Washington eyes closer review of Chinese investments in US

Buoyed by US President Donald Trump's anti-China trade rhetoric, lawmakers in both political parties may be setting the stage for a much closer scrutiny of Chinese mainland acquisitions in the US by expanding the authority of the panel that reviews foreign purchases of a US business.

A Wall Street Journal story published on Wednesday said that Republican and Democratic members of Congress are working on various options that would strengthen the authority of the Committee on Foreign Investment in the United States or CFIUS.

"I believe that they see a unique opening right now with a president who campaigned on protectionist policies, and specifically singled out China as a rogue trading partner," William Leahy, a Washington-based associate with Harris, Wiltshire, and Grannis LLP, wrote in an email to China Daily.

Leahy said he believes many members of Congress have long been skeptical of trade with China and Chinese investment in the US.

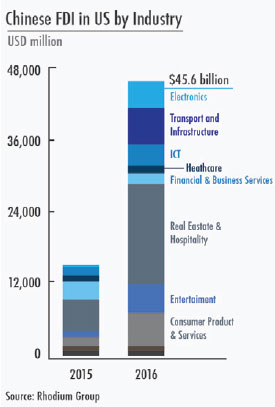

That investment last year was a record $45.6 billion, according to the New York-based consulting firm Rhodium, triple the amount for 2015 and a 10-fold increase of annual investment just five years ago. Acquisitions accounted for the majority of total investment, $44 billion, Rhodium reported.

Proponents of investments from China have expressed concern that more protectionism by the US could mean lower trade and fewer jobs in local communities.

According to Rhodium, in 2015 investments in the US by Chinese companies helped add 13,000 full-time jobs, bringing the total number over the past 15 years to more than 90,000. And a report released in January by the US-China Business Council said that China-US trade supports some 2.6 million jobs in the United States across a range of industries, including jobs that Chinese companies have created in the US.

A recent report from the Washington law firm of Covington & Burling LLP, said that "while the legislative landscape in the new Congress is still being defined, there is a greater chance now than at any time in the last decade of potential legislation to amend CFIUS."

Leading the move toward possible legislation are Senator John Cornyn, Republican of Texas, who is Senate Majority Whip, and Senator Charles Schumer, Democrat of New York, the Senate Minority Leader, according to the Journal.

Cornyn is seeking CFIUS to look more closely at Chinese technology deals, while Schumer wants CFIUS to consider economic factors when judging foreign deals, which the newspaper said would alter the committee's mandate.

Sophie Meunier of the Woodrow Wilson School of Public and International Affairs at Princeton University said in an email that Trump "may direct his administration to review incoming foreign investments more broadly and thoroughly through the CFIUS process and insist more forcefully on reciprocal access for American firms in China".

"On the other hand, getting more direct investment into the US will be crucial to Trump's objective of repatriating jobs," she said. "Better to have Chinese companies invest in the US than to have American firms outsource in China from the point of view of his objectives."

Leahy believes that the proposed legislation, if it comes to fruition, "will likely invoke national security concerns as a justification for revising or expanding the jurisdiction of CFIUS. "

Leahy also believes that reciprocity surrounding foreign investment, and specifically Chinese investment, appears to be a significant concern among lawmakers as well as members of the Trump administration.

"A Trump transition team memo made public last year indicated that the administration was planning to propose that USTR (US Trade Representative) and CFIUS scrutinize foreign companies attempting to buy American firms in order to ensure that equal opportunities are available for US investors," he said.

paulwelitzkin@chinadailyusa.com

(China Daily USA 02/23/2017 page2)