China charges the EV market

|

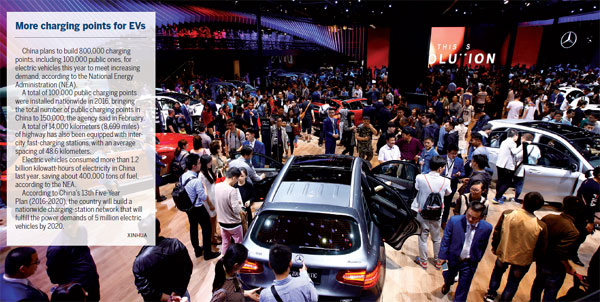

More than 1,000 automakers from around the world showed their new electric-vehicle models and concept cars at the Shanghai Auto Show last month. Xinhua |

Global automakers are developing a profusion of new electric vehicles for China, the world's largest auto market. Not only do they see a growing market, but they have little choice, as the government considers a plan to impose production quotas to reduce pollution, report PAUL WELITZKIN and AI HEPING in New York.

In China, he is known as Xiao Li, or "Little Lee". And at the Shanghai Auto Show last month, his voice could be heard at the showroom with a message: "Let us reconnect with nature, fill our lungs with clean air instead of pollution, let us see beauty more clearly. With new energy, we can see this future. Now let's make it ours."

The voice was that of actor Leonardo DiCaprio, the star of the 1997 blockbuster movie Titanic, who is known for his environmental activism and last year became Chinese automaker BYD's brand ambassador.

His message was part of a display for an electric vehicle (EV) made by BYD, and, according to media reports, was accompanied by images beamed on a circular wall showing Beijing covered in smog, and children wearing pollution masks.

DiCaprio's save-the-environment message was reflected in the cars on display by more than 1,000 global and domestic automakers as they pitched scores of EVs and plug-in hybrids to the world's largest auto market.

Foreign automakers have little choice because the EV market in China is growing fast, and looming over the show was another message from the Chinese government: Manufacture and sell more electric vehicles (EVs) or face potential penalties.

The message

That message is in a proposal drafted in September 2016 by Chinese policymakers requiring that automakers who produce or import more than 50,000 vehicles a year ensure that at least 8 percent of sales are new-energy vehicles by 2018. New-energy vehicles is the term China uses to refer to battery-powered vehicles, plug-in hybrids and fuel-cell cars. That 8 percent would increase to 10 percent in 2019 and 12 percent in 2020.

Non-complying companies would either need to buy credits from other automakers exceeding the goal, pay penalties or reduce their own output to meet the percentage total.

Some automakers say they may not be able to meet those targets, and Reuters reported on March 13 from Beijing that China is considering easing those proposed quotas.

Ian Robertson, a member of BMW's board, told the Financial Times that the carmaker was ready to meet whatever quota was imposed, and Jochem Heizmann, Volkswagen's China chief executive, said, "We are working to be able to fulfill this quota system next year."

Whatever the quota system is, automakers cannot abandon the world's largest market for EVs, and at the Shanghai show they not only displayed their new EVs, but also made a flurry of announcements about plans for new electric models.

Volvo Cars, the Chinese-owned Swedish automaker, announced it would produce a pure-electric car in China for sale worldwide starting in 2019.

General Motors Co, the No. 1 US automaker, announced that it will manufacture and sell a gasoline-electric hybrid version of its Chevrolet Volt in China. The vehicle will be made by GM's joint venture with a state-owned automaker, Shanghai Automotive Industries Corp. The automaker also said it plans to launch at least 10 new energy vehicles in the country, targeting 150,000 in annual sales by 2020.

"We have a pipeline ... that is going to put us in a very good position from a fuel-economy requirement perspective" that will enable GM to meet any EV rules, Matt Tsien, head of GM China, said at the Shanghai show. And he said that the company will start production of a pure-electric model in China within two years.

Eleven days before the Shanghai show opened, Ford, the US' No 2 automaker, announced plans to introduce two electric vehicles in China, with the first coming to market next year. It will be built in China through the Changan Ford joint venture

Ford also will launch an all-electric small SUV in China, North America and Europe within five years.

"The time is right for Ford to expand our EV lineup and investments in China," Mark Fields, Ford's president and CEO, said in a statement.

"We are going to start manufacturing electrified powertrains in China by 2020 and we plan to expand our NEV (neighborhood energy vehicle) engineering capabilities at our Nanjing Research and Engineering Center," said Ford's Trevor Worthington in Shanghai. "By 2025, we expect 70 percent of all Ford nameplates sold in China to have electrified powertrain options, including the full range from Changan Ford."

|

The world's largest automakers attended the 2017 Shanghai Auto Show, which opened on April 19, where they announced plans for new electric vehicles in China. The Chinese government is considering a new policy that 8 percent of high-volume automakers’ vehicle sales be new-energy models by 2018. Xinhua |

Italy's Maserati

One brand still displaying only classic gasoline models at the Shanghai auto show was Italy's Maserati, whose CEO, Reid Bigland, would not say if it might produce an electric or hybrid. China is the biggest market for Maserati's top-of-the-line Quattroporte sedan, and the brand's total Chinese sales rose 90 percent last year to 12,250.

The Chinese government's move to increase the number of EVs on the road is spurred in part by air pollution and traffic congestion in urban areas. Beijing also is seeking to become a technology leader that may prove pivotal for the global industry.

In 2016, EVs accounted for just 1.8 percent of China's industry sales, according to Reuters, but a total of 507,000 new-energy vehicles were sold in China that year, a 53 percent surge year-on-year, according to the China Association of Automobile Manufacturers. A spokesman for the group said the sales of such cars this year are expected to reach 800,000, growing 57.8 percent year-on-year.

While pushing consumers to buy EVs, China's vehicle sales so far this year showed that they still want SUVs. Overall vehicle sales totaled 7.27 million, a 1.4 percent decline year-on-year, according to the China Passenger Car Association. The decline would have been steeper without SUVs, whose sales grew 17.2 percent in the same period. It was the only growing segment in the first four months of the year.

Though the Chinese government is aggressively pushing EVs, and their sales are increasing, there is some concern in the auto industry about demand for them, especially if incentives designed to stimulate demand are removed from the market.

At the Shanghai Auto Show, Hiroji Onishi, Toyota senior managing director, expressed "skepticism (about) whether consumers would still want to buy EVs" once subsidies disappear, which is expected to occur about 2020, The Wall Street Journal reported.

Continuted demand

Worthington of Ford doesn't see it that way. He said China is already the world's largest EV market and "our view is that demand will continue to increase".

"Chinese consumers tend to be very open and accepting of new technology, more so than other markets," he wrote in an email to China Daily.

Management consulting firm McKinsey said about 43 percent of the 870,000 electric cars produced in 2016 were in China. Germany and the US accounted for 23 percent and 17 percent, respectively, according to Reuters.

Volkswagen sold 4 million cars in China in 2016, but only a few hundred were "green". The German manufacturer plans to begin production of an electric car in China next year, in a joint venture with Chinese group JAC. It is to be the first in a full range of pure-electric vehicles for China.

Some German automakers have said that the Chinese proposal favors smaller, domestic producers. German Economy Minister Sigmar Gabriel told German media in November that he expressed the view to his Chinese counterpart that the 2018 targets were not attainable.

But in that same month, German Environment Minister Barbara Hendricks announced her support for China requiring a quota system for EVs, which Bloomberg reported put her at odds with her country's automobile industry.

"If the German auto industry doesn't want to miss out on where the Chinese market is headed, it would serve the industry well to expand its model offerings as quickly as possible to align itself with such criteria," she said.

Observers note that electric vehicles represent just one option in the fight against air pollution in China.

"China is still relying on fossil fuels to generate electricity, so electric vehicles cannot solve the air pollution problem, but can shift the pollution from urban to rural " wrote IHS Markit analyst Jiajia Wang in an email.

While foreign and domestic automakers are focusing on the Chinese market for EVs, one China-based company is going to another country to manufacture EVs.

Beijing WKW Automotive Parts announced on May 5 that it will invest as much as $1.24 billion (1.13 billion euros) on an electric car factory in the eastern state of Saxony, near plants owned by Volkswagen AG and BMW AG, according to Bloomberg. That factory is expected to create more than 1,000 jobs and produce "premium" electric cars, the regional government said in a statement.

Marco Henkel, a spokesman for the Regional Economy Ministry, said that WKW hopes to benefit from a "Made in Germany" cachet for marketing its cars. WKW hasn't requested state aid, he told Bloomberg.

Li Fusheng in Shanghai contributed to this story.