Forces for courses

Updated: 2013-04-26 09:06

By Yao Jing (China Daily)

|

||||||||

"Before 2010 we focused most of our attention on Mission Hills, and we've done 20 projects for Mission Hills out of its total 22 golf projects in China."

The company has expanded into other developments to look for more opportunities, such as Stone Forest in Kunming, Yunnan province, and White Stone Hot Spring Golf Club in Hainan province.

As the China market increased to account for a third of its business, in 2007 it set up Hainan Schmidt Curley Golf Design Co Ltd, and at present is designing or building 10 projects.

"The biggest challenge for us is government policies because it is difficult for developers to get a permit to build a golf course," Schmidt says. "But regulations making the industry healthier are welcome. The most important thing is that the demand for golf is there in China."

Trinka says: "It appears that the government is trying to enact rules and regulations to provide better control. This will in turn make developers more responsible for the projects that they develop and create, to be both financially and environmentally sustainable."

Using an international designer adds to the prestige of a club, he says.

"They often have a better understanding of the game's subtleties, shot values and game strategies that would be necessary to challenge the very best players in the world."

Schmidt's former employer Nicklaus Companies of Florida, founded by Jack Nicklaus, designed the first course in China and has opened 15 since then. It now has 15 under construction. Worldwide it has designed about 380 courses.

|

||||

Developers are also an uncertain quantity for Gary Player Design in the US, the firm of the South African great Gary Player.

"We do the design, but we are not sure whether the project will be built because the developer decides they do not have enough money or do not get approval for the land," says Justin Downes, of Gary Player Design in China.

With half of the projects the company has worked on in China the designs have gone no further than the drawing board. The 12 courses that it is now designing or building include Jinji Lake Golf Club in Suzhou and Sand River Golf Club in Shenzhen, Downes says.

Downes, who has run the business in China for three years, says he has seen changes in the market.

"Developers are more interested in the profitability of the golf business now. They are realizing that they have to keep the quality of a course and want to make money in the long-term, not in the short term as before."

In fact, design done with an eye to the long term and high-quality construction brings the costs of upkeep down because grass, soil and trees do not need to be replaced as often.

In the past, developers were intent on making as much money from memberships as soon as possible to cover the cost of construction, with no regard to the attractive proposition of drawing and retaining long-term members, Downes says.

In addition, Downes says, the trend now is to create attractive, viable communities and activities around golf courses so that the game itself is not the be all and end all of the project.

Such activities include entertainment, real estate sales, weddings and conventions.

Although the Chinese government is very cautious in developing the golf industry, he says, he is optimistic about his business and that China, which now accounts for 20 percent of its business, will eventually account for half.

"We are just doing three to four projects every year in China, therefore we are not affected by the overall state of the industry."

With the complex process of building a golf course, Western consultants who thoroughly understand the game stand to benefit in a market in which knowledge and expertise has not had time to fully develop.

"I think China is a young market, and there is a lot of learning going on," says Tony Cunzio, vice-president and general manager of Flagstick, a US golf course construction management company.

"In China, it is much more difficult because the developer or owner has never done that. In the process of building a golf course, there is a lot of engineering, architects, etc. We are trying to help project owners and golf course architects build great golf courses."

Flagstick set up a Chinese branch in Kunming two years ago as its business in China grew. It is now working with Nicklaus Design on Dali Reignwood, a 36-hole-course in Dali, Yunnan province; is a partner with Gary Player Design in Longping Jinhua Sports and Leisure Park in Changsha, Hunan province; and is working on another 11 projects in China.

"Growth in China has actually been steady in the past two years but it was very fast four or five years ago," Cunzio says.

China still accounts for more than 60 percent of Flagstick's business, he says, and with Western markets in a lull, he sees China as a good bet for growth.

"There is a lot of hesitation due to the regulations or the direction of the government or the economy. But I think it is a very active market as the interest for golf in China is very high."

yaojing@chinadaily.com.cn

(China Daily 04/26/2013 page10)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Phone bookings for taxis in Beijing

Chinese consumers push US exports higher

Seoul delivers ultimatum to DPRK

Boston bombing suspects intended to attack NYC

No let up in home price rises

Bird-watchers undaunted by H7N9 virus

Onset of flood season adds to quake zone risks

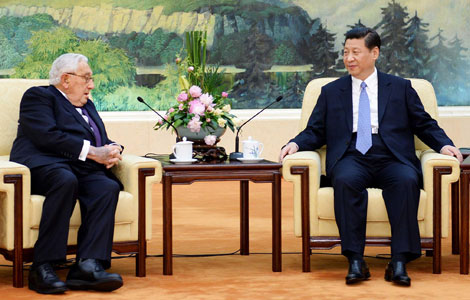

Vice-president Li meets US diplomat

US Weekly

|

|