Kawasaki drama meticulously planned

Updated: 2013-06-26 13:45

(www.asianewsnet.net/The Yomiuri Shimbun)

|

||||||||

The dramatic boardroom contretemps that led to the dismissal of three senior executives at Kawasaki Heavy Industries, Ltd. came to a head at an extraordinary board meeting on June 13.

“They proceeded with the merger talks without consulting with us,” one board member said. “They aren’t qualified to serve as executives.”

Other board members took turns criticising President Satoshi Hasegawa and the two others who were pushing ahead with a planned merger with Mitsui Engineering & Shipbuilding Co. A motion to dismiss the three was proposed.

Finally, Chairman Tadaharu Ohashi, who chaired the meeting and opposed the merger, gave the three a chance to speak.

“Please explain. Do you have anything to say? I’ll give you a fair hearing,” he said.

The three insisted that the merger was still only under consideration, and they had not started negotiations. But the other board members remained unconvinced.

This development was in line with a scenario that the antimerger board members had prepared in advance with advice from lawyers. The meeting at the company’s Tokyo head office in Minato Ward started at 3pm, and lasted 35 minutes.

Visibly annoyed, Hasegawa and the two pro-merger board members left the room after saying that they would consult their lawyers.

Industry sources say the merger plan was prompted by proposals put forward by the companies’ main banks, Mizuho Corporate Bank and Sumitomo Mitsui Banking Corp.

After the board meeting, a senior KHI official opposing the merger visited Mizuho Corporate Bank and said the planned merger was off.

According to sources at the bank, the KHI official told the bank that the company wanted Mizuho to continue to offer assistance.

KHI, which was established more than 130 years ago, consists of seven business divisions, including rolling stock and aerospace equipment. All are highly independent from the others.

Ohashi is from the rolling stock manufacturing division. He was president from 2005 to 2009, and earned accolades for increasing orders from overseas for train cars.

He is chairman of the Kobe Chamber of Commerce and Industry, and holds other key posts in business organisations.

Hasegawa and the other two sacked board members are from the gas turbine and machinery division.

“Mr. Hasegawa has experience only in the jet engine business, and he has far less influence than Chairman Ohashi,” a KHI executive said.

Industry observers believe Hasegawa and his aides leaned toward the merger because it would expand KHI’s shipbuilding business, which accounts for only about 10 per cent of the company’s total sales. By doing so, they apparently planned to increase their own stature and influence.

KHI is ranked second in the nation in terms of shipbuilding and heavy machinery businesses.

If the merger with fifth-ranked Mitsui Engineering & Shipbuilding had gone ahead, the new company would almost have been on a par with Mitsubishi Heavy Industries Ltd., Japan’s largest company in the industry.

In addition, they are believed to have sensed a business chance in government plans to step up development of seabed resources, such as methane hydrate--a kind of natural gas--and rare metals in Japan’s exclusive economic zone.

MODEC Inc., a subsidiary of Mitsui Engineering & Shipbuilding, has superb technologies in this field.

By absorbing MODEC, Hasegawa and his cohorts apparently planned to expand KHI’s sluggish shipbuilding business.

Ohashi was scheduled to resign from the board at a regular shareholders meeting to be held June 26.

The antimerger executives stepped in to dismiss Hasegawa and his aides because they predicted Hasegawa’s clout would grow and the merger plan would progress after Ohashi stepped down.

The ugly boardroom scenes have given KHI’s reputation a black eye.

“It was an internal war between supporters of Chairman Ohashi and those of President Hasegawa,” an official in the banking industry said. “It’s disgraceful behavior for a listed company.”

The disclosure of untrue information over the planned merger also played a part in the infighting.

On April 22, when the merger plan was first reported in the media, KHI issued a statement denying any such negotiations were taking place.

But the company’s lawyers warned the management executives that this denial could have legal risks.

The executives were told that telling a lie would not be acceptable just because it was a matter involving a corporate merger and acquisition.

If the executives attended the shareholders meeting while concealing this fact and the negotiations later came to light, “Our responsibility might be questioned with a shareholders filing a lawsuit,” a KHI executive said.

KHI’s stock price was 333 yen on April 19, before the merger plan was reported, but fell to 306 yen on June 13. KHI’s aggregate market value had fallen by about 45 billion yen.

Depending on future developments, KHI could be sued by institutional investors for the plunge in its stock price.

The new management lineup has a lot on its plate.

US$1 = 97.60 yen

S African worries about Mandela's condition

S African worries about Mandela's condition

Looted relics to return home this week

Looted relics to return home this week

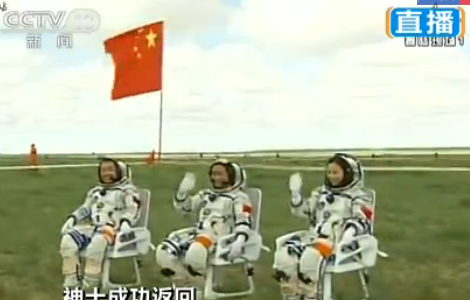

Astronauts go out of Shenzhou X's return capsule

Astronauts go out of Shenzhou X's return capsule

Djokovic, Williams, and China's Li win openers

Djokovic, Williams, and China's Li win openers

Russia, US disagree plan for Syria talks

Russia, US disagree plan for Syria talks

Cooling off, the traditional way

Cooling off, the traditional way

Surviving climber safe at home

Surviving climber safe at home

Warning on college majors

Warning on college majors

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US-China agree to boost corporate transparency

Global rating firm to rival 'Big Three'

New canal a lifeline for energy

China, EU hold human rights dialogue

Shenzhou X capsule makes successful landing

Americans struggle over smartphones on vacation

China can fix credit crunch: ADB

Public interests Party's top priority

US Weekly

|

|