Lew makes 2nd trip to China

Updated: 2013-11-15 09:57

By ZHANG YUNBI in Beijing, ZHANG YUWEI in New York and CHEN WEIHUA in Washington (China Daily USA)

|

||||||||

US Treasury Secretary Jacob Lew — as special representative of President Barack Obama — arrived in China on Friday for a two-day visit on the last leg of a five-nation Asian tour.

While he is expected to hear about China's commitment to market opening when meeting Chinese leaders, China will require a US commitment on issues such as the debt ceiling, observers say.

“If there is one thing that China wants to hear from the US — and that the US wants to convey to Chinese officials — it is that Chinese holdings in US Treasuries remains a secure investment and will be for the foreseeable future,” said Douglas C Borthwick, managing director of Chapdelaine Foreign Exchange.

Lew is the first high-ranking US official to visit China since the Third Plenum of the Communist Party of China's 18th Central Committee ended on Tuesday with a communiqué underlining the market's decisive role in the economy.

It is also his second trip to the country. His last trip, from March 19-20, came only five days after Xi Jinping became China’s president and was his first trip since taking office on Feb 28.

“With the recent conclusion of the Third Plenum, Lew’s timing is fortuitous, as the new leadership that assumed power in March is very focused on economic reform,” said Brendan Ahern, managing director of KraneShares, an asset management firm specializing in China-focused, exchange-traded funds. “There is a strong mutual interest by both countries for greater clarity and alignment on their economic goals.”

In a recent op-ed in the Wall Street Journal prior to his Asian trip, Lew argued that both the US and Asia should work toward rebalancing global growth for long-term gain. In it, he said the efforts China has put into transitioning toward domestic consumption from resource-intensive export growth are “imperative” to sustain strong growth in the medium term. The Treasury chief said the establishment of the Shanghai Free Trade Zone could “lead to more open investment”.

“The Shanghai Free Trade Zone represents a launch pad for US businesses into the (Chinese) mainland,” said Ahern. “China’s goal of raising consumer consumption could benefit US businesses that seize on the opportunity.”

Lew said earlier that there were many questions still to be answered concerning the communiqué from the Third Plenum, Bloomberg News reported. Many China watchers are also keeping an eye on the specifics to be rolled out in the coming months and years.

As special representative of President Obama, Lew has already visited Japan, Singapore, Malaysia and Vietnam.

Between Lew's two visits to China — the US’ largest creditor — the world witnessed a dramatic crisis over the US debt ceiling that partially shut down the federal government and has affected Washington's diplomatic agenda.

The crisis led to US Secretary of State John Kerry visiting Asia in place of Obama last month, raising concerns about the US’ commitment to its so-called rebalancing to Asia.

Douglas Paal, vice-president for studies at the Carnegie Endowment for International Peace, described the visit by Lew and also a planned visit to China in early December by Vice-President Joe Biden as “routine high level meetings, sustaining the rhetorical pledges to keep working on Sino-US relations in general and on financial issues in particular”.

“The Obama administration will use them to fortify the message that the rebalance to Asia continues in the political and economic spheres,” Paal said.

Ann Lee, an economics and finance professor at New York University, echoed this comment, saying she doesn’t expect the visit to change the current dynamics between investors from both sides.

“The US economy is still weak despite what Lew says and the US has not offered any significant reforms of its own aside from Obamacare, which has so far proven to be a disaster. Thus the only real FDI (foreign direct investment) coming into the US is still largely to buy cheap real estate,” said Lee.

Tao Wenzhao, a senior research fellow on US studies at the Chinese Academy of Social Sciences, said Washington may be especially interested in parts of the communiqué concerning government financing and the banking system.

“Lew will not shy away from talking about China's deepening financial reform, and Washington will explore the possibility of expanding China's imports from the United States,” Tao said.

The Chinese government’s efforts in restructuring the domestic economy to ensure sustainability will “naturally meet the demand” for optimizing the Sino-US trade structure, said Ruan Zongze, vice-president of the China Institute of International Studies.

“The US cares about the direction of the reform and is trying to establish more ground rules for two-way interaction,” Ruan said.

China is the largest foreign holder of US treasury bonds. “It seems uncertain whether the debt ceiling crisis will erupt again in February, when the next default deadline looms,” Ruan said. “Lew, as an authorized envoy, should also address Beijing's concerns on the debt ceiling issue and the demand to secure Chinese investment in US bonds.

“With the US's AAA credit rating in peril, Treasury Secretary Lew will do all that he can to assure that not only is the US still the best place for China to keep their investment, but it may be the only place,” said Borthwick. “He will likely point to the growth problems in Europe and Japan, and highlight that the growth to security ratio is probably highest in the US on a comparable basis.”

Two-way trade between the countries approached $500 billion last year. Analysts said the trade imbalance between China and the US will also be on agenda.

Tao said one of the options for Washington to deal with an annual trade deficit of roughly $300 billion is to lift restrictions on high-tech exports to China.

US carrier starts Philippine storm relief

US carrier starts Philippine storm relief

Treasures under the hammer

Treasures under the hammer

'Reverse' vending machine sells idea of recycling

'Reverse' vending machine sells idea of recycling

Heroic act helps thaw icy ties

Heroic act helps thaw icy ties

Newtown families mark anniversary with a plea for parents to unite

Newtown families mark anniversary with a plea for parents to unite

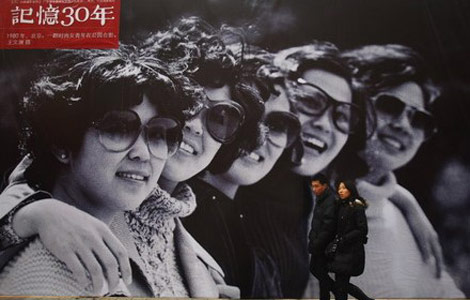

China's changing fashion since 1978

China's changing fashion since 1978

Healthy baby born to brain-dead mom in Hungary

Healthy baby born to brain-dead mom in Hungary

Top 10 romantic places to meet your Miss Right

Top 10 romantic places to meet your Miss Right

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China issues detailed reform roadmap

CCNY to occupy US's tallest building

Nobel prize winner's connections with China

US to seek commitment on market

CCA buys on Hudson riverfront

CCA buys on Hudson riverfront

US treasury chief makes 2nd trip to China

US spying agencies out of control

Yancoal strides into the potash game

US Weekly

|

|