China shines in clean power stakes

Updated: 2013-04-26 07:22

By Lan Lan (China Daily)

|

||||||||

|

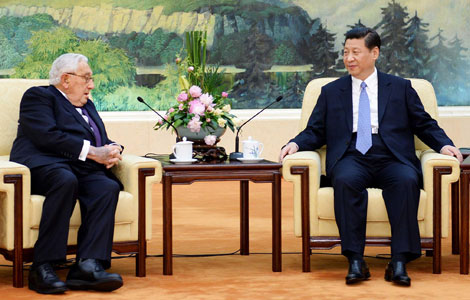

China accounted for 30 percent of total clean energy investment among G20 nations last year. Song Weixing / For China Daily |

Investment gains in renewable energies are result of good policy, says report

China regained the global top spot in clean energy investment in 2012 with a 20 percent rise, while investment in the United States and Europe dropped, a report has shown.

The sector attracted $65.1 billion (50 billion euros) in renewable energy investment last year, whereas investment levels worldwide declined 11 percent, said the report by research and public policy organization Pew Charitable Trusts.

The US, previously leading the way, ranked second with investment in the sector dropping 37 percent to $35.6 billion in 2012.

Although the US invented many of the leading clean energy technologies, the lack of consensus among American policymakers has caused the nation to underperform in manufacturing clean-tech products and to lose market share in the industry, the report said.

"When we look around the world, we see policy really matters when it comes to where investment will be going," says Phyllis Cuttino, director of Pew's Clean Energy Program.

She adds that uncertainty about renewable energy investment policies in the US had made investors look elsewhere, in areas where returns can be better guaranteed.

China accounted for 30 percent of total clean energy investment among the G20 nations last year, leading investment in solar, wind and other renewable energies.

China also led the world in deployment of clean energy technologies, adding 23 gigawatts of capacity, which accounted for a quarter of newly installed clean energy in 2012, the report showed.

Fred Krupp, president of the Environmental Defense Fund, says the reason why China has more investment than the US is largely due to its government's commitment to promote renewable energy.

"The Chinese government has got tremendous credit for setting aggressive targets for installation of renewable energies," he says. "I'd like to see more commitment in the United States."

The assessment report showed the center of gravity for investment has shifted from the traditional, established markets in the West to emerging markets in the East.

Curtailed government incentives have resulted in a falling investment in the long-standing, traditional markets, including Germany, Italy, the United Kingdom and Spain. Germany ranked third with $22.8 billion, down 27 percent compared with the previous year.

In sharp contrast, investment in the Asia and Oceania region grew by 16 percent to $101 billion in 2012, making it the leading regional destination for investment for the first time.

Clean energy investment also soared 75 percent in Japan to $16.6 billion, thanks to national efforts to develop alternatives to nuclear energy after the Fukushima Daiichi disaster in 2011. The country jumped to the No 5 spot for investment in 2012.

South Africa emerged as the fastest-growing destination for clean energy investment last year among the G20 nations, attracting $5.5 billion. In previous years, it had been less than $100 million.

About three quarters of the investment in South Africa was in the solar sector, with the rest pumped into the wind sector.

"More money will be going into South Africa, as long as it keeps its policies in place," says Cuttino, who adds that the country has implemented ambitious targets and policies.

South Africa's relatively new renewable energy program has resulted in 28 projects. A second round is under way.

Also, the recent lifting of constraints on nuclear power and shale gas development has released the potential of the country to go further in diversifying its energy mix.

Although worldwide investment in the sector fell by 11 percent last year, new generating capacity installed in 2012 hit a record 88 gW, said the report.

Cuttino says a sustained decline in the price of clean energy technologies and economies of scale had led to lower costs.

Her comments were echoed by Krupp of the Environmental Defense Fund. "One thing that has made clean energy more competitive is the fact that prices are coming down, and we will continue to see more reductions for price in solar energy and wind power," he says.

The rising price of natural gas will also make wind and solar more competitive.

Lin Boqiang, director of the Center for Energy Economics Research at Xiamen University, says investment in clean energy often involves a delay before results are seen, and the record-high installed capacity may be a delayed benefit of investment in previous years.

However, according to an earlier Bloomberg New Energy Finance report, clean energy investment slid 22 percent worldwide in the first quarter of 2013.

Investment in renewable and energy-efficient technologies in the US fell 54 percent to $4.5 billion, while investment in China declined 15 percent to $8.8 billion during the period.

"Each year, the first quarter is generally down, although not down this much," says Cuttino. "This was the worst first quarter since 2009. As the economy improves, I think the market is pretty resilient."

Lin says: "China has little problem in keeping a 30 percent annual growth in clean energy investment, largely due to a relatively low base.

"Also, the government has taken more action to help struggling manufacturers survive."

Public market financing in the sector worldwide fell sharply to $4.6 billion last year, 55 percent below 2011 levels. The stock prices of clean energy companies remained depressed due to falling product prices, oversupply in the manufacturing sector and uncertain policies, the Pew report said.

Venture capital and private equity investment declined by 34 percent in 2012, falling to $5.6 billion.

However, investment in small-distributed capacity, which refers to residential-scale solar projects of less than 1 mW, remains a shining point.

Germany and Italy ranked first and second in small-distributed capacity investment in 2012, with respective investment of $15.1 billion and $13.8 billion. Japan saw investment in this sector soar by more than 50 percent to $12.9 billion.

The US invested $7 billion in this sector in 2012, while China invested about $5 billion.

lanlan@chinadaily.com.cn

(China Daily 04/26/2013 page17)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

No let up in home price rises

Bird-watchers undaunted by H7N9 virus

Onset of flood season adds to quake zone risks

Vice-president Li meets US diplomat

China has a tourism law

Meeting delivers big deals

China denies border spat with India

Chinese consumers push US exports higher

US Weekly

|

|