Service sector bolsters China’s GDP despite stock woes

Updated: 2015-07-16 22:31

By PAUL WELITZKIN in New York(China Daily Canada)

|

||||||||

Observers are still sorting out what if any effect China’s stock market selloff had on the overall economy, as the Chinese government announced Wednesday that the nation’s gross domestic product (GDP) grew by 7 percent in the second quarter, bolstered by strength in the service sector.

The National Bureau of Statistics said the service sector made up 49.5 percent of total GDP — 2.1 percentage points more than in the same period last year — compared with the industrial sector’s 43.7 percent, with agriculture accounting for the rest.

Despite the relatively strong indicator, China’s Shanghai and Shenzhen A Share indices fell 3.01 percent and 4.22 percent respectively, on Wednesday. The market’s tumble, which began last month, prompted extraordinary support measures from the government and the People’s Bank of China (PBOC), the country’s central bank.

Darrell Duffie, a professor of finance at Stanford University in Palo Alto, California, said the GDP report would seem to allay fears that China’s economy may not be able to weather the fallout from the stock market downturn.

“However, due to lags in economic responses, the performance data for (the) next quarter will be far more revealing of the degree to which the selloff will have an adverse impact,” he wrote in an email.

Meg Lundsager, public policy fellow at the Wilson Center and a former US executive director at the International Monetary Fund, said it’s difficult to predict the impact of the stock market on the economy.

“With only a small portion of Chinese individuals invested in the market, there may not be much impact on consumer sentiment. Of course the stories about small investors losing their life savings in the market can put a damper on spending more broadly, just when consumption is contributing a larger share to economic growth,” Lundsager said in an email.

“The 7 percent number is encouraging because it is growth in the range that most (now) talk about as an informal threshold for things going well and because it is somewhat better than what was generally expected,” said Jacques deLisle, a law professor and director of the Center for East Asian Studies at the University of Pennsylvania in Philadelphia, in an email.

Even before the stock market turbulence the PBOC and the government took steps to counter an economic slowdown that seemed poised to exceed original targets. The central bank has trimmed interest rates three times since last November to spur domestic demand while the government increased infrastructure spending and provided additional tax breaks.

“The PBOC recognizes it needs to provide adequate liquidity to the economy to maintain positive inflation and to provide sufficient credit expansion to support more domestic demand,” said Lundsager. “Its policies have helped the development of the non-state sector and reduced dependence on public-sector investment and exports for growth.

“At the same time, the PBOC seeks to avoid fueling bubbles or financial market instability. The gyrations in the equity markets show how challenging these competing goals of underpinning domestic growth and securing financial market stability are to achieve,” she added.

“The PBOC's monetary policies are leaning in the right direction. I am not confident in the long-run efficacy of other government actions that prevented or discouraged investors from liquidating their equity positions,” Duffie said about actions that included a trading halt affecting nearly half of the stocks on the mainland.

“In general, government rules that prop up stock prices sound good to investors in the short run, but can introduce long-run distortion costs and weaken the risk management skills and incentives of market participants,” Duffie said.

“From a longer term perspective, the concern is that growth is being maintained through quite extensive state intervention in the economy (as occurred in 2008 as well). The worry is that this kind of intervention cuts against and potentially delays market-oriented reforms that the leadership has recognized and endorsed as necessary to sustain growth in the long run,” said deLisle.

In the second half of the year, Lundsager expects the Chinese government to focus on supporting domestic growth by financing investment and maintaining an accommodative monetary policy.

“The challenge will be to maintain financial market confidence and stability, while reducing the recent market interventions and returning to the path of financial sector deepening and liberalization,” she said.

“For now, the situation seems much calmer and more stable. I am optimistic,” added Duffie.

paulwelitzkin@chinadailyusa.com

Heavy downpour hits SW China

Heavy downpour hits SW China

Wan Li: A life in photos

Wan Li: A life in photos

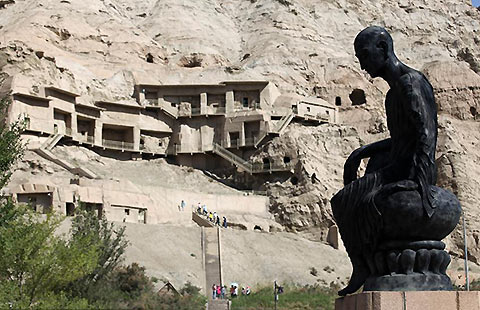

22 World Heritage Sites in China along the Silk Road

22 World Heritage Sites in China along the Silk Road

A day of masks

A day of masks

France celebrates Bastille Day

France celebrates Bastille Day

China's northernmost high-speed railway enters trial operation

China's northernmost high-speed railway enters trial operation

Eight industries the shared economy will transform

Eight industries the shared economy will transform

Photographer in search of his 'homeland' in post-Three Gorges landscape

Photographer in search of his 'homeland' in post-Three Gorges landscape

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China's GDP grows by 7%

Japan passes disputed bill

Petcoke called key in pollution fight

Service sector bolsters China’s GDP despite stock woes

Bush, Clinton dominate early presidential fundraising

Tiny Pluto sports big mountains, New Horizons finds

Greek parliament approves debt deal and first reforms

China's Internet giants reprimanded over obscene clip

US Weekly

|

|