Dark clouds loom over solar industry

Updated: 2012-02-24 08:24

By Meng Jing (China Daily)

|

||||||||

|

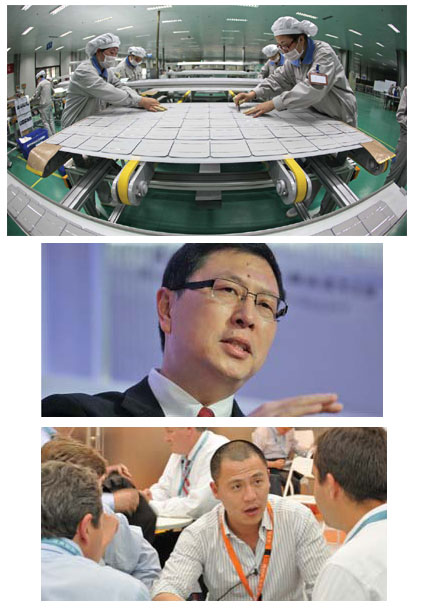

Top: Employees at a solar cell production line in Lianyungang, Jiangsu province. Mu Daoyong / for China Daily Above: Qu Xiaohua, president of Canadian Solar, believes the solar industry has a bright future in China. Provided to China Daily Below: Wang Yiyu, chief strategy officer with Yingli Solar, says that Europe is still the company's predominant market. Provided to China Daily |

Overcapacity, shrinking external markets dampen profit outlook for Chinese companies

They have often been hailed as some of China's biggest successes in recent times and champions for their efforts in reducing carbon emissions, creating jobs, lowering technology costs and entry barriers. But the sun no longer seems to be shining brightly for the more than 500 Chinese solar companies as trade wars and uncertain overseas prospects are threatening to strain growth prospects and profits.

Lower demand from Europe, the biggest export market for Chinese companies, and the plans by some European nations like Germany to do away with solar subsidies along with the rising trade complaints filed by US solar companies have triggered much of the current problems for the industry. Things have also been further compounded as the ongoing debt crisis in Europe has forced many European nations like Spain to halt subsidies for renewable energy projects.

Though most of the companies are banking on the largely untapped domestic market to tide over the crisis, that may not be the case, say experts, pointing to a possible industry shakeout and exit of several small- and mid-sized companies. Even then the problems may be far from over as the solar industry needs to find markets that can account for its huge output capacity. The production capacity of solar panels in China stands at about 23 gW and currently accounts for more than half of the global output.

"Though domestic deployment of solar power in China has started to take off, it alone cannot account for the huge manufacturing capability," says Zhu Junsheng, president of the China Renewable Energy Industries Association.

Zhu says that days of unprecedented growth are over and the future belongs to the companies that have cutting-edge technologies and high-quality products. With supply greatly exceeding the demand, overcapacity is another problem that needs to be fixed immediately, say experts. Signs that the industry is not taking stock of the situation have emerged after some Chinese polysilicon makers, a key ingredient for solar panels, decided to idle nearly one-third of their production and shut plants till there was a recovery in prices.

"Most of the solar manufacturers saw their margins decline in 2011. Excess global solar cell capacity and output could not keep pace with the massive slowdown in demand from the end markets," says Craig Stevens, president of NPD Solarbuzz, an international solar energy market research and consulting company.

According to NPD Solarbuzz, the growth rate of the global solar PV industry dropped from 153 percent in 2010 to 22 percent in 2011, driven largely by reduced government incentives in many major European markets, which account for more than 70 percent of Chinese solar product exports. Some companies like Yingli Solar, Suntech Power, Trina Solar and Canadian Solar that were earlier reliant mostly on the US markets have decided to focus on the domestic markets instead.

"We are not in the solar industry to make impressive strides in foreign markets. Rather our intention is to focus on the Chinese market, which has strong demand for clean power," says Qu Xiaohua, president of Canadian Solar.

Solar power deployment in China in 2011 grew by 500 percent over 2010 levels, with an accumulative installed capacity of 3 gW at the end of 2011. The National Energy Administration in China has raised its original plan of 5 gW accumulative installed capacity of solar power in China to 15 gW by 2015, which in turn opens up huge possibilities for Chinese solar PV makers.

Qu feels that the industry has a bright future in China, considering that solar power output prices are declining and inching toward price parity with conventional energy resources. Despite the substantial drop in prices, from 10 yuan (1.21 euros, $1.59) kW/h in 2002 to about 1 yuan kW/h, the current solar power costs are still not competitive enough, when compared with other clean energy, let alone conventional energy.

Wang Yiyu, chief strategy officer with Yingli Solar, says the overall market in 2012 will be better than 2011, but he refuses to label the situation as "optimistic". The New York Stock Exchange-listed company with a production capacity of 2 gW is a leading solar player in China and has recently decided to diversify its business into olive oil.

"After what we had been through in 2011, no one I know in this industry has the guts to increase their production capacity. The demand in 2012 will at least remain the same as 2011, so the competition will not be that tough compared to what we had last year," Wang says.

The Chinese market contributed 15 percent to 20 percent of Yingli's revenue in 2011, jumping from about 5 percent in the previous year. "The Chinese market will see rapid growth this year but Europe is still our predominant market, accounting for 45 percent to 50 percent of our revenue," he says.

Wang says that the solar panel industry is going through a restructuring that is needed for it to evolve in a more mature fashion. "The era of just building a factory and making easy money is over. There are still plenty of chances, but one has to be on top of the game to succeed."

(China Daily 02/24/2012 page6)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|