More farm products to be exported to China

Updated: 2014-12-29 04:02

By Yang Yao in Beijing(China Daily Latin America)

|

||||||||

|

|

Soybean plants are harvested at a field in the city of Chacabuco in this file photo taken in April 2013. Food demand is rising and the South American country is a natural grains exporter. Yet farm revenue is falling across the Pampas while soy yields stagnate due to high inflation and lack of crop rotation needed to maintain healthy soils. Enrique Marcarian / REUTERS |

The flow of agricultural commodities, soybeans in particular, from South America to China will increase by 45 percent in the coming decade, analyst forecasted.

On Dec 17, Rabobank published a report Unleashing the Potential for Global Food and Agriculture which said that the cross-continental links that bridge production and consumption, such as South America's grain and oilseed exports to China, are held back by slow investments in infrastructure that make logistics have a high share in export costs.

With better globally linked chains, South America and China could lead to another 20 million tons of soybeans trade by 2025, the report said.

China's demand for grains and oilseeds has been increasing and will continue to do so. Over the next decade, population growth and GDP growth will lead to increased per capita meat consumption, at an annual average rate of 1.4 percent overall, with the biggest growth expected to be in poultry, at 4.3 percent per year.

The increase in demand for meat translates to an increase in soy meal requirements of 1.6 percent per year, resulting in overall soybean consumption of 100 million tons by 2025.

According to the bank's analysis, given China's resource constraints, much of the additional production will have to come from imports. Soybean imports have increased from 13 million tons in 2001 to over 60 million tons in 2013, and Rabobank expects they could increase by an additional 20 million tons in the coming decade.

At present, the average feed conversion ratio (FCR) for pork in China is 3.2, which is much higher than standard in Europe of 2.5. Similar disparities exist in the poultry and beef markets.

The report said that if the FCR remains stable, up to 50 percent more feed demand could be expected through to 2025.

Currently, China imports soybeans from both the US and South America. The US for now has the advantage with a mature market and big well-established suppliers, but supply growth may be limited in the future, Rabobank said.

The greatest potential for growth in productions is in South America – particularly Brazil – as the country has more land that could be put into crop production than any other country.

The South America-China route could be the biggest opportunity for growth in trade, the report said.

Soybean trade from South America to China increased from 8 million tons in 2001 to 38 million tons in 2013, with China currently absorbing 75 percent of South American soybean exports. Rabobank projections indicate that Brazil and Argentina can increase soybean production by 40 million tons in the next 10 years (about 30 percent increase), and exports to China from these countries could increase by about 20 million tons in the next decade.

However, a few hurdles need to be cleared before this growth can be achieved, the report said.

The report's co-author Jane Peng, analyst with Rabobank, said transport logistics is considered the main shortcoming of Brazilian agribusiness, reducing its competitiveness and imposing limits on growth.

The country is overly dependent on high-cost road transportation for grains, with trucks traveling on congested roads that can become unusable during rainy periods. Railways and waterways that are cheaper and faster are currently underutilized.

According to the Brazilian Association of Cereal Exporters (ANEC), the average price for shipping soybeans from Brazil has been nearly $98 per ton over the past three years, which is five times higher than in the US and considered the most expensive in the world.

The report said that most agricultural expansion is in more remote regions of Brazil's northeast and central west. The distance to the southeastern ports from Mato Grosso is 2,200 kilometers, which will only increase as production expands further to the northeast.

Port capacity is another issue. In the past year, with a record soybean crop flowing out of Brazil, wait times at the main ports were up to three months, costing $20,000 per day.

Logistics in Argentina is also a problem as the country expands soybean exports. Approximately 83 percent of grain and soybean transport is done by truck. The primary and secondary road networks extend 170,000 kilometers, but only 31 percent are paved. While port availability is better than in Brazil, additional dredging will be required on the Parana River to move a greater number of large vessels upriver.

In 2012, the Brazilian government announced the Logistics Investment Program, which specifically focuses on the renewal and integration of the transportation network. The program has planned investments of BRL 290 billion ($120 billion)

Big-name industry players are investing in infrastructure improvements. A new port (Itaqui) is under construction in Maranhao, in Brazil's northeast, and Glencore, Louis Dreyfus and local players CGG and NOVA Agri are all setting up their own terminals. Eight companies have started developing ports and shipping grains along the Amazon River.

Both Argentina and Brazil have set limits on foreign land ownership, creating difficulties for Chinese companies operating in the countries. A way out is to partner with local companies. COFCO (Chinese National Cereal, Oil and Foodstuffs Corporation) has already started partnership with the local players.

Government policies toward food and agriculture also need to be changed, Peng said.

A reduction in export taxes in Argentina, for example, would go a long way towards increasing incentives for more production. Macroeconomic stability and sustained growth would also aid production in both countries.

Peng said that apart from changes that will be needed in South America, improvements in Chinese soybean crushing and storage will also be important enablers of increased South-to-South trade flows.

It is estimated that more than 80 million yuan ($13 billion) will need to be invested in the coming decade, mainly geared at upgrading current storage facilities, building new dryers and optimizing logistics.

The strengthening of the South America-China trade route for soybeans will also have a positive effect on the trade flows of other commodities, such as grains or dairy.

In addition, other exporters in South America like Uruguay and Paraguay could also benefit from growing trade, and other import markets in Asia, like Indonesia, could follow China's footsteps in increasing its trade with South America.

yangyao@chinadaily.com.cn

Missing AirAsia plane maybe at sea bottom

Missing AirAsia plane maybe at sea bottom

Yearender: Best selling Chinese films in 2014

Yearender: Best selling Chinese films in 2014

Top 10 policy changes of China in 2014

Top 10 policy changes of China in 2014

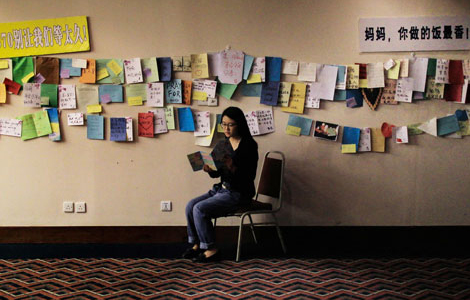

Families of MH370's passengers still hold out hope

Families of MH370's passengers still hold out hope

Clearing house sees bright future in Brazil

Clearing house sees bright future in Brazil

Where did you go flight QZ8501

Where did you go flight QZ8501

Trending across China: Never too old to learn

Trending across China: Never too old to learn

Cartoons capture 10 major China stories of 2014

Cartoons capture 10 major China stories of 2014

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

The Interview gets mixed views

Harvard students seek meaty profits from alpaca

Funeral set for Officer Wenjian Liu

China offers to help in search for missing AirAsia flight

AirAsia plane has tire problem in Philippines

Missing AirAsia plane could be at 'bottom of sea'

Deals planned to recover illegal assets from abroad

Parents seeking advantages send kids to US schools while young

US Weekly

|

|