'Made in China' to 'Made in USA'

Updated: 2015-03-27 11:03

By Dong Leshuo(China Daily)

|

||||||||

"Especially some of the medium Chinese businesses make decisions very quickly. That's been a key because they have been able to play their capital very fast. Particular now when the US economy is recovering, it's important when an opportunity arises, they could take advantage of it very quickly. Because over time, that project will be able to get enough capital," Swenson said.

Qingbin Cui, associate professor of the department of civil and environmental engineering at the University of Maryland, said the summit emphasized the need for international capital to invest in US infrastructure.

"China's infrastructure is developing very fast. The infrastructure here is out of date," Qingbin said. "In the past people just invest but not in maintenance. Now they find that the cost of maintenance is getting higher and higher. So they need more and fast investment. The government needs capital. They need public-private partnership."

Some members of the Chinese delegation mentioned the difficulty in starting a business in the US.

"A foreign company starting in the US from zero is tough," said Yan Li, from A&Z Pharmaceutical. "The problems are all aspects."

Li Chengrong of East West Bank said, "The way that Chinese do business is different from the Americans. For example, in China, their own property can be a guarantee when they borrow money from the bank. In the US, the bank also looks at your cash flow."

"American banking laws are very strict. For example, you cannot loan money to the company before they really start producing. The rule is different. They are now starting to understand more," she added.

"I'm not sure there's much understanding of our political system, and they (Chinese entrepreneurs) need to build relationships with policymakers when they invest here,"Nancy McLernon, president of the Organization for International Investment, an association representing the interests of US subsidiaries of global companies, told Xinhua news agency.

"Investing in the US market is a big trend, but you must make very good market research beforehand, or you will lose money here," Victor Yuan, senior vice-president ofSany Heavy Industry Corp, told Xinhua. Sany, a leading construction company in China, built a manufacturing base in Georgiain 2007 with an investment of$60 million.

Yuan said managing a company in the US is different from inChina. "The US companies advocate the importance of individual, while Chinese companies put more emphasis on the collective and authority," he said.

Labor cost in the US is still too high for manufacturers compared with in China, Yuan said. "To avoid this disadvantage, some important parts of the construction equipment thatSanyproduces in the US are still imported fromChina," he said.

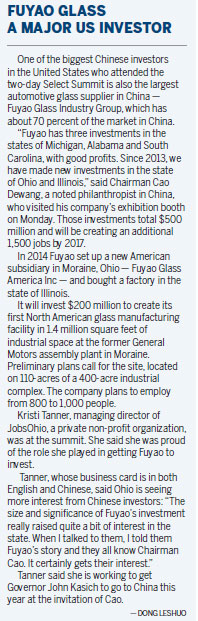

Cao Dewang, chairman of Fuyao Glass Industry Groupwhich has invested in Ohio, Michigan and Illinois, also mentioned the credit-rating system in the US. "At present our company's credit stand is 2A+, which makes our finance cost quite low, at 3.5 percent. However, if your company can't get an A score, you may have to face loan interests of 10 to 15 percent, which is too high to bear," he said.

Two burdens

David Rubenstein, co-founder and co-CEO of the Carlyle Group, a Washington-based global private-equity investment firm, touted investment opportunities in the US, and mentioned two kinds of burdens for the foreign investor: "One is the regulatory burden, the other is tax burden." And he said companies should be prepared for long haul instead of an immediate return.

"I think people should look at the investment in the US as well as elsewhere at 10 years of time minimum," said Rubenstein. "You have to take a much longer perspective. Don't expect profits to come overnight."

"The constitutions of the two countries are different. When the Chinese companies come to the US. They have to obey the law of the US They have to change their mindset," Liu kejiang, senior partner of Beijing DHH Law Firm, told China Daily.

"The tax system is complicated here," said June Chen, a partner of Deloitte.

"Before they come to the US, they had better figure out a general structure for taxes. Because if the structure is wrong, it would affect the final results. It would be hard to revise after it is established. So they need some time to prepare before they launch their business in the US."

Some Chinese businesses are still concerned about being targeted by the US government for alleged national security issues, subjecting them to reviews of the Committee on Foreign Investment in the United States (CFIUS).

A House Intelligence Committee report in October 2012 said that Chinese telecom- equipment giants Huawei and ZTE posed a national security threat to the US.

Sun Wansong, an official from China's Ministry of Commerce, told reporters on Monday that he told the US side during a discussion that he hoped the US will treat Chinese investment in a fairer manner and create a better climate for Chinese companies investing in the US.

Qingbin Cui thinks that the US "might have concerns of national security on projects like energy and the grid. But the roads, bridges and railway do not really relate to national security."

Contact the reporter at leshuodong@chinadailyusa.com

Chen Weihua, Sheng Yang in Washington and By Yang Yao in Beijing contributed to this story.

- 'Behind-the-scenes' visit at Paris Zoological Park

- Migrants risk lives crossing into Europe

- US denies visa to young man for transplant

- Germanwings' co-pilot 100 percent fit to fly: Lufthansa CEO

- Germanwings' co-pilot 100 percent fit to fly: Lufthansa CEO

- Voice recordings show one pilot locked out cockpit

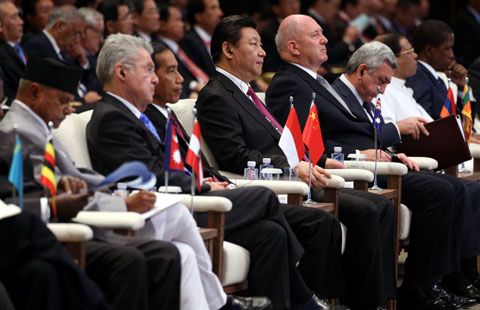

World leaders open Boao Forum for Asia 2015

World leaders open Boao Forum for Asia 2015

Buildings covered by fog in China's Qingdao

Buildings covered by fog in China's Qingdao

Across America over the week (from March 20 to 27)

Across America over the week (from March 20 to 27)

Walking tall

Walking tall

Press photo competition winners announced

Press photo competition winners announced

Strange but true: Gator takes a stroll on Florida golf course

Strange but true: Gator takes a stroll on Florida golf course

Top 9 hot-selling foreign products for Chinese babies

Top 9 hot-selling foreign products for Chinese babies

French photographer captures Beijing in the '80s

French photographer captures Beijing in the '80s

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Asian countries to seek win-win co-op: Xi

'Made in China' to 'Made in USA'

More countries to join China-backed investment bank

Grassland city looks to cloud computing

Scenic Hohhot wants to be smart based on emerging industries

Motive examined after

'deliberate crash'

Chinese CEO compares Apple Inc to Hitler

China's investment opportunities lauded

US Weekly

|

|