US regulator will hear appeal on 'Big 4' Chinese affiliates

Updated: 2014-05-10 08:55

By MICHAEL BARRIS in New York (China Daily USA)

|

||||||||

Chinese affiliates of the Big Four accounting firms have succeeded in getting the US Securities and Exchange Commission to hear an appeal of a judge's six-month accounting ban over the firms' refusal to cooperate with an accounting fraud investigation.

The SEC announced on May 9 that it would hear the affiliates' appeal of an SEC Administrative Law Judge Cameron Elliot's January decision to suspend the Chinese affiliates of PricewaterhouseCoopers, Deloitte Touche Tohmatsu, KPMG and Ernst & Young from auditing US-traded companies because of their refusal.

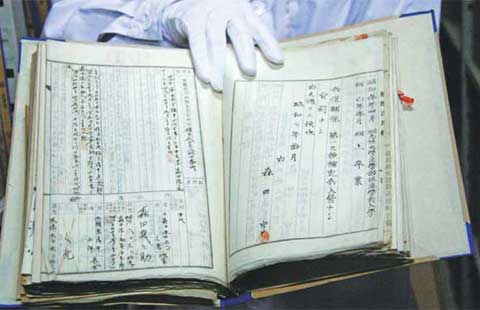

The firms argued they were trapped between US law, which required them to hand over any documents regulators request, and Chinese law, which prohibited transferring data that might contain state secrets to foreign parties. The firms announced their intention to appeal, soon after the decision was handed down.

The SEC's decision whether to uphold the suspension won't be made until after September when filing of legal briefs is completed.

The ban would force more than 200 Chinese companies traded in the US to find new auditors, while multinational corporations with significant operations in China would also have to bring in new firms to check those units. If the SEC upholds the judge's decision, the firms still could ask the US Court of Appeals in Washington to overturn it.

The case was at the center of a rash of accounting scandals which saw more than 100 Chinese companies listed on the New York Stock Exchange delisted or suspended from trading through 2011 and 2012. The plunge in share prices as cross-border listings collapsed wiped out more than $40 billion of value, sending investor sentiment into a deep freeze and ushering in an era of mistrust of US-traded Chinese shares. As their access to new capital dried up, dozens of Chinese firms fled the US stock market. The number of US IPOs from Chinese companies dived to two in 2012 from 11 in 2011 and 41 in 2010.

IPOs from China only began flowing to the US again late last year, highlighted by Alibaba Group Holdings' announcement last week that it would go public in New York in what could be the biggest IPO ever.

US and Chinese regulators have been trying to resolve some of the legal obstacles that auditors said blocked their cooperation with the SEC investigation.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US regulator will hear appeal on 'Big 4' Chinese affiliates

One dead, two missing in Virginia hot air balloon fire

China: Stop harassing oil rig in Xisha Islands

American's lens captures priceless Chinese May 4 history

Creating a global dining kingdom

Court ruling on protester unsettling

Alibaba, ShopRunner to launch joint China service

US museum to return statue to Cambodia

US Weekly

|

|