Resumption of IPOs will keep stock market sound

Updated: 2015-11-09 08:03

(China Daily)

|

||||||||

|

|

An investor looks at an electronic trading screen at a brokerage in Nanjing, Jiangsu province. [Asinewsphoto by Su Yang] |

Just as China's stock market jumped more than 20 percent from its August low, the China Securities Regulatory Commission announced on Friday that it will resume initial public offerings, which were halted amid a market rout in July.

Reactivating the stock market as an important channel to raise funds for domestic enterprises is understandable given innovation's role as a key driving force for future economic growth.

If China is to maintain at least 6.5 percent GDP growth in the coming five years, the stock market must assume a bigger role in financing the expansion of domestic companies, especially the innovative ones that are crucial to the development of new industries and upgrading of traditional sectors.

Besides, the resumption of IPOs may also play a role in cooling the current surge in share prices, which appears to be too quick to sustain in the long run.

Although the benchmark Shanghai Composite Index rose 6.1 percent last week to hit 3,590 points, it remains some 30 percent below the peak in mid June, but alarmingly, the total turnover on both bourses has exceeded 1 trillion yuan ($157.39 billion) a day, close to the average level before and during the market rout when leveraged buying was rampant.

The securities regulator has made great efforts to address illegal and excessive leverage, a serious problem that has made market movement more volatile than it should be. Therefore, as the amount of leveraged buying climbed back above 1 trillion yuan last week, the securities watchdog has decided it cannot afford to wait and see.

Since the surge of share prices is not backed by improvement in the performance of listed companies, an unlikely result when the economic growth just slowed to 6.9 percent in the third quarter of this year, the securities watchdog has a good reason to take measures to prevent misguided optimism from encouraging investors to take too much risk.

In this sense, the resumption of IPOs can kill two birds with one stone.

The move will help calm market sentiment before it becomes too bullish, while providing additional finance to sustain the economy's overall growth.

- IPOs set to resume amid rebound

- New players on the block: Chinese IPOs in US

- China curbs IPOs, enlists brokers in all-out bid to end market rout

- Firms, individuals punished for flouting stock market rules

- Intensified crackdown key to health of the stock market

- Pension funds ready to enter stock market in 2016

- A-share gains lead the world's stock market

- Stock market in recovery phase, Xi says

- Anti-graft move helps clean stock market

- Locals have tradition of drying foods during harvest season

- Beijing-Tianjin-Hebei govts to cooperate on emissions control

- Web promotion of prostitution to be targeted

- Two more spells of smog predicted to sweep North China

- Glass bridge in grand canyon of Zhangjiajie under construction

- Road rage cases pose huge safety challenge

Can Chinese ‘white lightning’ make it in US?

Can Chinese ‘white lightning’ make it in US?

Gunmen go on a killing spree in Southern California

Gunmen go on a killing spree in Southern California

Chinese, South African presidents hold talks to cement partnership

Chinese, South African presidents hold talks to cement partnership

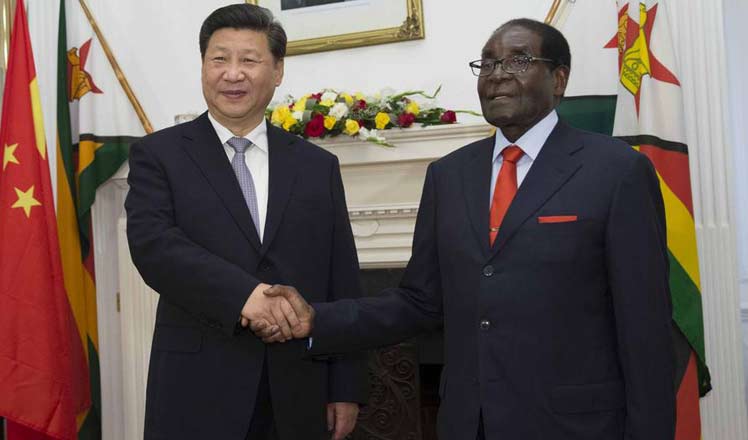

China, Zimbabwe agree to boost cooperation

China, Zimbabwe agree to boost cooperation

First lady visits Africa's 'new window' on China

First lady visits Africa's 'new window' on China

BRICS media leaders to secure louder global voice

BRICS media leaders to secure louder global voice

Western science in the eyes of Chinese emperors

Western science in the eyes of Chinese emperors

Top 10 smartphone vendors with highest shipments in Q3 2015

Top 10 smartphone vendors with highest shipments in Q3 2015

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|