ores, precious stones and other metals takes the share of commodities past 70%. In addition, 64% of Africa‟s total exports are made up of mineral fuels. Hence, the disproportionately large share of commodities is consistent across the majority of Africa‟s major trading partners, reflecting both Africa‟s resource abundance and dearth of higher value goods.

China adds diversity and resilience to Africa's economic thrust and global emergence. The increased demand for Africa's resources should thus be welcomed, as it offers diversity in bilateral relations. In 2009, African exports to China declined by 22% y/y to USD43.2 bn. However, relative to Africa's other key trade partners, the fall was small and expected, owing to a broad-based decline in Africa's commodity exporter's terms of trade. For instance, Africa's exports to Japan, the US and France declined by 56% y/y, 45% y/y and 30% y/y, respectively.

It is clear that Africa must reduce its unsustainable reliance on commodity exports as this heightens the continent's sensitivity to swings exogenously determined forces. However, to some extent, the criticism that China is only interested in Africa's natural resources misses the crucial point that, at present, natural resources remain Africa's core advantage in global trade. Africa must capture elevated global commodity demand to secure revenues. The management and allocation of the revenues collected from the sale of natural resources should generate large domestic multipliers by scaling up value-add industries; broaden industrial capacity; diversify exports; and develop social, economic and human infrastructure. Responsible decisions will inevitably lead to a rebalancing of trade with China and the rest of the world.

Africa's de-industrialisation: China is hollowing out Africa's manufacturing sector

Challenge: Some argue that Chinese exports are either preventing or hollowing out Africa's manufacturing capacity.

Africa has an overall trade surplus with China of around USD10 bn. However, this is due almost entirely to the natural resource exports from a few aforementioned countries, which provide nourishment for China's own domestic economic transformation. While Africa's exports are dominated by a handful of commodity-exporting countries, Africa's imports have a broader print across the African continent. Africa's imports from China increased from USD3 bn in 1992 to USD45.4 bn in 2008. In the process, China usurped France, the US and others, to become Africa's dominant source of goods in late 2006. Chinese exports to Africa proved particularly resilient to the global recession – relative to Africa's exports to China and African imports from other trading partners. For instance, Africa's second- and third-largest source of goods, France and the US, experienced export declines of 13% y/y and 15% y/y in 2009, respectively, while China's exports to Africa declined by a mere 6% y/y.

More than two-thirds of African countries run sizeable trade deficits with China. A dozen African countries imported more than USD500 mn from China in 2008 (see Figure 3). And, even though South Africa (USD8.7 bn), Nigeria (USD6.4 bn), Algeria (USD3.7 bn), Benin (USD2.3 bn) and Morocco (USD2.3 bn) dominate in nominal terms, accounting for 60% of total African imports from China, it is clear that a significantly larger proportion of African countries sources goods from China. In fact, nearly 32 African countries list China as a top-five source of imports.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|