Machinery maker gearing up for success in mining sector

Updated: 2013-12-16 07:45

By Zhong Nan (China Daily)

|

||||||||

Big-ticket mining projects are helping Chinese machinery makers consolidate their presence in Africa and to offset losses from dwindling demand in developed markets.

Shanghai Shibang Machinery Co, a high-technology enterprise in Shanghai, is one of the Chinese firms that is seeing robust demand for its products in African nations such as Angola, Namibia, Sierra Leone and Botswana. To further expand its business in Africa, the company plans to set up warehouses, service and technical centers in Ghana and Nigeria over the next five years.

Many of the opportunities are coming because of Africa's growing demand for mining and infrastructure projects, especially as mining has a big role in foreign exchange generation, says Cui Gaofeng, sales director of Shanghai Shibang.

The Chinese company recently won a contract from a Sudanese gold processing company to man the production line at a gold mine in the North Kurdufan state in Sudan. The contract entails the complete design, construction and maintenance of the production line, he says without revealing any figures.

Although most of the mining activities in Africa are focused on gold and diamond exploration, Cui says, there is a growing demand for mining other base metals such as iron ore and copper.

As the world's second largest continent, Africa holds about 33 percent of the earth's mineral reserves and produces more than 63 metal and mineral products such as gold, rare earths, iron ore, copper and diamonds.

"We are seeing a flurry of activity in base metals, especially in countries such as Tanzania, Nigeria and Zambia," Cui says.

According to Cui, most of the base minerals produced in Africa are still exported without any downstream processing. "This cuts the potential of selling more value added mineral products in various overseas markets and also constrains profit margins. What this means is that there is a growing demand for various types of crushers throughout Africa," he says.

African mines lack adequate mining machinery, technical knowledge and qualified personnel, Cui says. The investment on exploration activity in a majority of African mines has remained below $10 per square kilometer compared with an average of $50 per square meter in China and Australia, which shows the low degree of industrialization, he says.

"Using high-efficiency mining machinery and mature operating procedures from China can significantly improve the output and reduce profit losses," says Wang Lijie, a professor at the China University of Mining and Technology in Beijing.

"From a long-term perspective, African governments can use the money realized from mining investments on other sectors because it will help create jobs and help build an industrial chain in a smart way," Wang says.

Shanghai Shibang has already delivered crushing equipment to Nigeria, grinding machinery to Angola and sand-making machines to Zambia. The company's African footprint is spread across 15 nations, while its revenue in the continent stood at $41 million last year.

The company expects its sales revenue in Africa to reach $58 million this year. Currently, African business accounts for 25 percent of its global operations.

According to Cui, the company plans to establish new regional sales offices in Kenya and Algeria next year to further tap local business. The company already has an office in Accra, Ghana, that focuses on West Africa.

Despite Africa experiencing a process of industrialization and urbanization, its overall industrial foundation and ability are still weak, he says. African governments have realized that quality infrastructure is the best bet for the continent to attract foreign capital and talented people, he says.

Cui says many people in East Africa are keen to buy construction machinery such as impact crushers, mobile cone crushers and sand washers to become small contractors for big projects carried out by local or Chinese construction companies.

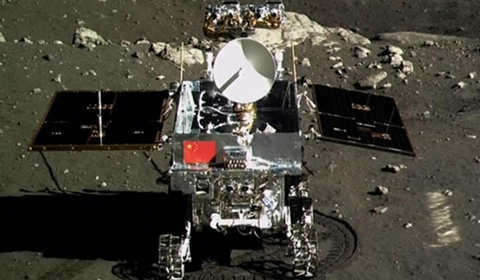

Moon rover, lander photograph each other

Moon rover, lander photograph each other

With a hole in its heart, South Africa buries Mandela

With a hole in its heart, South Africa buries Mandela

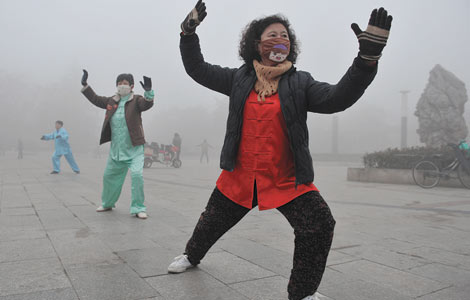

After the storm

After the storm

Guangzhou beats Al-Ahly 2-0 at Club World Cup

Guangzhou beats Al-Ahly 2-0 at Club World Cup

Two students wounded in US school shooting

Two students wounded in US school shooting

21 died in Xinjiang coal mine explosion

21 died in Xinjiang coal mine explosion

Mandela's body transferred to Qunu village

Mandela's body transferred to Qunu village

Postgraduates get hard lessons at job fair

Postgraduates get hard lessons at job fair

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese law firm expands in US

Chinese law firm expands in US

Complacency hinders US energy-saving strategies

China plans its Chang'e-5 lunar probe

Dialogue urged after naval incident

Chang'e-3 mission 'complete success'

Cave art's wide influence explored

DPRK leader's aunt unscathed after purge

Funding, market key to urbanization

US Weekly

|

|