The unexpected casualty of China's housing boom

Updated: 2016-08-31 14:02

By Zhu Qiwen(chinadaily.com.cn)

|

||||||||

|

|

Chinese homebuyers look at housing models of a residential property project during a real estate fair in Shanghai, China, May 2, 2015. [Photo/IC] |

The boom-bust circle of housing markets around the world usually begins as a comedy and ends in tears with some unbreakable marriage vows unfortunately broken.

So, does the sudden surge in the number of couples in Shanghai seeking divorce early this week mean China's super housing boom has finally come to a tragic end?

The answer is no, not at least for the moment.

The big smiles reportedly found on the faces of many of these newly-divorced couples must indicate otherwise. In fact, they might think themselves the lucky ones who were able to preempt policy changes that Chinese authorities allegedly will take to cool the housing market soon.

As a result of rapidly increasing home prices in large Chinese cities, especially the biggest ones such as Beijing, Shanghai and Shenzhen over the past year, talks have become louder and louder that Chinese policymakers may consider realty price curbs with tightened measures.

Because of relatively good asset quality and the high returns of housing mortgages, Chinese banks have been lending relentlessly to woo domestic homebuyers. Statistics from the People's Bank of China, the central bank, showed that domestic loans increased by 463 billion yuan ($69 billion) in July and as much as 457.5 billion yuan of new loans went to households.

Such unprecedented concentration of bank loans on homebuyers should certainly be a cause for concern.

On one hand, it seems not so wise to add more fuel to the red-hot housing markets to send realty prices a lot higher while the current level has already been far beyond most families' affordability. On the other hand, by crowding out enterprises, in particularly small and medium-sized ones, homebuyers have taken too much bank loans that are badly needed to support restructuring and innovation in many industrial sectors. Besides, the groupthink of Chinese banks to have such a strong faith in housing mortgages is also a red flag for regulators who are responsible for monitoring and preventing systemic risks.

- Shanghai housing sales surge as new curbs feared

- A call for affordable housing in big cities

- Better regulation of affordable housing will help it fulfill purpose

- Housing to be more sustainable, affordable

- China's housing sales to decline to more sustainable level: Fitch

- Polarized housing market creating policy dilemma amid signs of cooling

- No easy answers to resolving the issue of public housing

- China spends big in housing renovation

- Brazil leader's impeachment trial enters final stretch

- 94th anniv. of Victory Day marked in Turkey

- Merkel opens Germany's 17th Confucius Institute

- France's outgoing minister vows to 'transform' France

- One dead, three wounded in blast at Chinese embassy in Kyrgyzstan

- Tainted food sickens 37 Buddhist monks, 2 helpers in Cambodia

Top 10 wealthiest countries in the world

Top 10 wealthiest countries in the world

Princlings go to school

Princlings go to school

Chinese painters capture beauty of Hangzhou

Chinese painters capture beauty of Hangzhou

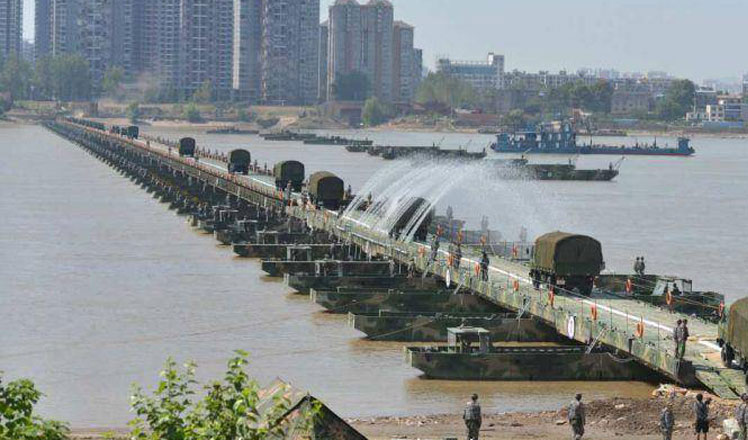

1,150-meter-long 'floating bridge' created

1,150-meter-long 'floating bridge' created

Take a sip of wine at the glass skywalk in Hunan

Take a sip of wine at the glass skywalk in Hunan

Groom and bride cycle their way to wedding

Groom and bride cycle their way to wedding

The world in photos: Aug 22- Aug 28

The world in photos: Aug 22- Aug 28

Daily life in Hangzhou, host city of 11th G20 summit

Daily life in Hangzhou, host city of 11th G20 summit

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|