Swiss move helpful

Updated: 2014-05-09 07:23

(China Daily)

|

||||||||

|

At the European Finance Ministers' meeting on Tuesday, Switzerland, the world's largest offshore financial center, agreed to sign a global standard on the automatic exchange of information on foreigners' bank accounts, a move that has been widely interpreted as lifting the centuries-old veil of secrecy that has made Swiss bank accounts so attractive to those looking to "hide" their money.

The move is a big step forward for governments that have mounted a concerted attack on tax evasion in the wake of the global financial crisis.

Swiss cooperation in opening up bank accounts is also good news for China's ongoing anti-corruption efforts as it will be much easier for the authorities to collect information on overseas accounts relating to corrupt officials, said a Beijing News column, which advocated domestic agencies positively coordinate with Swiss banks to gather information on the Chinese owners of bank accounts in Switzerland.

For a long time, corrupt officials and illegal businesses worldwide have considered Switzerland a safe haven for hiding their ill-gotten assets. So the move is bad news to corrupt officials and other criminals and good news for anybody fighting corruption.

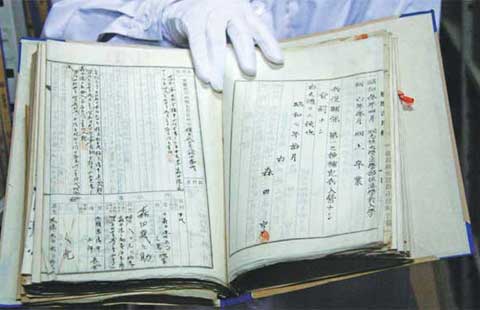

It is reported that Swiss banks have only agreed to automatically exchange information for tax purposes, but experience has shown that investigation of tax evasion often reveals clues to corruption.

It is of course unknown how many corrupt Chinese officials have put money in Swiss banks, but the latest move will undoubtedly prove to be an important channel for fighting corruption. To make the best use of this precious opportunity, Chinese anti-corruption agencies should be proactive.

The relevant agencies need to strengthen coordination with Switzerland on actual cases, as according to global agreements China may obtain more account information. In fact, this development should inspire China to seek information on global accounts.

In the United States, the Foreign Account Tax Act introduced in 2010 "targets non-compliance by US taxpayers with foreign accounts"; China can take similar measures to avoid corrupt officials laundering their money through overseas accounts.

Switzerland is not the only safe haven, and others are still insisting on maintaining their secrecy policies. But it is expected that the Organisation for Economic Co-operation and Development will apply more pressure on them. In the meantime, the move by Switzerland marks a great step forward.

US-born pandas arrive at Chinese research base

US-born pandas arrive at Chinese research base

Finding the best way to teach Chinese

Finding the best way to teach Chinese

Forum trends: Some "bad" habits I've picked up in China

Forum trends: Some "bad" habits I've picked up in China

Chinese man's killing reflects'dangerous'neighborhood

Chinese man's killing reflects'dangerous'neighborhood

'Red Chamber' play aims to put audience asleep

'Red Chamber' play aims to put audience asleep

Wuhan high-tech zone ready for investors, students

Wuhan high-tech zone ready for investors, students

Rio Confucius Institute is blossoming

Rio Confucius Institute is blossoming

Chinese students make finals

Chinese students make finals

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Islamic leaders join efforts against extremism

Xi: There is no gene for invasion in our blood

July elections in Thailand 'unlikely' amid crisis

China: US must be objective about Asia tensions

Big piece of first Chinese jetliner completed

Protecting environment tops public concerns in poll

Liquor maker redesigns public toilet to look like White House

2 Chinese killed in Vietnam riots

US Weekly

|

|