Green tax not growth burden

Updated: 2016-08-31 07:25

(China Daily)

|

||||||||

|

|

Smoke rises from a chimneys of a steel mill on a hazy day in Fengnan district of Tangshan, Hebei province February 18, 2014.[Photo/Agencies] |

A draft of China's first environmental protection tax law, reviewed by the top legislature on Tuesday, is poised to levy taxes on four taxable types of pollution-airborne and water pollutants, solid waste and noise-while excluding household waste and such mobile pollution sources as vehicles from the tax.

According to the draft, the current standards for pollutant discharge fees are set at the lower range. It has long been a social consensus that the country should exert more rigid and binding constraints on pollution and give tax a bigger role to play in environmental protection.

As early as 1979, China began to impose fees on those companies discharging pollutants and the standards have been gradually raised.

However, excessive laxness in the process of their imposition and collection, and sometimes interference from local governments, such as the use of fees exemption as an incentive to attract outside investment, means the fees have failed to check the discharging of pollutants. So, the enactment of a stricter and more binding tax to strengthen environmental protection is desperately needed at a time when the momentum of pollution and environment degradation has not been contained in China.

But given that China's enterprises now face a relatively high tax burden, the imposition of the environmental protection tax should take into consideration whether the tax will further increase their burden and dampen their sagging investment enthusiasm. Fortunately, the draft law stipulates a series of circumstances enabling exemption from the tax or a reduction.

The pending law means some large enterprises, the big polluters in particular, will no longer enjoy the privilege of tax exemption just because of the contributions they make to local fiscal revenues. This is a necessary step toward promoting fair market competition and striking a balance between the environment and development.

--Beijing Times

- One dead, three wounded in blast at Chinese embassy in Kyrgyzstan

- Tainted food sickens 37 Buddhist monks, 2 helpers in Cambodia

- Hillary Clinton outlines mental health plan

- Colorful parade at Notting Hill Carnival

- Canadian prime minister leaves for China for visit, G20 summit

- Erdogan says Turkey to fight IS, Syrian Kurdish militants

Top 10 wealthiest countries in the world

Top 10 wealthiest countries in the world

Princlings go to school

Princlings go to school

Chinese painters capture beauty of Hangzhou

Chinese painters capture beauty of Hangzhou

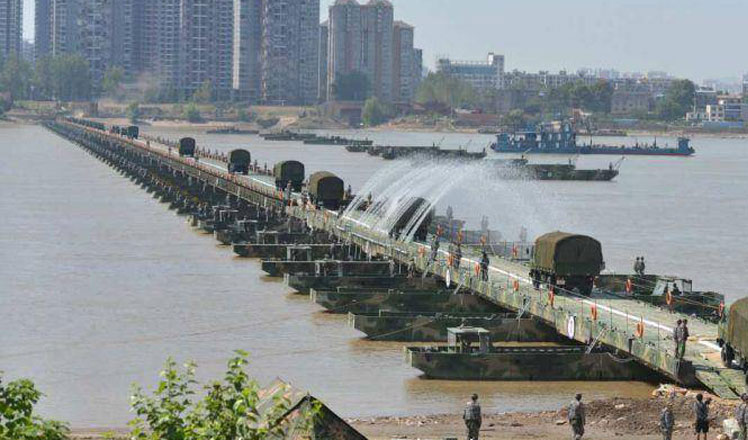

1,150-meter-long 'floating bridge' created

1,150-meter-long 'floating bridge' created

Take a sip of wine at the glass skywalk in Hunan

Take a sip of wine at the glass skywalk in Hunan

Groom and bride cycle their way to wedding

Groom and bride cycle their way to wedding

The world in photos: Aug 22- Aug 28

The world in photos: Aug 22- Aug 28

Daily life in Hangzhou, host city of 11th G20 summit

Daily life in Hangzhou, host city of 11th G20 summit

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|