Didi's Uber deal must not be at customers' expense

Updated: 2016-08-04 07:13

(China Daily)

|

||||||||

|

|

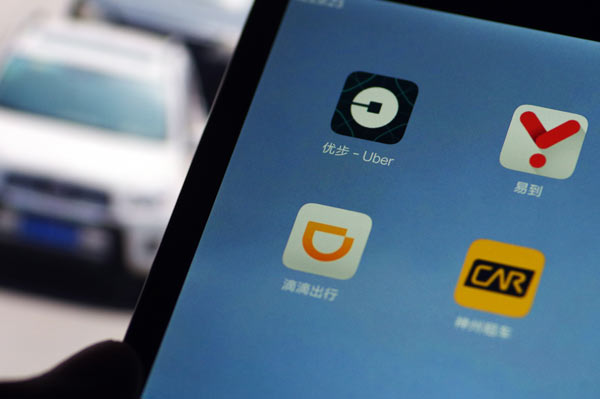

A mobile screen shows the logos of ride-hailing apps including Didichuxing, Uber, Yongche and UCAR. [Photo/VCG] |

Didi Chuxing and Uber China, the two biggest app-based ride-hailing service providers in China, have made huge losses in the past two years because of the subsidies they have provided drivers and customers in their competition for market share.

So the deal for Didi Chuxing to buy Uber's China operations, which will see the two on-demand ride providers retain their distinct brands and apps while merging their backends, will help save costs.

However, the deal, announced on Monday, will create a $35 billion ride-hailing juggernaut that will control more than 90 percent of the market, raising concerns that it could take advantage of its dominant position to the detriment of both users and competitors.Two days after the announcement of the deal, there have been media reports that Didi and Uber China have already cut their subsidies for drivers and raised their fares.

In fact, China has a regulation stipulating that any merger or acquisition in the country requires approval if the total turnover of the companies involved exceeds 2 billion yuan ($302 million) in the most recent fiscal year. The Ministry of Commerce, one of the Chinese regulators in charge of anti-trust affairs, has stated that the two companies will have to file their deal with the ministry for approval before it can go ahead.

Although it is estimated that the combined turnover of Didi and Uber China meets the filing requirement, Didi has said that since both companies are loss-making, it does not need to gain approval for the deal.

Obviously, the two sides have different interpretations of the filing rules. The mixed messages from the ministry and Didi testify to the challenge facing regulators with the emergence of internet technologies.

A case in point is the vicissitude surrounding the fate of mobile app-based ride-sharing services, which used to be seen as illegal but were finally legalized following the release of new regulatory rules last month.

It is time for the authorities to clarify the situation and respond to the concerns of the public.

Despite the regulatory challenges posed by technological innovations, the core regulatory principle should be encouraging competition and innovation while preventing monopolies from disrupting the market order.

Having a dominant market share might not necessarily lead to it being exploited, but it has the potential to reach that point. The authorities must closely monitor developments in the market to safeguard the core regulatory principle.

- Paragliding fans fly over Rigi mountain in Switzerland

- DPRK fires 1 ballistic missile into east waters

- Tokyo's white paper on defense policy 'full of lies'

- Syrian gov't, opposition trade accusation of alleged chemical attacks

- Obama calls Republican nominee Trump "unfit" to be president

- 5 feared dead as Russian helicopter shot down

Serbian artist creates incredible 3-D art

Serbian artist creates incredible 3-D art

Glimpse into the work and life of G20 guards

Glimpse into the work and life of G20 guards

Shopping and throwing Frisbee in virtual reality

Shopping and throwing Frisbee in virtual reality

Take a closer look at the life in Rio Olympic Village

Take a closer look at the life in Rio Olympic Village

From dusk to dawn: The other side of Beijing

From dusk to dawn: The other side of Beijing

Huangluo: China's 'long hair village'

Huangluo: China's 'long hair village'

Typhoon Nida lashes Shenzhen

Typhoon Nida lashes Shenzhen

Amazing robots work hard at Qingdao beer fest

Amazing robots work hard at Qingdao beer fest

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

US Weekly

|

|