CCA buys on Hudson riverfront

Updated: 2013-11-15 10:16

By ZHANG YUWEI in NEW YORK (China Daily USA)

|

||||||||

China Construction America Inc (CCA), a wholly owned subsidiary of China State Construction Engineering Corporation Ltd, completed the acquisition of 99 Hudson, a mixed-use development site overlooking Hudson River in Jersey City, New Jersey, the company said Thursday.

The acquisition — at a price of approximately $70 million — was CCA’s second all-cash real-estate transaction in Metro New York since the company purchased 445 South Street, a premier Class A office building, in Morristown, New Jersey in April.

Yuan Ning, president of CCA, told China Daily in a recent interview that the company started to form new strategies in the US market and move toward more merger and acquisition deals to expand the company’s portfolio.

“We started to acquire commercial buildings and also we want to develop our own residential projects in the New York area,” said Yuan, 48, who became the head of the US operation in 2001.

Totaling approximately 1.1 million square feet, 99 Hudson is located on the waterfront in Jersey City, offering easy access to midtown Manhattan and the World Trade Center. CCA plans to develop the site into an upscale mixed-use complex to include luxury condos, rental apartments, premium retail space and a boutique hotel.

Eyeing the US real-estate market, CCA set up its real-estate arm — Dynasty Capital — earlier this year, according to Yuan, as part of the effort to expand its core business in the US which has been focusing on construction. The new function will be focused on well located properties in New York and it’s currently working on several large residential developments in Manhattan.

“We have been doing business in this market for nearly 30 years and are well equipped to reach our goals for the real estate business”, Yuan said. “We are pursuing a relatively cautious investment strategy while remaining agile and responsive to market opportunities.”

“Actually we started as a real-estate developer in the US in the 1980s but since the year 2000 we started to focus on the construction business and became a general contractor in many cities in the US,” said Yuan.

Even though real-estate investment has been a major focus for CCA’s parent company in China, Yuan explained that the company, when it first entered the US in 1985, wasn’t ready to invest in such projects as it was still too new to the US market. It took the company about 15 years to wrap up the early investment in real estate and paid a big financial price, which Yuan didn't disclose.

The Chinese parent company, CSCEC China's largest State-owned construction company, ranks No 3 in the world, according to the International Construction, an industry magazine.

CCA has been an active player in the US construction market and a contractor of many sites across the US. In New York State alone, it won bids for projects including the renovation of the Alexander Hamilton Bridge (between Manhattan and the Bronx), construction of the ventilation shafts for the No 7 Subway line extension in New York (a $57 million deal), and the Yankee Stadium Station.

“Right now the company has work sites in New York, South Carolina, and the Bahamas,” said Yuan.

In May 2011, CCA started on a $3.6 billion resort development in the Bahamas, as both a general contractor and an investor. The 44-month-long Baha Mar project, a complex on Nassau's Cable Beach, will employ some 8,000 workers and is projected to generate a 10 percent boost to the Bahamas gross domestic product, according to Baha Mar Ltd, the development company behind the project.

Yuan said the company cannot rely on “organic growth” anymore, instead he said the company’s forming a strategy to invest more and get involved in more projects in PPP (public–private partnership), a government service or private business venture that’s funded and operated through a partnership of government and private sectors.

“We will acquire more local companies (including some construction companies),” said Yuan, adding it was part of the plan for the company to “diversify” its business in the US.

Contact the writer at yuweizhang@chinadailyusa.com

US carrier starts Philippine storm relief

US carrier starts Philippine storm relief

Treasures under the hammer

Treasures under the hammer

'Reverse' vending machine sells idea of recycling

'Reverse' vending machine sells idea of recycling

Heroic act helps thaw icy ties

Heroic act helps thaw icy ties

Newtown families mark anniversary with a plea for parents to unite

Newtown families mark anniversary with a plea for parents to unite

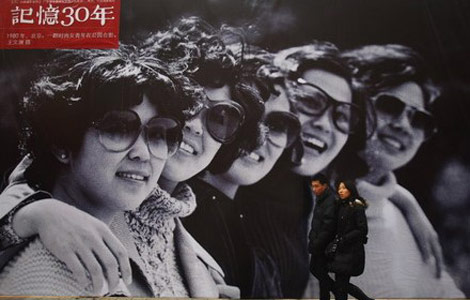

China's changing fashion since 1978

China's changing fashion since 1978

Healthy baby born to brain-dead mom in Hungary

Healthy baby born to brain-dead mom in Hungary

Top 10 romantic places to meet your Miss Right

Top 10 romantic places to meet your Miss Right

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US treasury chief makes 2nd trip to China

Nobel prize winner's connections with China

Canada should think globally: official

CCA buys on Hudson riverfront

CCA buys on Hudson riverfront

US spying agencies out of control

Yancoal strides into the potash game

Green chance offered to investors

Searching in Shanghai

US Weekly

|

|