Banker optimistic on

Sino-Canadian commerce

Updated: 2016-01-11 00:24

By Na Li(China Daily USA)

|

||||||||

Zhu Mingxuan, president and CEO at Industrial and Commercial Bank of China (Canada), discusses the internationalization of RMB, Na Li reports

|

|

Zhu Mingxuan, President and CEO at Industrial and Commercial Bank of China (Canada) (ICBK) |

Q: With a new Liberal government in Canada, what is the outlook for Canada and China in terms of further opportunities and challenges? What should both countries be focusing on?

A: Historically, the Liberal government has been more open to the world and has rich experience in economic development. From the family perspective, Trudeau the elder established the relations with China ahead of many Western countries, as Chinese President Xi mentioned in his meeting with PM Trudeau in the APEC, China respects that relationship and Trudeau the elder. I believe PM Justin Trudeau’s government has a better understanding about China and is more willing to develop the relationship with China than the previous government, which was stated in his mandate letter to the minister of international trade.

The US is the largest trading partner of Canada, but NAFTA is no longer the NAFTA 20 years ago since the US economy is changing, Mexico is changing, so is Canada and the world. Canada should diversify its economy and pay more attention to the Asian market, especially China, to which Canada should focus more on the trade and investment than the differences. China should do the same thing. There are irreconcilable issues between China and the US, but not between China and Canada. I am very optimistic about the relationship between China and Canada since our two economies are very complementary; Canadian products and services in the agri-food, energy, minerals and high-technology sectors are needed by Chinese customers; and the transportation shouldn’t be an issue since the two countries are connected by many direct flights and ocean routes. The Canadian market should be the top tier overseas market for Chinese companies, not to mention the talents available from the Chinese immigrants in Canada, and North American market can be developed through Canada.

The current trade between China and Australia is about US $200 billion, and the number should be bigger between China and Canada, which, of course, needs the joint efforts between the public and private sectors from both countries.

Q: China is strongly pushing to increase the use of renminbi on a global scale. The internationalization of its currency is picking up pace with the latest RMB hub to open in one of the world’s largest financial centres in Toronto recently, and the Industrial and Commercial Bank of China (Canada) has launched the first clearing bank in North America in March. What is your view on this?

A: The Canadian dollar is one of the major currencies, but not the strongest. One of the main reasons is the Canadian dollar’s dependency on the oil and minerals, so it is sometimes called “oil dollar”. In order to make the Canadian dollar stronger, Canada needs to diversify its economy, which is the challenge for the new Liberal government. In addition, the Canadian economy is having difficulties since both the oil and mineral/metal price is low, and the potential risk of volatility in the real estate market is increasing. The financial sector is one of the strongest in Canada, but sometimes overregulation damages its competitiveness, not to mention the profitability of the banking sector in the world is decreasing.

RMB internalization is picking up pace in the world, including the Americas. The first center in the Americas, the North American RMB Trading Center, was opened on Nov 9 in 2014. Two centers were rolled out in Latin America this year, including Chile and Argentina. Recently, an influential group was formed in the US to push for its RMB trading center. So now Canada has competitors in this continent. However, Canada still has the first-mover advantage, and its stable and well-regulated financial sector is an additional asset, even better if its economy is more diversified, and takes advantages of the RMB trading center. Canada can be an effective bridge between Asia and North America or even the Americas, Toronto may become one of the world’s leading financial centers. The federal government in Canada is “small” in many ways, but needs to drive the economic agenda more aggressively as a country, and private sectors need to move more quickly so to enjoy the benefits of the RMB trading center, otherwise it may not be able to stand out from the competition in the Americas.

Q: Can you enlighten us on the advantages for Chinese investors and investments in Canada, and Canadian businesses and investments in China. How is it doing business in Canada and how is it for Canadian investors interested in China? Your advice and suggestions to succeed.

A: Chinese investors are enthusiastic about investing in Canada, however, I haven’t seen much success over the past few years, and the reasons are: First, many Chinese investors lack overseas investment experience, and lack knowledge of the culture and legal system in Canada, which they may learn from Japanese and Korean investors. Second, lack of talent on the ground; however, this may be solved if Chinese investors tap into the talent pool of Chinese immigrants here. Third, Chinese investors tend to do things by themselves, but since they lack experience and knowledge in this country, as I mentioned, they need local partners.

The biggest barrier for Canadian companies investing in China is the misunderstanding of China, and some issues are exaggerated, including the IP issue and fake products.

- Obama says US must act on gun violence, defends new gun control rules

- Over 1 million refugees have fled to Europe by sea in 2015: UN

- Turbulence injures multiple Air Canada passengers, diverts flight

- NASA releases stunning images of our planet from space station

- US-led air strikes kill IS leaders linked to Paris attacks

- DPRK senior party official Kim Yang Gon killed in car accident

Special report: Rise and rise of China's outbound tourism

Special report: Rise and rise of China's outbound tourism

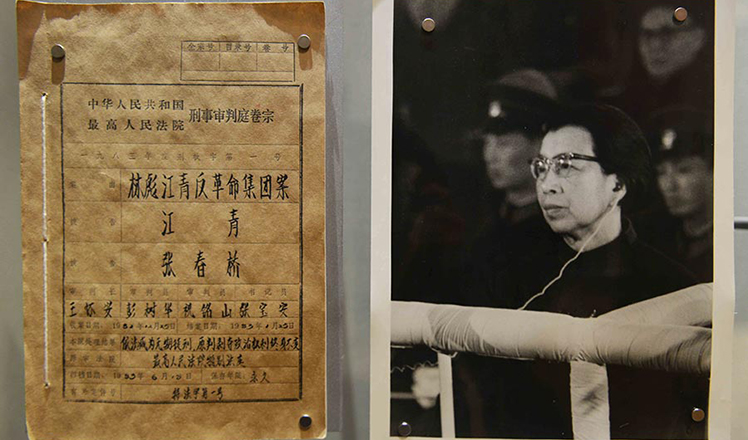

Trial data of former senior Party officials on display

Trial data of former senior Party officials on display

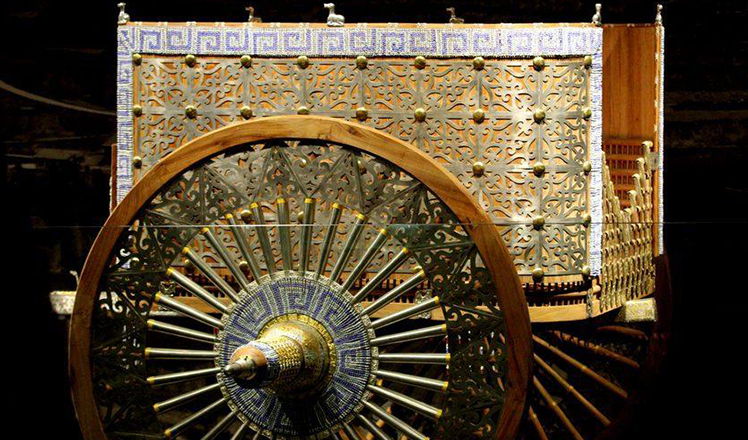

Replica of luxurious chariot from ancient times wows Xi'an visitors

Replica of luxurious chariot from ancient times wows Xi'an visitors

Number of giant pandas in China reaches 422

Number of giant pandas in China reaches 422

Attendees feel the thrill of tech at CES trade show

Attendees feel the thrill of tech at CES trade show

Vivid dough sculptures welcome Year of the Monkey

Vivid dough sculptures welcome Year of the Monkey

Kidnapped five-year-old reunites with her family 56 hours later

Kidnapped five-year-old reunites with her family 56 hours later

Kung Fu Panda hones skills from master

Kung Fu Panda hones skills from master

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|