China deepens auto ties in Michigan

At the international auto show in Detroit this week, a handful of Chinese companies showed off their wares. Chinese have invested billions in the US automotive industry, with most of it going to Michigan, reports Paul Welitzkin from the Motor City.

The rising role of Chinese investment in the US auto industry, particularly in the state of Michigan, was on display last November when two organizations hosted events in the same week related to the industry that still defines the Wolverine state and its economy.

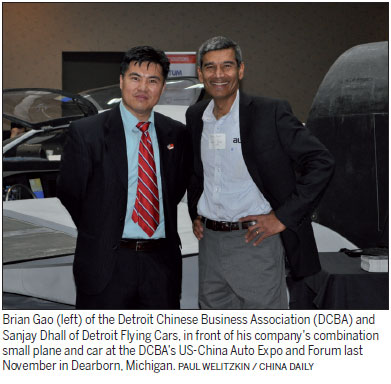

In Dearborn, home of Ford Motor Co, the Detroit Chinese Business Association (DCBA) sponsored its US China Auto Export Forum, featuring auto industry executives, companies, entrepreneurs and government officials from Michigan and Canada.

Across town in a northern Detroit suburb, the newly established Michigan US-China Exchange Center, hosted a delegation from the China Wuxi Die and Mould Trade Association at a gathering that included auto-related companies, executives and government officials. Cai Leiming, president of the association, signed a cooperation agreement between her organization and the exchange center to promote cross-border investment and trade.

"The partnership with the Michigan-US China Exchange Center is important to us because American industry, particularly the auto industry, is somewhat mysterious to us. We would like to learn more and I think we can with this platform," said Cai.

The Chinese have invested $3.15 billion in the state since 2003 with about 73 percent of that in auto-related companies and technology, according to Kevin Kerrigan, senior adviser for automotive initiatives for Michigan and the Michigan Economic Development Corp.

The New York-based Rhodium Group said the Chinese have invested more than $4.3 billion in the US auto industry with about 75 percent of that in Michigan. California is second with about 8 percent.

"We have been importing components from China for many years. If we have the opportunity to bring a Chinese company here that will create jobs in Michigan that is a good thing. The auto industry is truly global. We sell our products in China, so I think it's reasonable to expect China to sell products here," Kerrigan said.

History's epicenter

Qiang Hong, senior research scientist at the Center for Automotive Research in Ann Arbor, Michigan, said Chinese investment in Michigan began in the early 2000s. Successful examples include Pacific Century buying Nexteer in 2010. In 2013, Wanxiang America Corp, the North American subsidiary of the Chinese auto parts conglomerate Wanxiang Group, purchased bankrupt battery maker A123 Systems Inc. Recently, Key Safety Systems unveiled the $1.6 billion purchase of air-bag maker Takata Corp.

"Now the (auto) investment is becoming more of a two-way street. It's not just focused on US companies going to China, but Chinese companies coming to the US," said Hong.

Kerrigan noted that the North American auto industry started in Michigan in the late 1800s and early 1900s. "At that time Detroit was the epicenter of the auto industry and industry giants like Ford and General Motors were stated," he said. "Michigan has remained the state in the US where vehicles are designed and built. We are still the leader in the development of motor vehicles today."

The Nexteer purchase symbolizes how the Chinese used their US auto investments to not only bolster its domestic industry, but also to strengthen its rapidly emerging economy. China's leadership considers the automotive sector a major pillar of its economy.

In 2010, Nexteer was acquired by China's Pacific Century Motors, a joint entity formed by E-Town, a state-owned enterprise that serves as the financing and investing arm of the Beijing municipal government, and China-based PCM Systems, a manufacturer of automotive components. In 2011, AVIC Auto, a subsidiary of AVIC, purchased a 51 percent controlling stake in Pacific Century Motors.

Nexteer, the former Delphi Saginaw Steering Systems, became a wholly owned, standalone subsidiary of GM when Delphi Corp emerged from Chapter 11 bankruptcy in 2009. Nexteer had been seeking new ownership since then because it made steering components for other car makers outside of GM.

The Nexteer acquisition and others that followed showed that Chinese investment wasn't just focused on acquiring technology, according to Hong. "While technology was important, the Chinese also used US purchases to bolster their management skills, business operations expertise and to learn a different business and cultural environment," he said. "This will help them to create companies capable of competing on a global scale in an industry that is increasingly turning to a global approach."

In another major Chinese investment, auto supplier Yanfeng Automotive Interiors has emerged as a leading supplier of instrument panels and cockpit systems, door panels, floor consoles, overhead consoles, lighting and decorative trim. The company was formed in 2015 as a joint venture between Yanfeng Automotive Trim Systems Co Ltd and Adient, the former seating unit of Johnson Controls Inc.

"Following the downturn in 2008 (global financial crisis) Chinese investment in the Midwest saved and strengthened some suppliers and some of their product lines," said Jayson Pankin, president and CEO of the Auto Harvest Foundation and a former executive with auto supplier Delphi Corp.

Industry recovery

From the depths of its downturn in 2009, the US auto industry has rebounded. After selling 10.4 million vehicles in 2009, sales reached 17.55 million in 2016, a record. That has led to a recovery that extends from the original equipment manufacturers (OEM) like Ford and GM to industry specific suppliers and even businesses that provide ancillary services.

But US sales by Detroit's Big 3 auto companies fell 2 percent to 17.2 million in 2017, according to Autodata Corp. It was their first year-over-year decline since 2009, ending an unprecedented seven-year expansion. Demand for new vehicles - especially SUVs - remains healthy as the new year begins.

At the Detroit Chinese Business Association's expo, companies lined up to offer their services to an industry that will be investing billions in things like autonomous or self-driving vehicles, electrification and connectivity.

William Pong is the general manager of Castle International Trade Co Ltd, a privately-owned company in Ningbo in Zhejiang province. It employs about 230 workers who manufacture casting, machining, forging and stamping parts, which are used in metallurgy, automobile, chemical and engineering industries.

"All of our parts are made for customer's specifications. We supply to America, Europe and Singapore. About 98 percent of our sales are exports with about 70 percent for the auto industry," he said.

Pong was not only looking for new customers but also potential partners to expand overseas. "We seek two types of partners - the first has a Tier 1 or Tier 2 plant. Second is an experienced sales agent or representative in the auto industry," he said.

Tier 1 refers to a direct supplier to OEMs; Tier 2 are key suppliers to Tier 1 companies.

Jimmy Hsiao is CEO of Quantum Compliance and Logic Solutions, an environmental, health and safety software company in Ann Arbor. He is a native of Taiwan who studied at the University of Michigan.

"We have a series of software products that we sell to manufacturers around the world including auto-related companies," he said.

Quantum software is used to help manage an auto plant's safety program and keep track of the handling of environmental waste. Quantum does business in North America and China and the company has 50 employees in Ann Arbor, 120 in the Chinese mainland and 25 in Taiwan.

Hsiao expects the US-China auto relationship to become closer. "I think the relationship will become even tighter. A lot of Chinese companies are now setting up operations in the US and that will continue," he said.

Hsiao is also the CEO of Logic Solutions in Ann Arbor, which will benefit from the shift to electric vehicles (EVs) and autonomous cars. "Both EVs and driver-less vehicles will need a lot of software for sensor systems and artificial intelligence. We can provide that software to auto companies," he said.

Nathan Graham is an attorney with Fragomen, a national law firm with an office in Troy, a Detroit suburb. Fragomen assists the Big 3 auto companies and their suppliers in getting overseas workers to become eligible to work in the US.

Graham said the industry recovery has spurred demand for engineers and software developers. "These people are in demand because the car of today is almost more computer than it is a machine," he said. "Our business with China has been steadily increasing over the last five years. We are seeing more Chinese engineers and developers who want to work in the US auto industry."

Graham said that the US industry is attractive right now. "The Chinese are intensely interested in making money. When the US industry is as strong as it is now, the Chinese are attracted to working here," he said.

Future investment

Hong of the Center for Automotive Research said patterns are developing around Chinese investment. "(Chinese) companies are setting up R&D (research and development) centers especially in Michigan and California. In fact a competition is developing between Michigan and California socially in autonomous driving," he said.

Electric vehicles will become a factor, but this may depend on national policies. "EVs may require companies to decide if they want to go global or stay at home," Hong said.

Kerrigan agrees with Hong.

"We are starting to see Chinese companies put research and development centers in Michigan as they try to understand the new areas of autonomy, connectivity, electrification and sharing. We see a lot of interest from China in working with Michigan companies on this new technology," he said. "Chinese have taken the position that they want to become a leader in the electrification of vehicles."

"Shorter term, the export model in China will find success in selling lower-cost EVs in markets other than North America and Europe. (Eventually) you will see the Chinese manufacture cars in North America and Europe but on a smaller scale," said Pankin of the Auto Harvest Foundation.

"We haven't seen a Chinese OEM set up an assembly plant in the US yet. We know that will happen. I wouldn't be surprised if in the next five years we see a Chinese OEM making cars in the US and yes I think Michigan would the ideal place for the plant," said Kerrigan.

Contact the writer at paulwelitzkin@chinadailyusa.com

|

Feng Xingya (third from right), chairman of GAC Group. JUDY ZHU /CHINA DAILY |

(China Daily USA 01/19/2018 page20)