Yuan's role highlights summit

Updated: 2015-04-18 04:18

By TALIA BECKETT and HATTY LIU in Vancouver(China Daily Canada)

|

||||||||

|

|

Colin Hansen, CEO of AdvantageBC |

Private and public sector leaders from across Canada and Asia will meet at the Pacific Finance Summit to create a blueprint for Canada to capitalize on its new status as clearing hub for China's currency.

The summit, part of the international conference series presented by CityAge Media, will be held June 16 at the Vancouver Convention Centre. It is co-hosted by AdvantageBC and the Province of British Columbia.

Participants of the summit will look at how Canadian and Chinese companies will gain competitive advantages by settling accounts between Canadian dollars and renminbi, or yuan, which is expected to become the world's third major trading currency within the next five years.

According to Colin Hansen, CEO of AdvantageBC, Canada's status as a renminbi hub is "a unique opportunity, which will make [Canada's] importers and exporters more competitive and extend out trade reach across the Americas."

The Peoples Bank of China designated Canada as China's first renminbi settlement hub in the North American continent on Nov 9. The Industrial and Commercial Bank of China (ICBC) branch in Canada is the official clearing bank.

"The new currency exchange system will mean that Canadian companies will now be able to efficiently conduct transactions in real time between Canadian dollars and Chinese renminbi," Hansen said in a press release. "Canadian companies will [have] savings in currency exchange costs, reduction in transaction risks, as well as faster and more direct payments."

The ability to directly trade in what is expected to be one of the world's top three currencies within five years will add as much as C$32 billion in exports for Canada and grow the country's financial services footprint in Asia.

Canada is also the seventh country in the world to be allocated a renminbi Qualified Foreign Institutional Investor quota by China, which will allow companies in Canada to use renminbi to invest directly with China's capital markets.

According to AdvantageBC, these successes offer Canada an opportunity to grow both its status as a global financial center and its exports to China and other Asian countries.

Confirmed speakers at the Pacific Finance Summit include Michael de Jong, BC Minister of Finance; Teresa Wat, BC Minister of International Trade; Janet L. Ecker, President and CEO of Toronto Financial Services Alliance; and Rongrong Huo, head of China and RMB Business Development of HSBC.

Natural History Museum opens in Shanghai

Natural History Museum opens in Shanghai

Japanese WWII surrender video debuted at China museum

Japanese WWII surrender video debuted at China museum

Beijing film festival draws top moviemakers, Oscar winners

Beijing film festival draws top moviemakers, Oscar winners

Across America over the week (from April 10 to 16)

Across America over the week (from April 10 to 16)

Historic hotels offer more than a view

Historic hotels offer more than a view

Top 10 foreign holders of US Treasuries

Top 10 foreign holders of US Treasuries

Lost in sandstorms

Lost in sandstorms

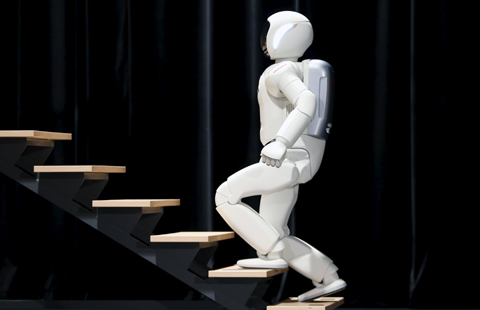

New roles for technology: Rise of robots

New roles for technology: Rise of robots

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Central bank lowers reserve ratio

Envoy sees many benefits from Xi's Pakistan visit

China concerned at reports of New Zealand-US plan to spy on diplomats

Old Summer Palace may sue over controversial replica

China and the 2016

US election

World Bank, IMF: will work

with AIIB

Ex-PM says US, China can be allies

Hainan Air links San Jose, Beijing

US Weekly

|

|