Risk averse

Updated: 2012-10-05 08:33

By Andrew Moody and Hu Haiyan (China Daily)

|

||||||||

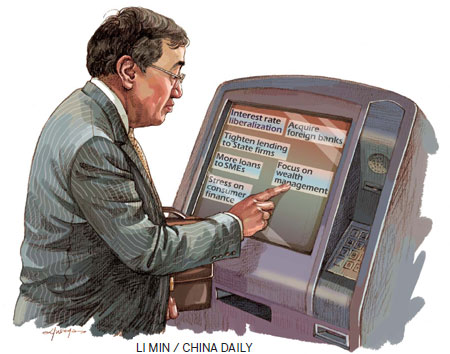

Reforms needed if banks are to lend to small firms instead of playing safe with State enterprises

After many banks in Europe and the United States helped trigger the worst financial crisis for 80 years, becoming more Western does not necessarily seem a sensible way forward for China's banks.

But the world's second-largest economy needs a more modern banking system for its economy to move forward.

Its banks have to become more commercial so they can provide the funding its private sector and, in particular, its small and medium-sized enterprises, want.

It will also be difficult for China to make the transition to a more consumer-driven economy - less dependent on infrastructure investment and selling cheap export goods - if there is development of consumer finance such as more personal loans and credit cards.

One of the criticisms of the system is that it is dominated by the Big Four State-owned banks: Bank of China, China Construction Bank, Agricultural Bank of China and the Industrial and Commercial Bank of China.

Their lending preferences to State-owned enterprises and the funding of local government projects rather than private businesses result in misallocation of capital resources throughout the whole economy, according to some analysts.

Chinese Premier Wen Jiabao warned in April that some of the banks were enjoying too much of a monopoly.

"To break the monopoly, we must allow private capital to flow into the finance sector," he said in a radio broadcast.

One barrier to competition in the banking sector is that interest rates in the economy - set centrally by the People's Bank of China - allow little leeway for banks to price risk so it makes sense for them to focus on large safe loans to State-owned leviathans rather than engage in riskier lending to private enterprises.

In June - in what was seen as a major move toward greater interest rate liberalization - the central bank gave banks the freedom to offer deposit rates 10 percent above the benchmark rate and borrowers 20 percent below it.

Junheng Li, the founder and senior equity analyst of JL Warren Capital, an independent equity research advisory firm based in New York, believes the move was "symbolic rather than meaningful".

"Although many view the recent cut of benchmark rates as a major step toward interest rate liberalization, true liberalization is unlikely to happen as long as the dominant superstructure of China's banking system does not unhinge itself from the State and starts lending on commercial criteria," she says.

Weijian Shan, a veteran of the China banking scene, believes people are wrong to see interest rate liberalization as a panacea.

The chairman and chief executive officer of PAG, the Hong Kong-based alternative investment manager, says it might have the opposite effect to the one intended and actually lead to a reduction in lending to the private sector.

"If all of a sudden there was no benchmark rate and everyone could lend at whatever rate they wanted, it could lead to over-competition between banks and interest spreads getting squeezed," he says. "In that situation SMEs would find it even more difficult to get loans because the banks would not have as much cushion to write off bad loans. In my view, some kind of control of interest rates is necessary to avoid over-competition and to protect the health of the banking system."

The banking system has already undergone substantial reform. It was only in 1995 the Commercial Banking Law was introduced to commercialize the operations of the major State banks.

The major banks have since floated part of their equity with Bank of China's offering in Hong Kong in 2002 some 7.5 times oversubscribed.

|

||||

Chinese banks now feature as some of the biggest in the world. ICBC, China's largest bank, is now ranked third in the world with $2.46 trillion of assets with only Deutsche bank and BNP Paribas bigger, according to bankersalmanac.com.

There are now four Chinese banks in the world's top 10 with China Construction Bank ranked eighth with $1.95 trillion of assets, Bank of China ninth with $1.88 trillion and Agricultural Bank of China 10th with $1.86 trillion.

According to a survey by PricewaterhouseCoopers, China could overtake the US as the world's largest banking market by 2023 based on projected growth of banking assets.

In just one generation, China has moved from a country where very few had bank accounts to one where $1.2 trillion of purchases are made on credit cards each year, according to the 2012 Bluebook of Credit Card Industry in China and where by the end of 2011 there were some 339,000 ATMs across the country.

Shan at PAG, who was responsible for turning around China's 15th largest bank - Shenzhen Development Bank - when partner at Asia private equity group Newbridge Capital and sold its stake to Chinese insurance giant Ping An, says many underestimate the extent of the reform which has taken place.

"I think China's banking reform has come a very long way since 2002 and 2003 with the listing of the major banks and introducing market mechanisms into the banking system," he says. "Without these reforms the Chinese banking system would not be as healthy as it is today. It would not have withstood the economic crisis of 2008 and 2009."

Following China's membership of the World Trade Organization, China has opened its doors to foreign banks and many now operate in China.

Bank of East Asia, DBS from Singapore, Hang Seng Bank, HSBC and Standard Chartered estimate they will be operating 500 branches and sub branches by 2014, according to another PwC report, Foreign Banks in China 2011. Yet the 127 foreign banks that operate in China still represent just 1.83 percent of the total banking assets in China, according to the same report.

May Yan, director and head of Chinese banks' research for Barclays in Hong Kong, says it still remains very problematic for foreign banks to expand in China.

"There are a lot of regional requirements and regulations which makes it very difficult for foreign banks to grow," she says. "Since they were allowed into China as a result of the WTO, they haven't really increased their market share at all."

Shan at PAG says the problem for any foreign bank in China is the sheer scale of the market. "When it comes to retail banking you need to have a franchise. Let us say you build five branches a year. It will take you 100 years to get to 500 branches. Bank of China already has 10,000," he says.

There are those who believe that real change will not take place in the banking sector unless there is a much greater opening up of the banking sector to foreign competition.

Joy Yang, chief China economist at Mirae Asset Securities, based in Hong Kong, says the real barrier is that Chinese banks enjoy good profits and want to keep them for themselves. "I think the domestic banks complain to the Chinese government and say why do they want to share profitability with foreign banks," she says.

One of the key criticisms of the banking system is that the major banks prefer to lend to State-owned enterprises rather than the riskier private sector.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|