Malaysia Airlines shares to be halted

Updated: 2014-08-08 10:16

(Agencies)

|

||||||||

|

|

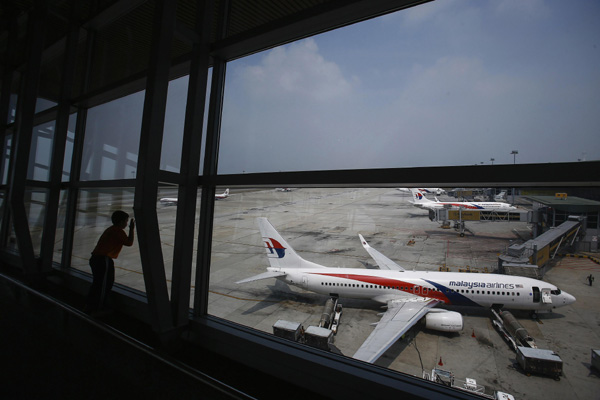

A boy looks at a Malaysia Airlines Boeing 737-800 aircraft (foreground) on the tarmac at Kuala Lumpur International Airport in Sepang outside Kuala Lumpur in this June 27, 2014 file photo. [Photo/Agencies] |

KUALA LUMPUR - Malaysia Airlines (MAS) plans to suspend its shares from trading on Friday, two sources familiar with the situation said, likely paving the way for state investor Khazanah Nasional to take the airline private as a first step in a major restructuring.

Trading in the company, whose official name is Malaysian Airline System, will be halted due to "a pending corporate announcement," according to the sources, who declined to elaborate. The sources declined to be identified as the matter was private.

|

|

| Dutch firm to take over MH370 search |

|

|

| MH17 recovery mission halted over security concerns |

Loss-making Malaysia Airlines' problems deepened on July 17 when its Flight MH17 was shot down over Ukraine, killing all 298 people on board. That incident accelerated the government's plans to restructure the airline, the sources said.

A de-listing would pave the way for Khazanah, which is chaired by Prime Minister Najib Razak, to revive the ailing carrier, possibly by selling off its profitable engineering, airport services or budget airline units, trimming its payroll and installing a new management team.

MAS officials could not immediately be reached for comment on the share suspension. A Khazanah spokesperson said the fund could not comment on "speculation."

The restructuring and potential sale of MAS is politically fraught due to opposition to job losses from its labour union, which has hampered previous revival plans, and its status as Malaysia's national flag-carrier.

At MAS's current price of 24 sen per share, majority shareholder Khazanah would need to pay around 1.23 billion ringgit ($383 million) for the 30.6 percent of shares it does not already own, according to Reuters calculations.

Sources said Khazanah is expected to pay a premium over Thursday's closing price.

Already squeezed by intense local and longer-haul competition from rivals such as AirAsia, MAS turned in its worst quarterly performance in two years in the January-March period and is currently burning through its operating cash.

The company is expected to announce its April-June earnings on Aug. 20. Analysts said it could be the airline's weakest quarterly performance yet partly due to flight cancellations after the disappearance of MH370.

MAS shares ended unchanged at 24 sen per share on Thursday, 4 percent lower than where they were before the disappearance of MH370. The broader index rose 1.9 percent during the same period.

- Malaysia Airlines faces fight for survival

- Malaysia Airlines releases full list of passengers on MH17

- Malaysia Airlines says requested higher flight plan

- INTERPOL to assist in investigation following Malaysia Airlines crash in Ukraine

- Malaysia Airlines says MH17 has clean maintenance record

- Double disasters taint Malaysia Airlines

- Malaysia Airlines European flights to take alternative routes

Will Chinese tourists 'heart' New York too?

Will Chinese tourists 'heart' New York too?

Mobile gamer iDream Sky raises $115m in IPO

Mobile gamer iDream Sky raises $115m in IPO

China Southern launches Guangzhou-New York service

China Southern launches Guangzhou-New York service

Chinese cadets' numbers rise in US military academies

Chinese cadets' numbers rise in US military academies

US funded Chinese fashion website targets a new customer segment

US funded Chinese fashion website targets a new customer segment

'Dr Tea' takes on the US

'Dr Tea' takes on the US

NYC spurs small business

NYC spurs small business

US-Africa summit starts with development fora

US-Africa summit starts with development fora

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Pandas find friend in World Peace

Obama authorizes targeted airstrikes in Iraq

New Guangzhou-NYC flight 'a gift'

China's mobile gamer lists at Nasdaq

Will Chinese tourists 'heart' New York too?

Hagel in New Delhi to expand defense ties with India

Scale of Ebola crisis 'unprecedented'

Compromise called for in Sino-US ties

US Weekly

|

|