Reassuring trade data indicates improvement in China's growth dynamics

Updated: 2016-01-14 11:46

By Louis Kuijs(chinadaily.com.cn)

|

||||||||

The December trade data was quite reassuring. It indicated that despite the stock market turmoil, the evolution of China's growth dynamics in the real economy may actually be improving.

Goods exports momentum improved in December, reflecting some pick up in global demand and the depreciation of the RMB since early August. Better import data is driven by recovering "normal imports", used in China's own economy, pointing to a pick-up in domestic demand.

Key data elements

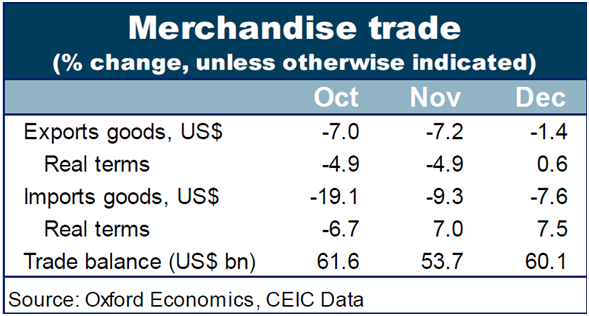

China's goods exports momentum improved in December – the decline of 1.4 percent year-on-year in USD terms suggests an increase of 0.6 percent year-on-year in volume terms (see table, based on our estimates). In 2015 as a whole, this leaves export volumes up by an estimated 0.8 percent.

Headline goods imports data was down 7.6 percent in USD terms a year ago, due to year-on-year import price declines that we estimate at 14 percent. But, as we signaled a month ago, import volumes have started to improve - they were up 7.5 percent year-on-year in December.

The trade surplus of $60.1 billion in December brought the whole-year surplus to $599 billion for 2015 according to the trade data (it is lower according to the balance of payment definition), up 56percent from 2014.

Impact and outlook

The export data suggests that global demand picked up some momentum at the end of 2015, after displaying weakness over most of the year. The most recent estimates from the Dutch CPB suggest that global imports still grew at only 1percent year-on-year in October, in volume terms.

However, the improvement in China's export momentum in December also reflects the favorable impact of the depreciation of the RMB since early August. China's exporters had been losing global market share in much of the second half of 2015 because of the lagged effect of substantial earlier depreciation of many currencies against the USD.

But, since early August the trade weighted RMB depreciated 4.8 percent, according to the CEFTS currency basket. Going forward, amid a modest pick-up in global trade growth and aided by the weaker RMB, we expect China's export growth to rise to around 2 percent in 2016, in real terms, with risks on the upside.

The improvement in imports that started in November has been driven by better "normal" imports, used in China's own economy. In USD terms, normal imports fell 3.3 percent year-on-year in December, compared to 16.1 percent in the first 10 months of 2015. Given the double digit year-on-year import price declines, this implies solid growth in real terms last month and points to a pick-up in domestic demand growth at the end of 2015.

In all, the December trade data was quite reassuring, indicating that, despite the stock market turmoil, the evolution of China's growth dynamics in the real economy may actually be improving somewhat.

The better export data and high trade surplus will provide some support to the balance of payments and the RMB. However, given the recent turbulence, we expect financial capital outflows to remain high in the early months of 2016 and the RMB to depreciate further against the USD to 6.8, before medium term forces drive a recovery thereafter.

The author is head of Asia economics at Oxford Economics.

The opinions expressed here are those of the writer and don't represent views of China Daily website.

- China economy enters 'new normal' eyeing 7% growth rate: G20

- China economy under downward pressure: finance minister

- Pessimism can't cloud silver lining for economy

- Europe urged to grant China market economy status

- China to remain global economy driver: Justin Yifu Lin

- Resilience of the economy not to be underestimated

- Eight keywords of China's economy in 2016

- A glimpse of Spring Rush: little migrant birds on the way home

- Policy puts focus on genuine artistic students

- Police unravel market where babies are bought, sold as commodities

- More older pregnant women expected

- Netizen backlash 'ugly' Spring Festival Gala mascot

- China builds Mongolian language corpus

- Special envoy to visit Laos and Vietnam

- El Nino expected to wreak havoc in S. America well into 2016

- Police officer rescues frightened sloth at corner of busy highway

- US Secretary of State visits Laos, aiming to boost ties

- 2 Chinese nationals killed, 1 injured in suspected bomb attack in Laos

- New York, Washington clean up after fatal blizzard

Creation of China Daily's Tibetan-style font

Creation of China Daily's Tibetan-style font

Drone makers see soaring growth but dark clouds circle industry

Drone makers see soaring growth but dark clouds circle industry China's Zhang reaches Australian Open quarterfinals

China's Zhang reaches Australian Open quarterfinals

Spring Festival in the eyes of Chinese painters

Spring Festival in the eyes of Chinese painters

Cold snap brings joy and beauty to south China

Cold snap brings joy and beauty to south China

First trains of Spring Festival travel depart around China

First trains of Spring Festival travel depart around China

Dough figurines of Monkey King welcome the New Year

Dough figurines of Monkey King welcome the New Year

Ning Zetao, Liu Hong named China's athletes of the year

Ning Zetao, Liu Hong named China's athletes of the year

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|