Weibo, Leju go public in NYC

Updated: 2014-04-18 11:40

By Michael Barris in New York (China Daily USA)

|

||||||||

Pricing at lower end worried some, but both didn't fail to perform well

On a day when two initial public offerings on New York stock exchanges put China in the US financial community spotlight, the stars didn't disappoint.

Weibo Corp, the Chinese micro blogging service owned by Sina Corp and Alibaba Group Holdings Ltd, surged 19 percent above its offering price in its first trading on the Nasdaq Stock Market after raising $285.6 million. Leju Holdings Ltd, which operates real estate information and e-commerce websites in China, climbed 18.5 percent on the New York Stock Exchange after raising $100 million.

Weibo's IPO is regarded as a barometer for the expected IPO of e-commerce giant and 19 percent Weibo shareholder Alibaba later this year. Alibaba's offering is expected to raise about $15 billion, rivaling Facebook's massive public debut in 2012.

Many saw a worrisome sign in Weibo's and Leju's IPOs pricing at the low end of their respective marketed ranges.

But Weibo, which trades under the symbol WB, ended the day at $20.24, up $3.24 after it sold 16.8 million American depositary shares (ADSs) at $17 each, valuing the company at $3.46 billion. The company had earlier planned to sell 20 million ADS at between $17 and $19 each.

Weibo priced the shares at the lower end of the range because of the recent US stock market turmoil, particularly in technology shares, Sina Chairman and CEO Charles Chao said.

"Because of the recent downturn in the IPO market in the US, we are happy that we can still set Weibo's IPO price at the bottom of our initial targeted range," Chao told reporters ahead of the IPO.

The company also intentionally sold fewer shares than initially planned to lower dilution. "We wanted to have a deal that works from a market perspective," a banker who declined to be named because he was not authorized to speak to the media, told Reuters.

Leju, trading on the NYSE under the LEJU symbol, closed at $11.85, up $1.85. It had cut the size of its offering by 44 percent, offering 10 million shares at $10, the low end of the $10 to $12 range.

Investors, fearing stocks are over-valued, have recently begun turning to safer sectors such as utilities. Technology and biotechnology shares have borne the brunt of the pullback, with the tech-heavy Nasdaq recording its biggest drop in 2 1/2 years last week.

Since its launch in 2009, Weibo has become the go-to destination for nearly 600 million Internet users to discuss everything from politics to TV soap operas. But the service has been losing market share to messaging apps such as Tencent Holdings Ltd's WeChat. Unlike Weibo, where posts are visible to anyone, WeChat conversations are private.

Weibo has only turned a profit in the fourth quarter of 2013. It posted a net loss of $47.4 million in the first quarter of this year - more than doubling its $19.2 million loss of a year earlier. First-quarter revenue more than doubled to $67.5 million, but slipped 5.5 percent from the previous quarter.

Leju, which operates in 250 Chinese cities, last week said it would team up with US online real-estate service Zillow Inc to launch a website that would allow China's acquisitive homebuyers to read Zillow's US property listings translated into Chinese. Chinese bought more than $11 billion of US residential real-estate properties last year.

Addressing Weibo's growth issues, Chao said the company's market share was due to shrink as competitors emerged to challenge Weibo's rise into a "very, very powerful, popular" force in China.

"We have only been in this market for four and a half years," Chao told CNBC. And we have been growing very, very rapidly in the first two-three years, partly because we were the first social media kind of product in China on the mobile (devices).

"But on the other hand, there was no competition from the beginning. As competition intensifies, naturally there will be some dilution in usage."

Forrester Research Inc analyst Wang Xiaofeng said Weibo missed an opportunity to go public when its potential value was highest. "We are all aware it has been beaten up by Tencent's WeChat," she said. The biggest challenge for the company will be providing "more effective marketing" before user activity drops further, the analyst said.

Weibo's IPO sparked a media crush that livened up an otherwise typical Manhattan work morning. People on their way to work saw the big screen atop the Nasdaq building at Broadway and 43rd Street flash the company's logo against a red background and then broadcast the IPO ceremony live from the exchange. As the company's IPO party streamed onto Broadway minutes later to pose for photos, numerous advertising screens throughout Times Square displayed Weibo's logo.

Max Wolff, chief economist and strategist at Citizen VC, said Weibo has strong growth potential as a stock, despite its challenges. Although Weibo often is compared to Twitter, "the Chinese language is different in important ways, thus 140 characters is not 140 letters", Wolff said.

"It is much more rich, think 60-plus words."

Furthermore, "Weibo is a Chinese language utility but is accessed from 70 countries, thus, somewhat international", he said.

Joy Zhuang, a freelance New York-based journalist from Fujian, China, said she used Weibo heavily when it was new, "but then it fell far behind".

"I think it still plays an important role in Chinese society because everybody needs to know the information," Zhuang said.

Meng Jing in Beijing contributed to this article

michaelbarris@chinadailyusa.com

|

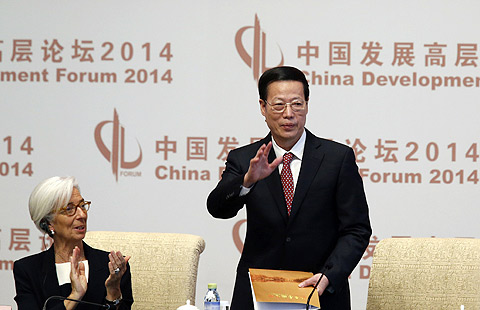

Charles Chao (fourth from left), chairman and CEO of Sina Corp, is joined by Chinese-American singer and songwriter Lee-Hom Wang (third from right) and other guests, celebrating the IPO of Weibo Corp, the microblogging service owned by Sina, outside the Nasdaq in New York on Thursday. Michael Barris / China Daily |

|

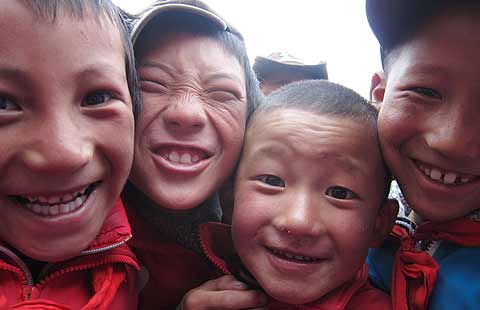

China's Leju Holdings, an online real estate information and services platform, listed on the New York Stock Exchange on Thursday. Jack Freifelder / China Daily |

(China Daily USA 04/18/2014 page1)

Runners and their 4-legged friends race in New York

Runners and their 4-legged friends race in New York

Top 10 Chinese Internet firms eyeing IPOs in US

Top 10 Chinese Internet firms eyeing IPOs in US

Chinese cop cadets learn about US police work

Chinese cop cadets learn about US police work

In Boston, warming up for, remembering marathon day

In Boston, warming up for, remembering marathon day

Families of missing passengers face agonising wait

Families of missing passengers face agonising wait

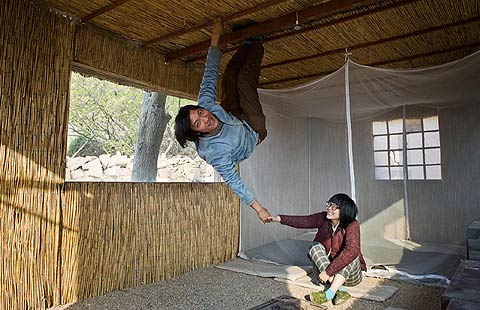

Couple leave the city for 'Self-sufficiency Lab'in mountains

Couple leave the city for 'Self-sufficiency Lab'in mountains

Turning waste into something valuable

Turning waste into something valuable

Dignitaries put their foot down

Dignitaries put their foot down

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Weibo, Leju go public in New York

Silicon mayors are on mission to China

Hainan Air announces 1st Beijing to Boston directs

Sellers making clear profits on Google glass

J&J builds world's largest supply chain base

BlackRock licensed to invest further in China using yuan

UN hosts Chinese Language Day

US Commerce chief vows trade growth

US Weekly

|

|