Intl brands' pricing strategy in China

Updated: 2012-10-01 09:50

(China Daily)

|

||||||||

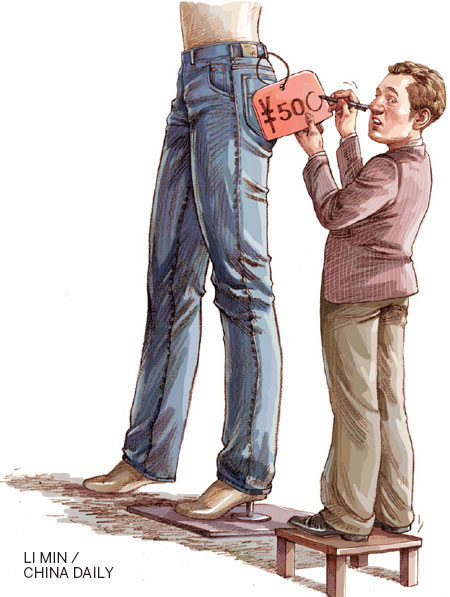

Changing economic landscape forces multinational companies to alter pricing strategies in China

Trawling through the various online shopping sites in China, one would be surprised to see the huge number of purchasing agents offering international products from reputed brands to Chinese customers. On Taobao, China's biggest online shopping site, at any given time one can find as many as 100,000 such agents of a varied scale offering diverse products such as cosmetics, garments, luggage, milk powder and health supplements.

Purchase agents are those who buy international brands from overseas markets, then sell them to Chinese customers with some built-in profit margins. One reason why they are so popular in China is that even though the products are being offered at prices higher than those in international markets, they are still cheaper than in a domestic company franchise store. Pricing products higher in China and attaching a premium to them is a common pricing strategy used by international companies to reach out to well-heeled customers.

While that strategy has worked in the past, companies are now realizing that having a premium price tag alone does not ensure robust sales or continued success. The price is now seen more as a separator and not a differentiator in the huge Chinese consumer market.

There is no doubt that pricing is an important element in the overall marketing mix of a company as it is directly related to product positioning. At the same time, pricing also governs other elements like product features, marketing channels and promotional activities.

George Yip, professor and co-director of the Center on China Innovation at the China Europe International Business School, says that international brands have to take into consideration the extra expenses they incur when developing new markets, especially when the sales volume is far lower than that in the home markets.

In such situations, companies often raise product prices in overseas markets to recover these costs, he says. But that is only part of the overall pricing formula, says Yip, author of Managing Global Customers.

"Foreign companies generally sell to a higher level of the economic pyramid in developing countries such as China. So essentially their customers can afford the higher price," Yip says.

"This is also a typical foreign market penetration pricing policy: Start high and move down later to expand the customer base," he says. "These high prices are sustainable if customers pay and there is no other cheaper competitive alternative."

With the Chinese economy largely resilient to the global economic turmoil and the "higher level of the economic pyramid", or the upper and middle class in China, expanding quickly, there is now more than ever a desire among international companies to find the right pricing strategy to stay ahead of the competition in China.

Coach vantage

|

|

|

Coach Inc is one of the first companies to realize the perception of Chinese consumers and profit from its early moves. [Photo/China Daily] |

When people have higher purchasing power, it is natural for them to move up the economic ladder, says Gao Xudong, senior research fellow and vice-director of the Tsinghua University Research Center for Technological Innovation. "This is especially evident in the Chinese market," says Gao, former director of the MBA program at Tsinghua University.

"It is a rational choice for high-end brands to price higher in China," Gao says. "China is still a hierarchical society where people need brands to label their social status, and there is demand for every social class."

US leather goods maker Coach Inc was one of the first companies to realize the perception of Chinese customers and make hay from its early moves. Coach had 96 domestic retail locations in the Chinese mainland, Hong Kong and Macao as of June 30 this year and posted revenue growth in excess of 60 percent during its 2012 financial yearfrom July 2, 2011 to June 30, 2012.

The luxury goods maker says that there is a price disparity between the Chinese and US markets, but stresses that its products provide added customer values like essential luxury, status symbol and even a must-buy "local specialty", for those traveling to the US. Coach bags sell from upwards of 3,000 yuan ($475,366 euros) in China, whereas most of the bags in US outlets are priced under $300 (233 euros), or even in some cases under $100.

Jonathan Seliger, president and CEO of Coach China, says the price disparities also stem from unavoidable factors.

"In fact, price discrepancies exist in all countries for all brands," Seliger says. "There are many reasons for the price difference. This includes the cost of transportation, marketing and the opening and operation of stores."

In addition, he says: "We have been in the US for over 70 years and are the overwhelming No 1 brand there. This automatically allows for scale efficiencies. We do not yet have that in many international markets, including China."

Seliger is well aware of the purchasing agents and the queues of Chinese customers outside the Coach factory stores in the US. "We are happy to see increasing engagement with Chinese customers in both China and overseas markets," he says.

Seliger says the US company has a way to deal with this situation as it frequently updates the product lineup with new designs (almost every month). "So even those who fly frequently between China and the US may find it hard to find the very bag they are looking for in a Coach outlet," he says.

"As Coach offers monthly newness and products tailored for local markets, we believe the accessible pricing and local promotional initiatives are enough incentives to boost domestic consumption," Seliger says.

"We do not offer traditional products that last for 10 plus years like many other European brands."

At the same time, most of the Coach products in China are priced at about half the price of traditional European luxury brands.

"In terms of pricing, our products in each of the markets is priced 40-60 percent lower than most other European brands," he says. "Coach has always been positioned as an accessible luxury brand since its inception in 1941."

The unique positioning helps the US company differentiate itself from European brands which are at the top of the pyramid and target only a small group of exclusive customers, as well as the "mass market" brands that appeal to the general public.

"We work with the fast-growing middle class in China," he says. "We want to be selective but not exclusive."

According to analysts, the gift consumption tradition in China has also helped brands charge higher prices. More than 25 percent of the luxury products purchases in China are for gifts, says a recent report released by US consultancy firm Bain & Co.

Jeff Gong, director of Beijing Vogue Glamour Brand Marketing Inc, a brand consultancy, says there is a huge difference between Chinese and Western consumption behavior. "While the Europeans love to keep the good stuff for the family, Chinese people present it to guests or to others as a gift."

Dale Preston, managing director of retail measurement in China at market research firm Nielsen, says pricing varies depending on the sectors, but what people are ultimately after is "value for money", whether it is for self-use or as a gift.

"If you are a premium brand, give customers a good story and good history; while for products displayed on the shelf like a shampoo, tell them what the product can do for your hair, whether it can make your hair shinier. If the product can deliver what it promises, then the brand image will be solidified," he says.

Gao from Tsinghua University says Chinese people's penchant for high-end brands will last for some time, and hence the brands will enjoy a considerably long "golden period" in China.

"As the disparity between different social classes is huge, the social hierarchy won't disappear in a short time. So Chinese people will keep chasing after brands and those beloved brands will always remain on a high perch for a while," he says.

Expensive affair

In modern society, pricing by cost is already too old-fashioned, especially when it comes to the service industry, brand experts say. Instead, "total experience" is fast becoming the selling point and also the money engine for international companies.

"You don't calculate the cost and then decide the price; that's really what we did 20 years ago," says Daniel Lutz, senior vice-president of Nestle Ltd, Greater China region. "Today we sell value to customers."

The pricing is dependent on consumer expectations, he says. "For example, if an ice cream is only for cooling down, you just need to make something from water and sugar, which will be very cheap; but if the customers' expectation is to indulge, they would like to pay more for products with milky chocolate and almonds on the top, which can be more expensive than the cost of the ingredients."

Coffee chains like Starbucks and Costa are companies that cater to this philosophy. Unlike the street corner coffee shops for "grab and go" that are common in Western countries, the two coffee chains have a more relaxed European aura at their Chinese stores: gentle lighting, soft music, comfortable couches and a smile pattern made of chocolate floating on the surface of the coffee.

As a country with a tea culture lasting thousands of years, Chinese customers did not really take to the innovations in the beginning. But the exotic atmosphere soon attracted many youngsters and executives.

The international pleasure experience does not come cheap. While thirsty people can get a good bottled coffee for 6 yuan in the convenience store, they have to shell out 25-40 yuan for a cup of coffee in Starbucks or Costa.

The over-popularity of these shops sometimes even becomes annoying to the owners. Addicted Chinese customers sit in the coffee shop all day long nursing a coffee and listening to music, thereby leading to lower customer footfalls than in Western countries.

In the US and Europe, Starbucks is identified with high quality but is not necessarily exclusive, says Mike Bastin, a researcher from the School of Contemporary Chinese Studies at Nottingham University. "But in China, Starbucks has a different meaning and is seen as a brand from America, and easily associated with a positive American image.

"Urban people like to reward themselves with these slightly expensive products to make them feel different and exclusive. If Starbucks lowers the price, it might cost the exclusivity of the brand, and customer erosion," he says.

Gavin White, group general manager of glo London, a British casual dining brand, finds similar preferences among his customers.

Although White was told to vary the tastes to cater to Chinese customers, he soon found out that customers want authentic and original British taste.

A year ago when the brand opened its first restaurant in Shanghai, nearly 70 percent of the customers were expats and 30 percent Chinese, but now the situation is completely reversed. Most of the customers at the outlet are in their 30s or 40s, mainly middle-class customers "coming to get an international dining experience", White says.

In a regular Chinese restaurant, it costs 50-100 yuan per person for a decent dinner in Shanghai, whereas the average price for a meal in glo London is 150-200 yuan.

White says that although the company's pricing principle is "keeping it reasonable while making a decent margin", he has his own complaints on the price.

Although there are some importers in Shanghai selling British ingredients, the prices of these materials are often very high. "If you go to the city market where there are imported foods, their prices are ridiculous. We have to charge slightly more than we want because the costs of the important ingredients are very high."

Indeed, it is not cheap to create international experiences - the rent in first-tier cities is soaring along with the property price, while staffing is getting pricier.

"In terms of staffing, Shanghai is no longer cheaper than London, especially if you are looking for English-speaking staff," White says. "The staff turnover is probably the highest; rent is on par, and we pay more for electricity and gas than we pay in the UK."

Gong says the higher prices have created a sense of "exclusivity" for customers.

"If Starbucks lowers its price, the store will be packed with people using free wi-fi; and the same principle applies to other Western restaurants: a low price will attract more customers, which will spoil the overall environment; and the staff will need to work more for the same margin which they can easily gain by charging more."

Changing perceptions

Not all the international brands are lucky enough to charge a premium, especially when they can get cheap alternatives. For brands targeting the mass consumers in the western countries, they now find it harder and harder to command a premium in China, as they did some 20 years ago.

|

|

|

At glo London, Chinese diners prefer authentic British tastes. [Photo/China Daily] |

To adapt to the changing market, these brands are walking down the altar and shaking hands with the fast-growing middle class in China.

Levi's is such a brand. Ever since it entered China in 2001, it kept a high profile that it made jeans only for wealthy Chinese people: In its home country, the US, a regular pair of Levi's jeans is priced at around $70, and during the sale season, customers can easily get a pair for about $15-$30. But in China a pair of Levi's jeans costs typically about $100-$150. Even during the sales season, discounts on the Levi's brand rarely go under the 50 percent mark.

The situation lasted until August 2010 when the company launched a new sister brand called Denizen. Although the company said it was not specially designed for the Chinese market, it chose Shanghai to launch this brand, the first time it launched a new product in a foreign country. A pair of Denizens costs between 299 yuan and 399 yuan, far lesser than its sister brand Levi's. The company's target audience for the product was young people in the 18-35 age bracket, essentially customers who are willing to consume international brands but not affluent enough to spend $150 on a pair of jeans.

Terence Tsang, the former senior vice-president of Levi's, says the brand is targeted at the middle stratum between the premium and the mass market. "When customers shop for the Denizen, they also have a chance to know more about the Levi's brand, which they can scale up to in the coming years."

As the clothing products are generally made in China, and they have quite a range of alternative products, it is hard for these brands to command a premium price in China, says Preston from Nielsen.

"Higher pricing is often decided by the brand strength of a company," says Preston from Nielsen. "If the brand is strong enough to charge a premium, there is no problem. But if not, they will have to adjust their strategy. It is getting a lot harder for brands to charge premium unless you have genuine reason to do that." he says.

Not only the consumer products, but also service brands are moving down the consumer chain to approach those with decent income but not yet super-rich, as the consuming power in the second- and third- tier cities has tremendously increased.

Philippe Garnier, vice-president of sales and regional marketing APAC, Hilton Worldwide, says they are dedicated to introduce more sister brands of Hilton in China.

"It is lucky that everyone knows Hilton, but not a lot of people realize that Hilton has 10 brands, covering a range of products from the five-star Hilton to the Scandic which targets the middle-income group."

Only recently has Hilton begun to bring those brands into China, Garnier says. "We are opening hotels on a regular basis, and by the end of 2014, will have at least 100 hotels in China."

Hilton has a bigger proportion of the international travelers as it has presence in international cities such as Beijing and Shanghai, even as it is fast expanding its presence in the secondary cities also.

"Our new hotels will mainly be in second-tier cities, as we already have a strong presence in first-tier cities," Garnier says.

The Hilton brand is so well established that it is able to lead the market in terms of price in many markets. But as the brand moves further into the second- and third-tier cities, the prices will be adjusted accordingly, he says.

The pricing strategies will be different as more hotels come up due to vast disparity between th

e east and the west, as well as rural and urban areas of China, says Harry Tan, general manager of Days Inn China. While a three-star hotel room in Beijing can command prices of 500-600 yuan, a five-star hotel room in Jiaozuo, Henan province costs only 300-400 yuan.

"The pricing is decided by a number of factors, but the location and the brand are often the key considerations," says Garnier. "It will be a very dynamic process."

wangchao@chinadaily.com.cn