Shares, dollar slide on Ukraine scare

Updated: 2014-04-26 07:24

(576)

|

||||||||

NEW YORK - US and world stock indexes fell on Friday as tensions between Ukraine and Russia weighed heavily on global equity markets and the rouble, while yields on the 30-year US Treasury bond reached the lowest in nearly a year.

Disappointing earnings from bellwether consumer product companies Amazon and Ford fed the decline on Wall Street, with the three main indexes all closing lower for the week.

Gold and the Japanese yen rallied on safe-haven buying. The 30-year US Treasury bond's yield fell to 3.42 percent, lowest since last June.

Russia warned Kiev on Friday that it would face justice after Ukrainian forces killed up to five pro-Russian rebels in eastern Ukraine on Thursday.

Standard & Poor's downgraded Russia's credit rating to triple-B-minus, one level above junk. That forced Russia's central bank to raise interest rates by 50 basis points to 7.5 percent to try to head off inflation from a weakened currency.

"(The market's) a little bit tired, but then you throw in all this stuff - it's Friday, you have the weekend coming, you have the whole Russia and Ukraine thing, Putin is pounding the table, so naturally you get this risk-off mentality," said Ken Polcari, a director at O'Neil Securities in New York.

The Dow Jones industrial average fell 140.19 points, or 0.85 percent, to end at 16,361.46. The S&P 500 lost 15.21 points, or 0.81 percent, to 1,863.40. The Nasdaq Composite dropped 72.777 points, or 1.75 percent, to 4,075.561.

US consumer shares were the weakest sector in the S&P. Amazon closed almost 10 percent down at $303.83 after sharp hikes in spending, which offset a revenue jump.

Ford Motor Co fell 3.0 percent to $15.78 after first-quarter earnings missed expectations, hurt by higher warranty costs in North America.

Russian stocks fell 1.6 percent and Russia's dollar bonds due in 2023 fell to 94.6 cents on the dollar, just off their lowest levels since issuance in September.

The rouble fell to 36.016 to the dollar, its lowest in nine days.

MSCI's measure of world stock markets was down 0.7 percent. European shares closed down 0.8 percent on concerns that the United States and Europe were readying tougher sanctions on Moscow that could lead to Russian retaliation.

The benchmark 10-year US Treasury note was up 7/32 to yield 2.6677 percent.

The dollar fell to 102.12 yen, down 0.2 percent on the day and its lowest in a week. But it recovered against the Swiss franc, gaining 0.02 percent to 0.8812 franc after earlier falling to a week low of 0.8798 franc.

German government bonds, favored by risk-wary investors, gained in tandem with gold. Spot gold was up 0.7 percent at $1,302.46 an ounce after hitting a 9-day high at $1,305.

Brent crude oil finished down 0.7 percent at $109.58 a barrel but stayed near seven-week highs. US oil settled down 1.3 percent at $100.60 a barrel, after plumbing a near three-week low at $102.05.

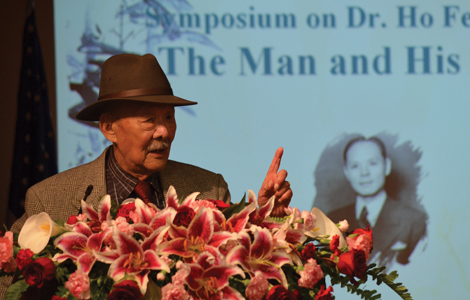

'Global citizen' becomes head of C-100

'Global citizen' becomes head of C-100

At 96, a legendary chef can still inspire 'the best' Chinese food

At 96, a legendary chef can still inspire 'the best' Chinese food

China's wine consumption is growing

China's wine consumption is growing

China's reforms 'hitting right note'

China's reforms 'hitting right note'

Groundbreaking held for Harvard biz center named for a Chinese American

Groundbreaking held for Harvard biz center named for a Chinese American

UK royals wrap up tour of Australia and NZ

UK royals wrap up tour of Australia and NZ

Michelle honors 'Take our daughters and sons to work Day'

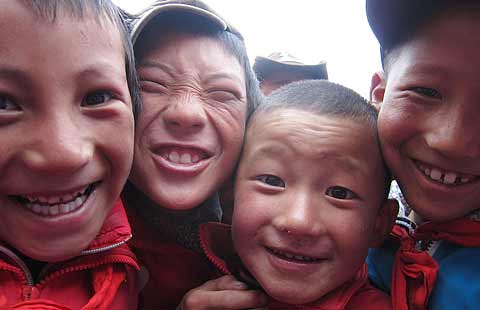

Michelle honors 'Take our daughters and sons to work Day'

Pop-up cat cafe opens in New York

Pop-up cat cafe opens in New York

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

C-100 strengthens

US-China relations

David Tsang: Building a better future

Stephen Siu: Follow the star, no matter how far

Across America

Harvard dedicates new business center

Obama's Diaoyu Islands vow 'may backfire'

HK official says China's wine consumption can grow

US, Japan fail to reach TPP deal

US Weekly

|

|