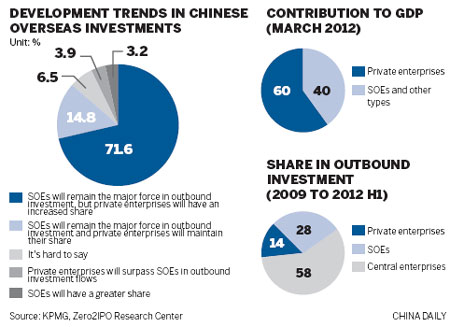

China's private businesses are poised to take a more dominant position on the world stage. Until recently state-owned enterprises have been at the vanguard of the world's second-largest economy's moves into international markets, particularly in resources and raw materials. But already in the first six months of this year, four of China's top 10 outbound M&A deals have been by private companies, compared with just one during the same period last year. The most high profile of these is perhaps Shuanghui International Holdings' $4.7 billion (3.5 billion euros) proposed acquisition of Smithfield Foods of the United States in May. According to a new report by international business adviser KPMG, The Dream Goes On: Rethinking China's Globalization, which will be published in English soon, some 75 percent of respondents predicted major international advances for China's private businesses over the next five to 10 years. According to the report, within three years, a third of private companies will set up an overseas sales network, around a quarter will establish offices abroad and about 15 percent will establish factories overseas.

Some private enterprises are being driven overseas because of the increasing costs of doing business in China with rising wage costs and higher value of the Chinese yuan. But of those interviewed in the report only 8.2 percent did it for costs reasons alone. Seeking out new markets (cited by 19.2 percent), building international marketing networks (16.6 percent) and becoming an internationally competitive global company (15.7 percent) were more important factors. The report concludes that, in fact, many Chinese private firms have reached a "tipping point", at where "going out" is an effective way to upgrade and transform their business. "Many Chinese enterprises have realized that outbound investment is not just a way to achieve geographical expansion or acquire natural resources. Once enterprises have reached a certain stage of development, outbound investment is a way to break through development bottlenecks," the report concludes.

Oliver M. Rui, professor of finance and accounting at China Europe International Business School in Shanghai, agrees with KPMG's findings and says that what is forcing them abroad is that their old business model no longer works. "They can no longer just be OEM players producing low design, low margin goods because the domestic markets they serve now want brands and higher quality products." He says that China has exceeded a per capita income of $8,000, which has been a global benchmark when consumers demand better products and services. "In Shanghai and in other parts of eastern China that is now $20,000. That is why you see many companies from there looking to make acquisitions," he says. "They are increasingly going to go out to Europe and the United States to acquire brands and research and development capability that will strengthen their position in their own markets." According to Ministry of Commerce, private companies now account for up to 70 percent of ODI in some of China's more prosperous eastern provinces. One province the KPMG report highlights is Jiangsu, which is seen as a hot bed of Chinese private companies stepping up their global efforts. At the Economic and Technology Park at Yangshe, 60 km from the center of the province's major city Suzhou, Xu Weimin was an early pioneer of the efforts of Chinese companies to go overseas.

The 60-year-old is president of Jiangsu Dongdu Textile Group, which has a turnover of 8 billion yuan ($1.3 billion; 980 million euros) and 26,000 employees, 10,000 of which are located in Southeast Asia. "If China's economy wants to develop to a higher level, Chinese companies need to speed up the pace of going international, which is becoming a necessary and vital step for every company," he says. A former local state-owned enterprise, it began selling overseas in 1993 and is now one of China's top 50 exporting companies. He insists that although a third of its garments are made overseas in Vietnam, Malaysia and, in particular Cambodia, any company setting up overseas operations to save costs would be misguided. "People think going global will help solve problems such as labor shortage and rising labor costs. We had thoughts like that at the beginning but even 20 years later we haven't made those costs savings. "Going global is more for Chinese companies to participate in international competition, to find target markets in an overseas environment and get to know that market." Xu, who spends two-thirds of his time abroad and works on behalf of the government advising Chinese companies about their overseas efforts, says the main problem with trying to achieve costs savings by establishing bases abroad is that Chinese manufacturing is among the most efficient in the world. "From our own experience, if you invest in Southeast Asia the overall efficiency level is around a third of that in China. Companies from other countries are also trying to move to these locations so there is a lot of competition for resources." In the conference room of his offices on the 16th floor of International Trade Tower on Suzhou's Xihuan Road, Wang Zhiming, vice-director of the Suzhou Bureau of Commerce, says the local private businesses are not afraid of going abroad since they have had long exposure to multinational businesses. Nearly 300 sq km of the city is taken up by the Suzhou Singapore Industrial Park, which has attracted more than 3,000 foreign enterprises, including 77 Fortune 500 multinationals. "The so-called Suzhou model for development was on foreign companies coming and investing in the various development zones around the city. That is how the city's regeneration began 30 years ago. "Many of our private businesses grew up supplying to foreign companies on these zones. There are also export processing centers there."

Wang says many local businesses are now keen to make overseas acquisitions in their own right and there is no shortage of suitors. The bureau holds around six seminars a year from investment promotion agencies from the US, Sweden, the UK and Japan. "One of the main problems for companies going abroad is the lack of information and these seminars provide information on investment opportunities. They are very much open to the idea of Chinese investment coming in even though there has perhaps been resistance to it in the past," Wang says. "We definitely want to encourage more business to also export and I think that transformation is happening now." The ambitions of some Suzhou entrepreneurs go way beyond mere exporting, however. Lu Qiyuan, president of the Jiangsu Qiyuan Group, used to be just a steel pipe maker but he now has bigger ideas. The 48-year-old proudly shows a model of a $1 billion development he is planning to build in Addis Ababa. If it goes ahead, it will feature a shopping mall, a five-star hotel and a major residential housing scheme on a 500,000 sq meter site. |

| Getting ready to take big strides |

|

He Liehui is a private business owner who has set up an African base to export goods to Europe and the United States. The 37-year-old, chairman of Shanghai-based Touchroad International Holdings Group, is able to bypass strict controls on Chinese imports by having a textile factory in Botswana. "Many companies set up factories in Africa and then export their products to Europe and the US," he says. "To do this you must have a certain percentage of your workers who are African and obtain some raw materials from Africa. It varies from country to country." But He, who has written a book on trading with Africa, China's Africa Strategy, which is to be translated into English, says it would not make sense for a Chinese company to set up in Africa just for that reason. "The export market is very seasonal. During the high season you could export 80 percent for your products that way but the rest of the time you need to also sell to the local market, just to maintain your workforce," he says. [Read more] |

Lu Weiguang, president of A & W Woods based in Shanghai, has made overseas investments in Brazil, the US and, more lately, Africa. The company makes hardwood flooring for commercial clients such as retailers Haagen-Dazs and Coach but retail is its main market. The company first started exporting to the US in 2006, where it has since acquired a sales business, but also now has factories in Brazil and Africa, where it now has major plans to expand. "I want to transfer a lot of our activities to Africa, where the costs are low and we now have good channels. We have the only wood factory in Togo at present and we want to expand to surrounding countries such as Nigeria, Benin and Cote d'Ivoire." Lu says he has sold one of the company's two Brazilian factories at a loss since the rising value of the Brazilian real has made it difficult to export semi-finished products back to China but the upcoming World Cup and Olympics make Brazil a buoyant market. The company is planning to host a match featuring China national team players at its remaining factory, which has an adjacent pitch, later in the year. [Read more] |

|

|

Going overseas is key for development China has entered new phase of outbound investment, says author of KPMG report Private companies are set to spearhead China's overseas business expansion over the next decade, according to a new report. While privately-owned enterprises contribute 60 percent to China's GDP, they only account for 14 percent of China's overseas M&A deals, with state-owned enterprises contributing the rest. But, according to research by international business adviser KPMG in The Dream Goes On: Rethinking China's Globalization, 75 percent of respondents believe they will play an increasing role over the next 5 to 10 years. Vaughn Barber, head of China Outbound for KPMG based in Beijing and co-author of the report, which will be published in English soon, says many private businesses now see going overseas as a key way of developing their businesses. "Many of the POEs have reached a stage where ODI is a channel to achieve a transformation in their business. "They see it as a way of overcoming skills barriers and problems of access to finance that they have in the domestic economy. ODI is also a key route for them to achieve their goals of upgrading." The increasing dominance of private businesses can be seen in the number of overseas mergers and acquisitions deals they have recently carried out. Private companies accounted for four out of the top 10 Chinese outbound M&A deals in the first half of this year, compared with just one in the same period of last year. [Read more] |

| Two Views |

|

Understanding cultural nuances New generation of Chinese managers are redefining the international business landscape By Johan Bjorksten China has seen four consecutive years of increased outbound deals both by total deal value and the number of deals, with 2012 recording a historical high outbound deal value of $58.3 billion and 124 deals. The 12th Five-Year Plan (2011-15) has set clear targets for overseas investment, including a 17 percent increase in outbound investment, to reach $150 billion by 2015. Government planners already predict outbound direct investment will reach $88.7 billion this year. Some companies, mainly state-owned ones, are tapping into global energy and raw materials. But most privately owned enterprises are reaching overseas for other reasons: to acquire advanced technology, management experience, global sales channel networks or strong brands. At the helm of these privately-owned enterprises are a new generation of managers who have the international mindset, management skills, and the will to create value for their business and the overseas companies they may acquire. Nobody in Sweden had heard of Geely before the company bought the Volvo car brand in 2010. Li Shufu, the founder of Geely, was known by many Chinese as someone who started from humble beginnings in his native Zhejiang province to lead the second-largest private automobile company in China, but he was at the time relatively unknown outside China. Businessmen such as Li can bring tremendous advantages to an acquisition: a strong entrepreneurial spirit, experience and access to well-established networks on the Chinese growth market, as well as a strong entrepreneurial spirit, speed and a "can-do" attitude that will support the company's future development. In the West, Chinese companies are often portrayed as monolithic organizations with a mysterious management team and hidden ties to the government. [Read more] The author is chairman of MSLGroup, the strategic communications and engagement unit of French multinational Publicis Groupe, in China. |

Private firms can bloom globally Africa is a golden investment opportunity for Chinese investors By Wu Jiangang Though state-owned enterprises account for most of the overseas direct investments from China, it is only a matter of time before private enterprises catch up with them in the investment stakes. Africa, which is seeing a rapid growth in investments from Chinese private enterprises, is already proof of the new trend. Though China began to embrace the opening-up strategy in late 1970s, it was only in the early 2000s that it actually started using "going global" as a national strategy. Since 2004, ODI has developed rapidly. There is no doubt that the early impetus for ODI came from the merger and acquisition moves of state-owned enterprises. Most of these moves were targeted at foreign enterprises with access to natural resources or to proprietary technology. But this pattern of going global has not worked well. Though SOEs accounted for more than 90 percent of the ODI in recent times, many of these projects were a waste of China's precious foreign reserves. According to official data, more than 70 percent of the overseas investments made by Chinese SOEs were unprofitable, while the rest were questionable. There are several reasons for this. The main reason obviously is the flawed M&A strategy pursued by Chinese SOEs. Deals pursued by SOEs anywhere have a success rate of less than 35 percent, judging from the past M&A experiences of Japanese and South Korean companies. Also, Chinese SOEs have not made much headway due to their close links with the government and the resultant political tag affixed to their actions. This has led to the failure of several deals, or in some cases to higher acquisition costs. [Read more] The author is a lecturer at the Management School of Shanghai University and a research fellow at the China Europe International Business School Lujiazui International Finance Research Center. |

|

Related readings: |

|

China's individual, private businesses top 40.6m Chinese companies snapping up overseas brands |

China's private firm profits up 15.6% in July Private firms lead China's investment overseas |