Wineries seek growth in China market

Updated: 2014-07-20 23:28

By Mu Chen (China Daily USA)

|

||||||||

Argentine wines are prospering despite a major shift in the Chinese wine market and are positioning themselves for an even brighter future.

In 2013, Argentine wine exports to China increased by 28 percent in value to $21 million and 18 percent in volume to 472,000 cases, according to statistics from Wine of Argentina, an association that represents 250 Argentine wineries.

By contrast, overall wine imports by China fell by 4.1 percent in value and 4.4 percent in volume last year, the International Organization of Vine and Wine reported in May.

The anti-graft campaign started at the end of 2012 prohibited government and State-owned enterprises from lavish spending and receiving gifts — previously two key drivers of the Chinese wine market.

France — China's top wine importer, which is famed for its ultra-expensive labels, such as Chateau Lafite Rothschild and Chateau Petrus — took the brunt of the campaign in 2013 with a 12.3 percent drop in value and a 2.1 percent drop in volume, according to the OIV.

Ma Zhen, editor-in-chief of Wine in China magazine, said the exceptional nature of consumer behavior had been hindering true market forces in China.

"Only recently have Chinese consumers begun to seek good-quality table wines at the right prices," Ma said.

Andrew Maidment, head of China and Europe at WOA, said the shift to entry- and mid-level wines has particularly helped Argentine wines because Argentina specializes in value-for-money wines.

Last year, Argentine winery Salentein saw a sales increase of over 200 percent for the entry-level brand Portillo, which retails at 100 yuan ($16) a bottle, and of 30 to 40 percent for the mid-level brand Salentein Reserva, which is 228 yuan ($37) a bottle.

Santiago Diaz, China brand ambassador of Salentein, said that the change in the China market affected all wineries from all countries. But it has not been as big a deal for his company.

"We sell our products through our sole distributor, Torres China, which has a reliable and varied client base not much affected by the change in regulations," Diaz said. "The focus going forward is to introduce premium Argentine wines to our growing consumer base."

Priscilla Chan, sales and marketing manager at the Shanghai-based wine importer and distributor Eurowill Ltd, said Argentine wine has an added advantage in the Chinese market.

"Argentina is undoubtedly famous for its malbec, which especially suits the Chinese palates because of its supple structure and sumptuous style," Chan said.

The fruitier and bolder flavored malbec has become the flagship grape for Argentina in China with a surge of 436 percent in value and 311 percent in volume since 2009.

In the newly emerging Chinese wine market, raising awareness is the key challenge for Argentine wine. Individual wineries, such as Salentein, are making concerted efforts to build and spread the Argentine brand.

Maidment said: "It is a very competitive marketplace where supply still outstrips demand, and to stand out, you need to have a compelling story that Chinese consumers hear, understand and find attractive."

muchen@chinadaily.com.cn

Brazil launches China desk to handle economic ties with China

Brazil launches China desk to handle economic ties with China

NY Wheel reels in Chinese EB-5 investors

NY Wheel reels in Chinese EB-5 investors

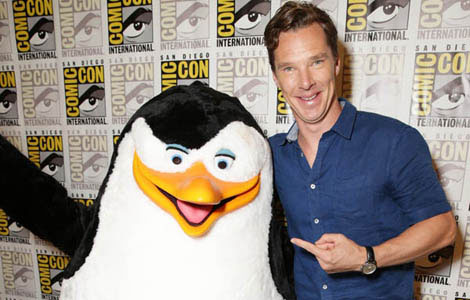

The Penguins of Madagascar to enter China

The Penguins of Madagascar to enter China

Panda cub Bao Bao turns one

Panda cub Bao Bao turns one

HK kid's symphony returns to NY

HK kid's symphony returns to NY

China, US reach agreement

China, US reach agreement

40 bodies from jet returned to Dutch soil

40 bodies from jet returned to Dutch soil

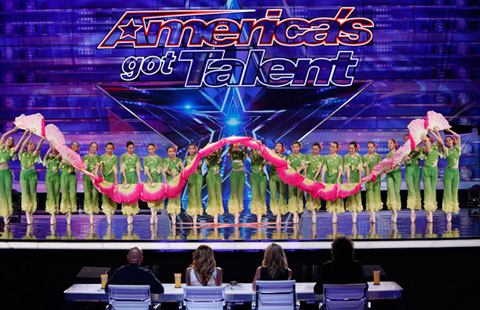

Dance troupe's fusion performance wins over judges

Dance troupe's fusion performance wins over judges

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Manufacturing hits an 18-month high

Transformers producers hit with breach of contract suit

US chipmaker to be deemed monopoly

Chinese still seek Beckel termination

One dead in shooting in Philadelphia

France: Air Algerie plane 'probably' crashed

TransAsia crash while landing in Taiwan

China, UC-Davis set up food safety center

US Weekly

|

|