Yuan convertibility remains major snag

Updated: 2012-06-01 09:11

By Andrew Moody (China Daily)

|

||||||||

|

| Li Min / China Daily |

The turmoil on global stock markets as a result of the euro crisis has been felt around the world and not least in China - with plans to open up the Shanghai Stock Exchange to foreign companies appearing to have been put on hold.

This was seen as a key step on the way to the government's aim to make the east coast city a major global financial center by 2020.

Last year, the project no longer seemed an ever-distant mirage as companies such as HSBC and Coca-Cola seemed to be gearing up to list.

| ||||

In March, however, Shanghai Mayor Han Zheng said preparations were not finalized and there was no timetable for a foreign stock's debut, which some felt indicated a U-turn.

Even if there was commitment to open up the exchange, the waters - anticipating a Greek euro exit - are currently too choppy. The Shanghai Composite Index has fallen by 5 percent from a peak of 2452.01 on May 4 to 2372.23 on May 31.

Some observers believe an international board could only be allowed to set sail on the high tide of a rising market.

More worrying, however, the trading volume of A shares on the exchange has plummeted from about 420 trillion in December to just about 115 trillion in April.

Fang of the Shanghai Financial Service Office did not want to comment when contacted last week on where recent announcements leave internationalization of the exchange and Shanghai's bid to be a global financial center in just 8 years' time.

Without global firms listing in Shanghai and with the absence of companies providing sophisticated financial services such as derivatives as well as futures and stock options, the coastal city could only be destined to be a large Chinese financial center rather than an international one.

Many believe the main barrier remains the lack of convertibility of the Chinese yuan and that any plans to internationalize come up against this stumbling block time and again.

In the case of setting up an international board, companies such as McDonald's or Coca-Cola listing on Shanghai would be able to raise yuan on the exchange to fund their expansion within China.

What they would be restricted from doing, however, would be taking money out of the country. On every other major stock exchange in the world they could do this in an instant.

From his offices in Jinmao Tower on Century Boulevard, Gary Rieschel has an ideal vantage point to look at the impressive skyline of Shanghai's financial center.

The founder and managing partner of Qiming Venture Partners, a $1-billion private equity fund, believes the currency convertibility issue has not only held back an international board but also put a brake on the city's advancement as a financial center.

|

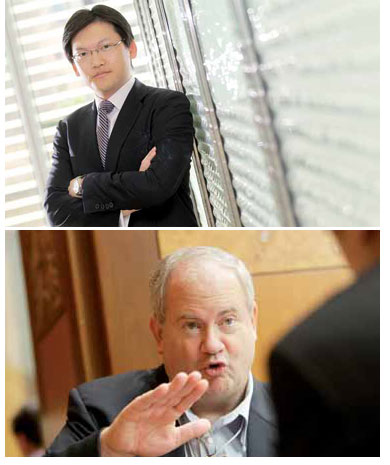

Top: Joe Chang, head of the Hong Kong office of SCM Strategic Capital Management Asia. Edmond Tang / China Daily Above: Gary Rieschel, founder and managing partner of Qiming Venture Partners. Nelson Ching / Bloomberg |

"If you allow American Express or IBM to come and raise 10 billion yuan on the exchange who then approves that being converted into dollars and being used elsewhere in the world? Taking money out of China is a major sticking point," he says.

Rieschel, however, believes an international board can be launched without the capital markets being fully open and full convertibility of the yuan.

"I think it is nice to have but not a must have. I would not view it as even an acceleration toward full convertibility of the yuan," he says.

"What it would be, however, would be a raising of the bar. Foreign companies listing would lead to more transparent accountancy and an overall improvement of all shares listed, making them a more investable entity."

Current market turbulence seems to rule out any immediate launch of an international board.

"I think the market has to rise by 30 percent before China can pursue the international board again," says Gary Liu, deputy director of CEIBS Lujiazui International Finance Research Center in Shanghai, who has also acted as an adviser to China's Shenzhen exchange.

"I think it is difficult currently because there are at least 500 Chinese companies waiting in line for an IPO so there is no reason why the Chinese government should give more opportunities to foreign companies."

China's top securities regulator Guo Shuqing, the new chairman of the China Securities Regulatory Commission (CSRC), is believed to be very keen to open up China's financial system and pave the way for Shanghai to become a global financial center.

In April, the body more than doubled the amount foreigners can invest in shares, bonds and bank deposits through the qualified foreign institutional investors (QFII) scheme from $30 billion to $80 billion. It also increased the amount of offshore Chinese currency, mainly in Hong Kong, that can be brought back into the mainland from 20 billion yuan to 70 billion yuan.

Stuart Leckie, chairman of Stirling Finance, which advises on investments and pensions in Asia, says this signals a new approach.

"This has not been the thinking up until now but what we have seen from the new chairman is a keenness to develop the stock market and to accelerate the pace of internationalization," he says.

Speaking from a conference in Sea Island, Georgia, Leckie, who is also the author of a new book with Rita Xiao, Investment Funds in China - A New Look, says it was difficult to predict when an international board in Shanghai would become a reality.

"It might be in two or three months or two or three years. The exact timing is more likely to be when the market is doing well," he says.

One measure of the current relative isolation of the Shanghai Stock Exchange is the way its index, the Shanghai Composite index, often does not move in correlation with the other major indices in the world.

"The Shanghai index trades in a rather disconnected way to the world's major share markets," says Michael McCarthy, chief market strategist at CMC Markets, the online trading platform based in Sydney.

"I think it reflects a lack of foreign investment and the fact that it is driven by purely domestic concerns. The market has also languished because Chinese people have had more of a property focus and have not invested in shares."

One danger for Chinese companies, if an international board is set up, is that foreign companies may seem more attractive to domestic investors and they, as a result, become starved of funds.

Daryl Guppy, technical analyst and founder and director of Guppytraders.com, based in Darwin, Australia, thinks there would be an appetite for such shares at the launch of an international board.

"My feeling is that there would be an initial rush of enthusiasm but once people found out these shares traded pretty much the same as local companies, I think the fund flows would normalize," he says.

Guppy, well known as a regular pundit on CNBC Asia's Squawk Box and for a weekly column in China Daily, however, adds that the international board is only one of a number of key stepping stones for Shanghai becoming a global financial center by 2020.

"To achieve this, it still requires significant internationalization of the yuan. It could only work if dealers could trade easily in and out of the market," he says.

"The market also has to offer a considerable range of derivative options and other such products. There has to be much more sophistication to the market than there currently is."

Some argue the reforms have to go deep if Shanghai is to become part of the international financial system.

The banking system is entirely dominated by the big State-owned banks: Bank of China, Industrial and Commercial Bank of China, Agricultural Bank of China and China Construction Bank.

The central bank, the People's Bank of China, sets the interest rate that operates through the system.

Many believe this system has led to imbalances in the economy and that there is a need for more banking competition so capital is not so rigidly priced or "mispriced", as some argue.

|

From top: Oliver M. Rui, professor of finance and accounting at CEIBS; and Michael McCarthy, chief market strategist at CMC Markets. Photos Provided to China Daily |

Oliver M. Rui, professor of finance and accounting at CEIBS, says opening up China's capital markets will expose the rigidities of the current system.

"The most important role of the banking system is to allocate the capital to the right people but without price differentiation you cannot allocate money efficiently. That is why a lot of money is wasted by the State-owned enterprises in real estate or infrastructure where you get very low returns," he says.

"What you need is a more developed banking system and more banks lending to the private sector."

McCarthy at CMC Markets says it is the need for major reforms like these that may delay Shanghai's emergence as a global financial center.

"I suspect that the 2020 goal may be unrealized as the implications of the opening up of capital markets become clearer to the central authorities," he says.

"I think their desire to maintain stability as well as prosperity more likely to make them cautious rather than aggressive."

There are concerns that if Shanghai does overcome these obstacles and becomes a major global financial center, it might sound the death knell for Hong Kong, which despite its international status also operates as an offshore financial center for the mainland.

"Hopefully, we won't have to go back to fishing," jokes Joe Chang, head of the Hong Kong office of SCM Strategic Capital Management Asia. "Right now Hong Kong still has the edge, capital can freely come and go, there is a solid legal system based on English law and I think Hong Kong can still play a role in helping the mainland internationalize its market system. I think in the longer term it could be damaged."

Chang says high profile companies like Italian fashion company Prada and US suitcase maker Samsonite that have recently done IPOs in Hong Kong might go to Shanghai instead in future.

"If you want to attract mainland consumers why go the indirect way rather than direct one," he adds.

William Fong, investment director of Asia Pacific Equities for Barings based in Hong Kong, believes if Shanghai becomes the major financial center in Asia, there will be still room for others.

"I think what will tend to happen is that each financial center will specialize. Hong Kong will focus on property and consumer brands and Singapore will retain its strength in shipbuilding and marine-related engineering."

Meanwhile, the mainland authorities have to make their own judgements as to the pace of reforms required to achieve the goal of turning Shanghai into a global financial center.

Rui of CEIBS says there still remain advantages of China's current more closed system, particularly when many around the world would like to run for cover from the current euro crisis.

"The non-convertibility of the yuan actually protects China from the rest of the world. The crisis currently being generated by the euro is not likely to spill over to China," he says.

"China would still have a lot of resilience in any scenario. It has the largest foreign currency reserve in the world and if anything happened to the yuan, it would still have the power to stabilize the situation."

andrewmoody@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|